Question

Below is a partial list of business events entered into by Denver Wholesale Sporting Goods, Inc., during the first fiscal quarter of the current year.

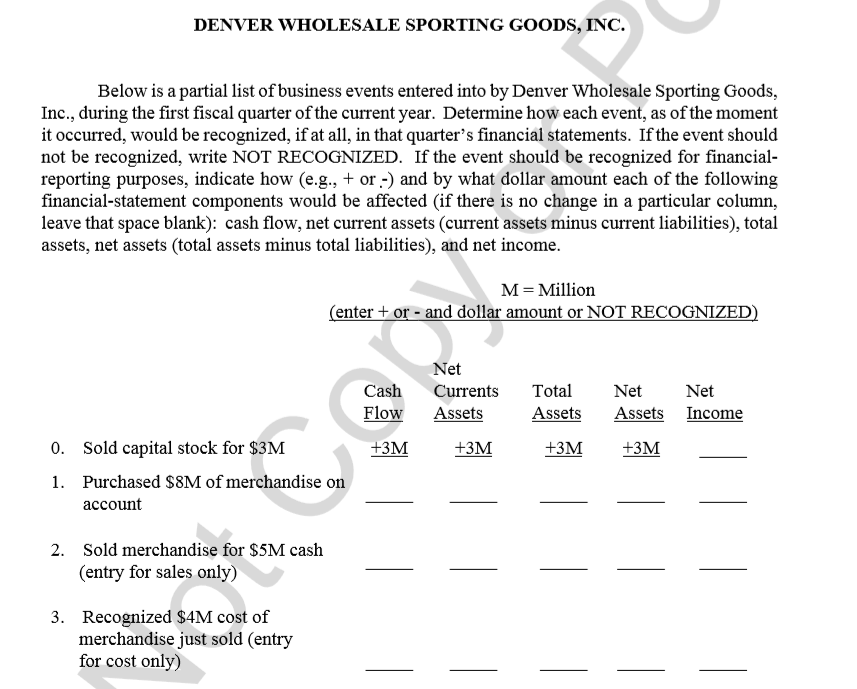

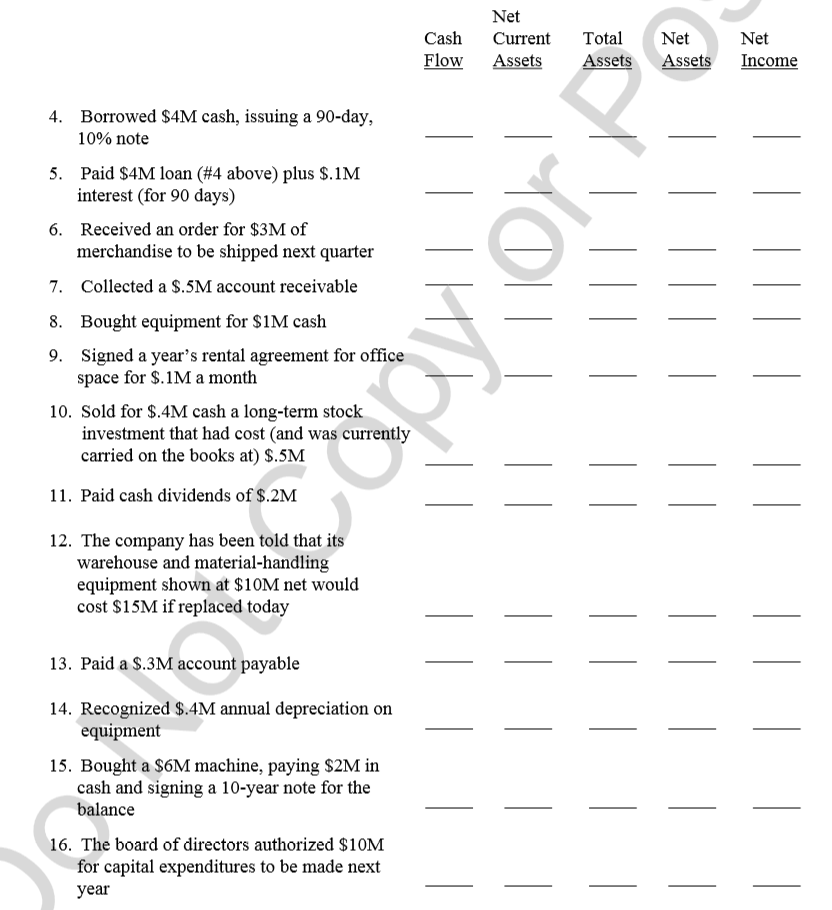

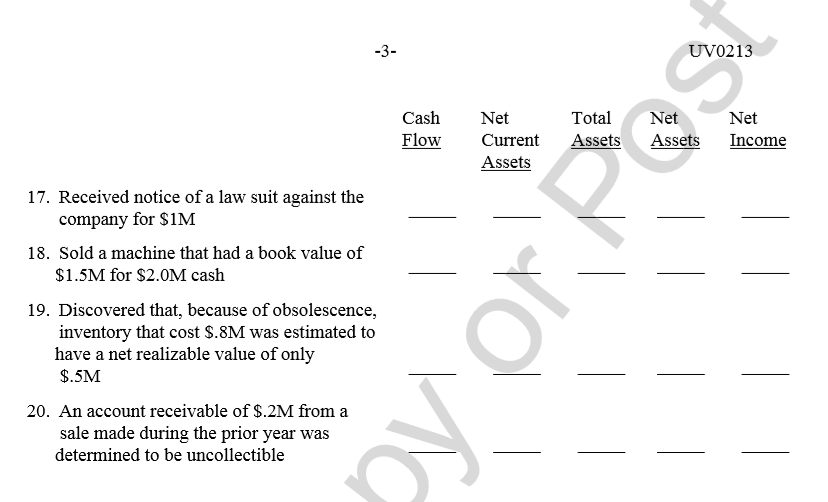

Below is a partial list of business events entered into by Denver Wholesale Sporting Goods, Inc., during the first fiscal quarter of the current year. Determine how each event, as of the moment it occurred, would be recognized, if at all, in that quarter's financial statements. If the event should not be recognized, write NOT RECOGNIZED. If the event should be recognized for financial- reporting purposes, indicate how (e.g., + or-) and by what dollar amount each of the following financial-statement components would be affected (if there is no change in a particular column, leave that space blank): cash flow, net current assets (current assets minus current liabilities), total assets, net assets (total assets minus total liabilities), and net income.

DENVER WHOLESALE SPORTING GOODS, INC. Below is a partial list of business events entered into by Denver Wholesale Sporting Goods, Inc., during the first fiscal quarter of the current year. Determine how each event, as of the moment it occurred, would be recognized, if at all, in that quarter's financial statements. If the event should not be recognized, write NOT RECOGNIZED. If the event should be recognized for financial- reporting purposes, indicate how (e.g., + or-) and by what dollar amount each of the following financial-statement components would be affected (if there is no change in a particular column, leave that space blank): cash flow, net current assets (current assets minus current liabilities), total assets, net assets (total