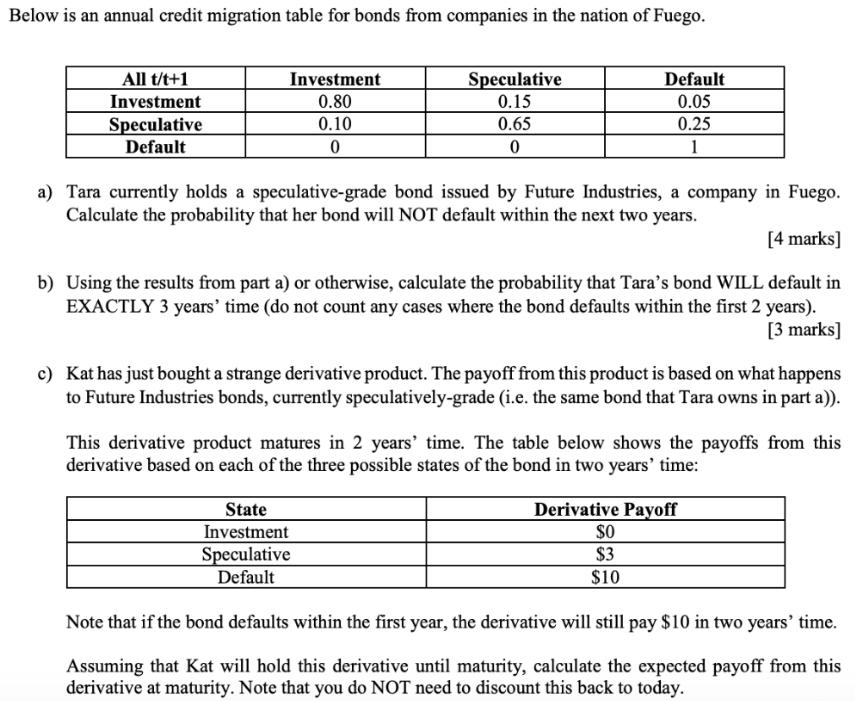

Question: Below is an annual credit migration table for bonds from companies in the nation of Fuego. All t/t+1 Investment 0.80 Speculative 0.15 Default 0.05

Below is an annual credit migration table for bonds from companies in the nation of Fuego. All t/t+1 Investment 0.80 Speculative 0.15 Default 0.05 Investment Speculative 0.10 0.65 0.25 Default 1 a) Tara currently holds a speculative-grade bond issued by Future Industries, a company in Fuego. Calculate the probability that her bond will NOT default within the next two years. [4 marks] b) Using the results from part a) or otherwise, calculate the probability that Tara's bond WILL default in EXACTLY 3 years' time (do not count any cases where the bond defaults within the first 2 years). [3 marks] c) Kat has just bought a strange derivative product. The payoff from this product is based on what happens to Future Industries bonds, currently speculatively-grade (i.e. the same bond that Tara owns in part a)). This derivative product matures in 2 years' time. The table below shows the payoffs from this derivative based on each of the three possible states of the bond in two years' time: State Investment Speculative Default Derivative Payoff $0 $3 $10 Note that if the bond defaults within the first year, the derivative will still pay $10 in two years' time. Assuming that Kat will hold this derivative until maturity, calculate the expected payoff from this derivative at maturity. Note that you do NOT need to discount this back to today.

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Lets tackle each part of the problem step by step Part a Calculate the probability that Taras bond will NOT default within the next two years The bond ... View full answer

Get step-by-step solutions from verified subject matter experts