Answered step by step

Verified Expert Solution

Question

1 Approved Answer

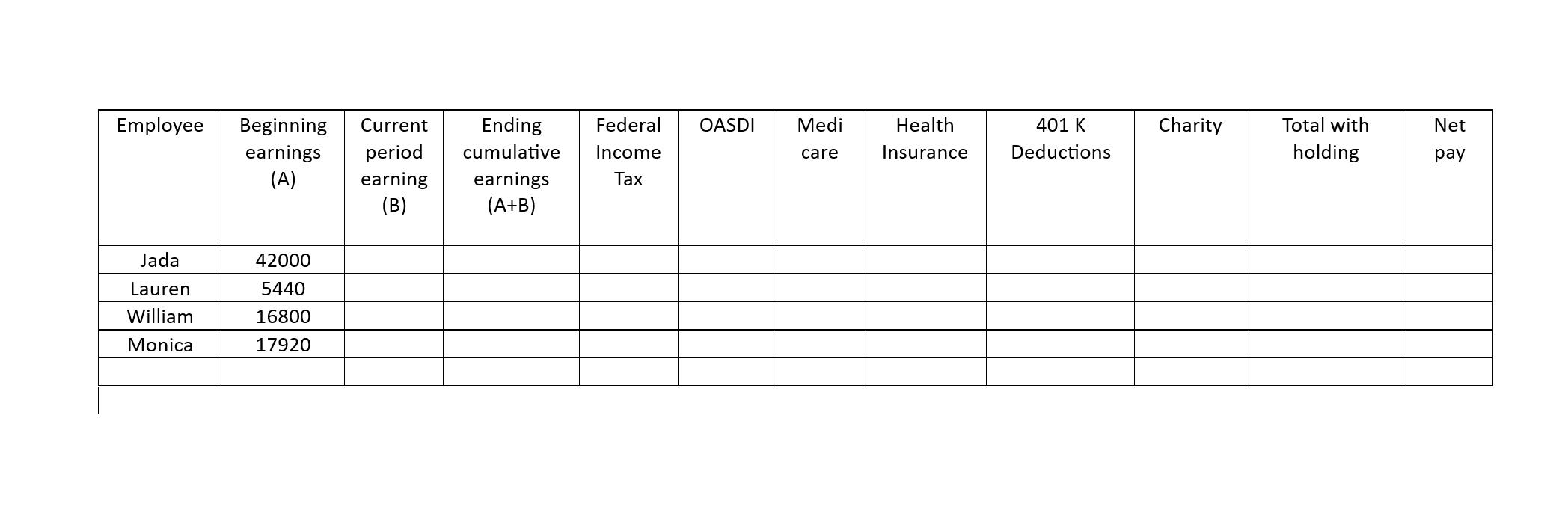

Below is a partial payroll register for Harrowing Consulting Firm for the week ending in June 30. Assumed tax rates are as follows:

Below is a partial payroll register for Harrowing Consulting Firm for the week ending in June 30. Assumed tax rates are as follows:

FICA represents the Social Security & Medicare amounts combined.

- The Social Security tax rate is 6.2 percent. Taxable earnings for Social Security are based on the first $142,800

- The Medicare tax rate is 1.45 percent. Taxable earnings for Medicare are based on all earnings.

SUTA

- State unemployment tax, 5.4 percent (0.054) on the first $7,000 for each employee.

FUTA

- Federal unemployment tax, 0.6 percent (0.006) on the first $7,000 for each employee.

Employee Jada Lauren William Monica Beginning Current Ending earnings period cumulative (A) earning earnings (B) (A+B) 42000 5440 16800 17920 Federal Income Tax OASDI Medi care Health Insurance 401 K Deductions Charity Total with holding Net pay

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

For Jada Lauren FICA OASDI 62 of 47440 42000 2604 Medicare 145 of 47440 42000 609 Health Insurance 6...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started