Question

Below is a sample credit card statement with a statement date of April 1, 2018 (start of billing cycle) and a due date of April

Below is a sample credit card statement with a statement date of April 1, 2018 (start of billing cycle) and a due date of April 30, 2018 (end of billing cycle).

I ONLY NEED QUESTIONS IN BOLD ANSWERED. QUESTION 10, 11, 12 and 13.

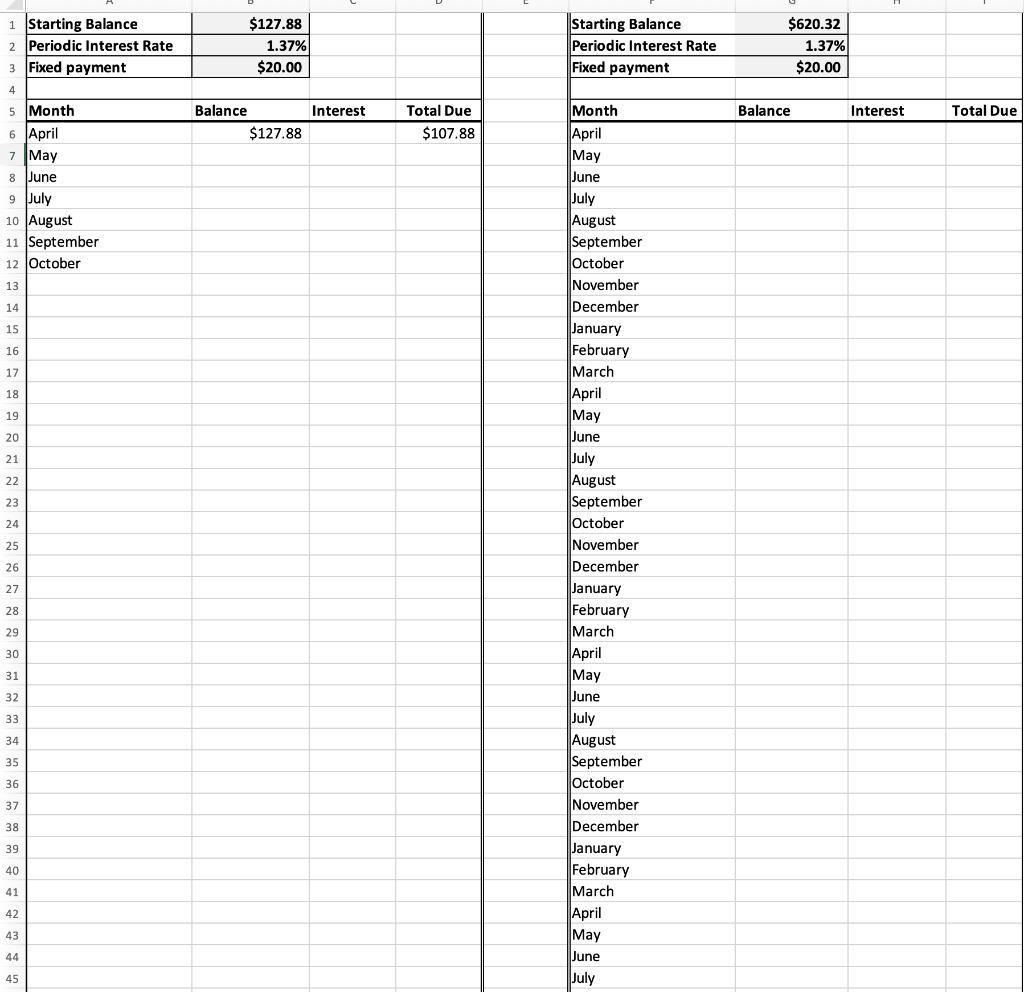

For the Excel spreadsheet I need to know the calculations to input onto excel (what cells to reference in order to get the correct answer.)

| Previous balance (+) | 254.39 | Current Amount Due | 127.88 |

| Purchases (+) | 127.88 | Amount Past Due | |

| Cash Advances (+) | Amount Over Credit Line | ||

| Payments (-) | 254.39 | Minimum Payment Due | 20.00 |

| Credits (-) | |||

| FINANCE CHARGES (+) | |||

| Late Charges (+) | Periodic Rate | 1.37% | |

| NEW BALANCE (=) | 127.88 | APR | 16.47% |

1. What is the periodic rate for this credit card? ____________________

2. What is the annual percentage rate (APR) for this credit card? ______________________

3. How is the APR calculated based on the periodic rate?

4. What is the current balance for this statement? _____________________

5. What is the minimum payment due? _____________________

6. Suppose John Doe pays the minimum payment for this month (April). What would his remaining balance be?

7. Now that he is carrying a balance, he will be charged interest in subsequent months. Calculate his interest payment for May.

8. Using the 1 + trick, calculate how much he will owe in May.

9. Suppose he pays the minimum payment in May. Calculate his balance after he makes a payment.

10. (Work in Excel) John Doe has decided that he will stop using this credit card until he pays it off in full. Use the spreadsheet template attached to figure out how long it will take John to pay off his debt. (Use the template on the left-hand side for this example.)

He will pay off his debt after _______________ months.

He will pay _______________ in interest.

11. (work in Excel) Using the template on the right-hand side, change the balance to $620.32. How many months will it take him to pay off this debt at a minimum payment of $20/month? How much will he pay in interest?

He will pay off his debt after _______________ months.

He will pay _______________ in interest.

12. What are some ways that he can pay less in interest?

13. Change the minimum payment to $30. If he pays $30 per month, how long will it take to pay off this debt? How much interest will be paid?

He will pay off his debt after________ months.

He will pay ________ in interest.

*This is the Excel Template, I need to know what cells to reference in order to calculate answers on excel spreadsheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started