assets minus total liabilities), and net income M Million enter t or- and dollar amount or NOT RECOGNIZED Net Cash Currents Tota Net Net FlowAssets Assets Assets Income Sold capital stock for $3M +3M +3M 0. +3M +3M 1. Purchased $8M of merchandise on account 2. Sold merchandise for $5M cash (entry for sales only) Recognized $4M cost of merchandise just sold (entry for cost only) 3. Net Cash Current Tota Net Net Flow AssetsAssetsAssets Income Borrowed $4M cash, issuing a 90-day, 4. 10% note Paid $4M loan (#4 above) plus $.1 M interest (for 90 days) 5. 6. Received an order for $3M of merchandise to be shipped next quarter 7. Collected a $.5M account receivable 8. Bought equipment for S1M cash 9. Signed a year's rental agreement for office space for S.1M a month 10. Sold for $.4M cash a long-term stock investment that had cost (and was currently carried on the books at) $.5M 11. Paid cash dividends of $.2M 12. The company has been told that its warehouse and material-handling equipment shown at $10M net would cost $15M if replaced today 13. Paid a S.3M account payable 14. Recognized $.4M annual depreciation on equipment 15. Bought a S6M machine, paying $2M in cash and signing a 10-year note for the balance 16. The board of directors authorized $1OM for capital expenditures to be made next year UV0213 Net Cash Net TotalNet Flow Current AssetsAstIncome Assets 17. Received notice of a law suit against the company for S1M 18. Sold a machine that had a book value of $1.5M for $2.0M cash 19. Discovered that, because of obsolescence, inventory that cost S.8M was estimated to have a net realizable value of only $.5M 20. An account receivable of S.2M from a sale made during the prior year was determined to be uncollectible

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started