Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown

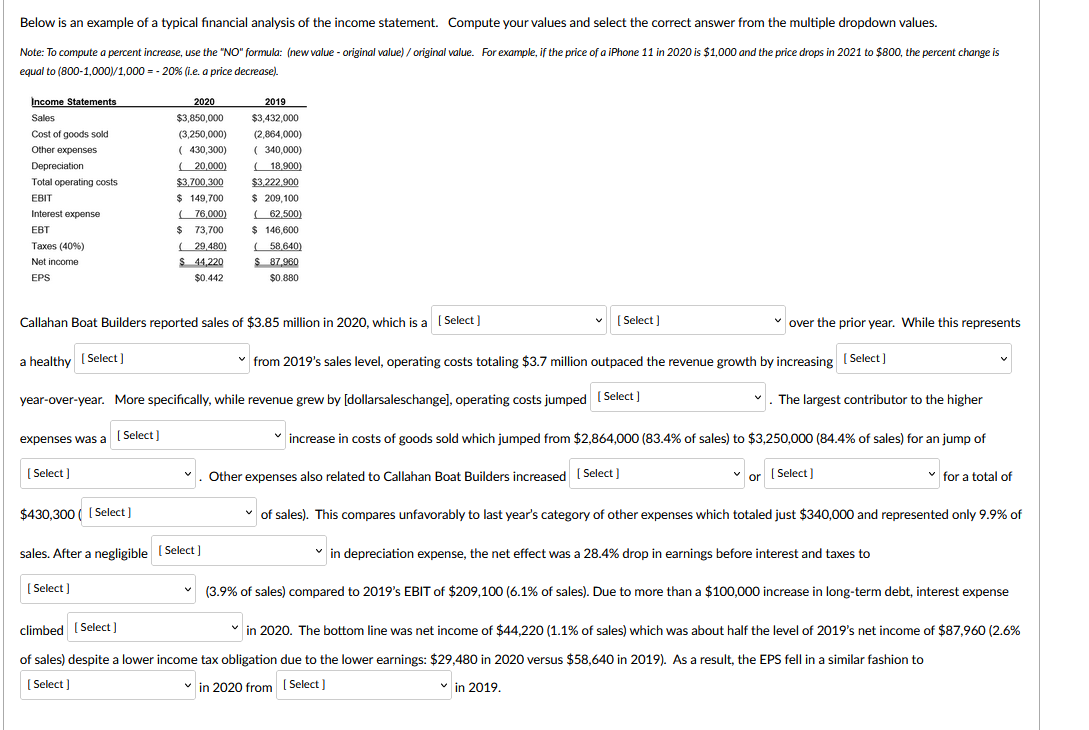

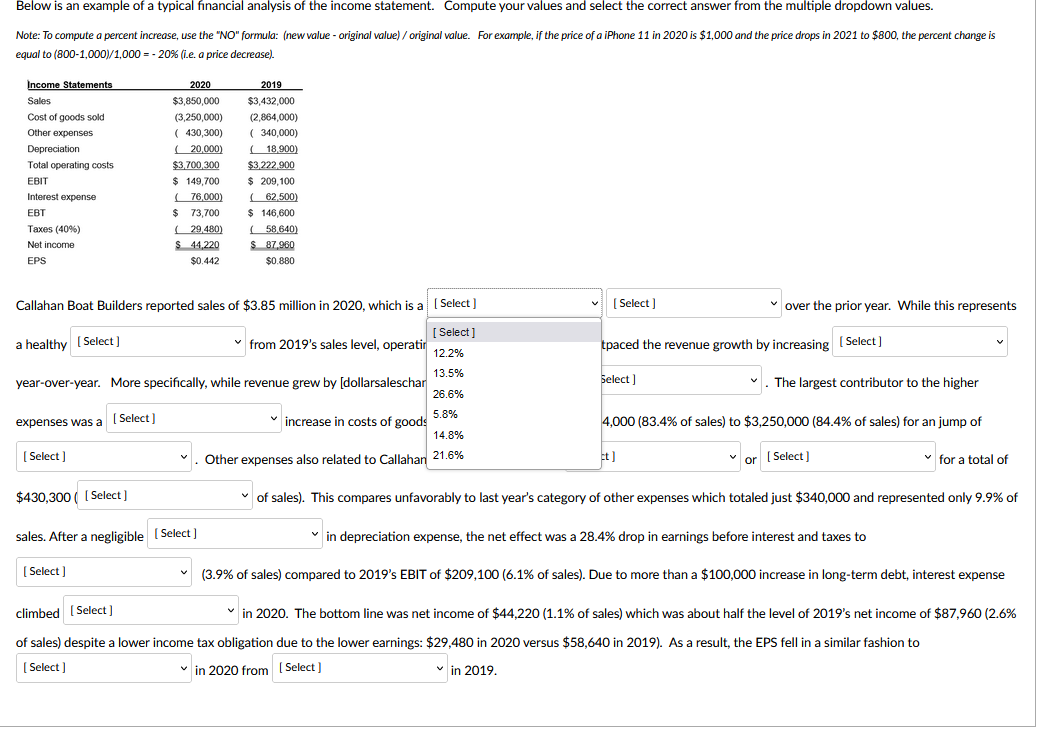

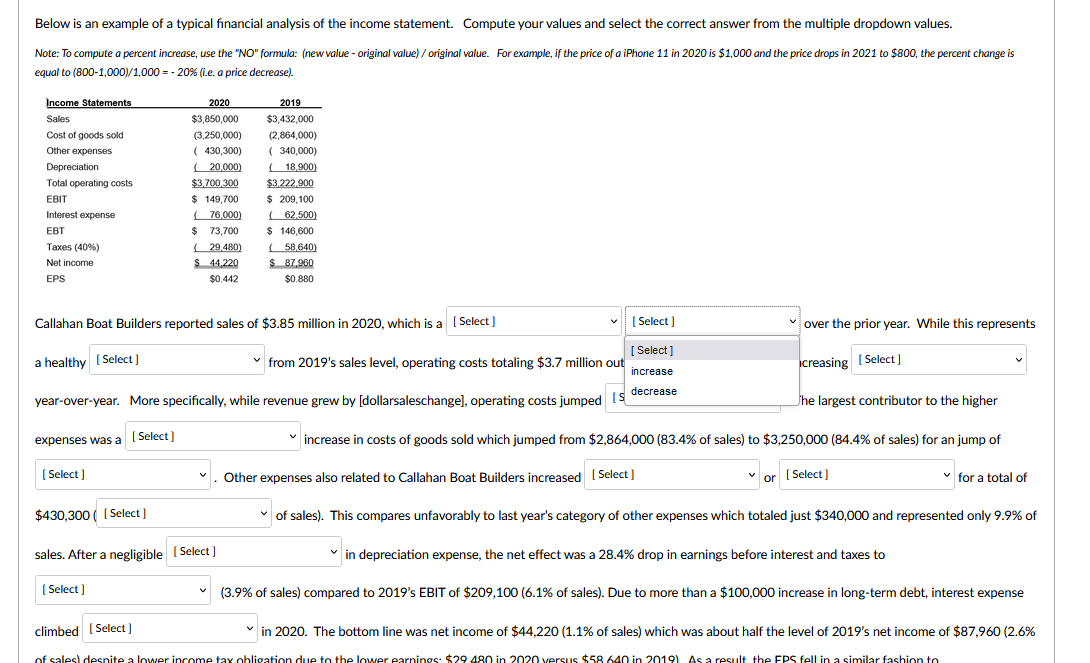

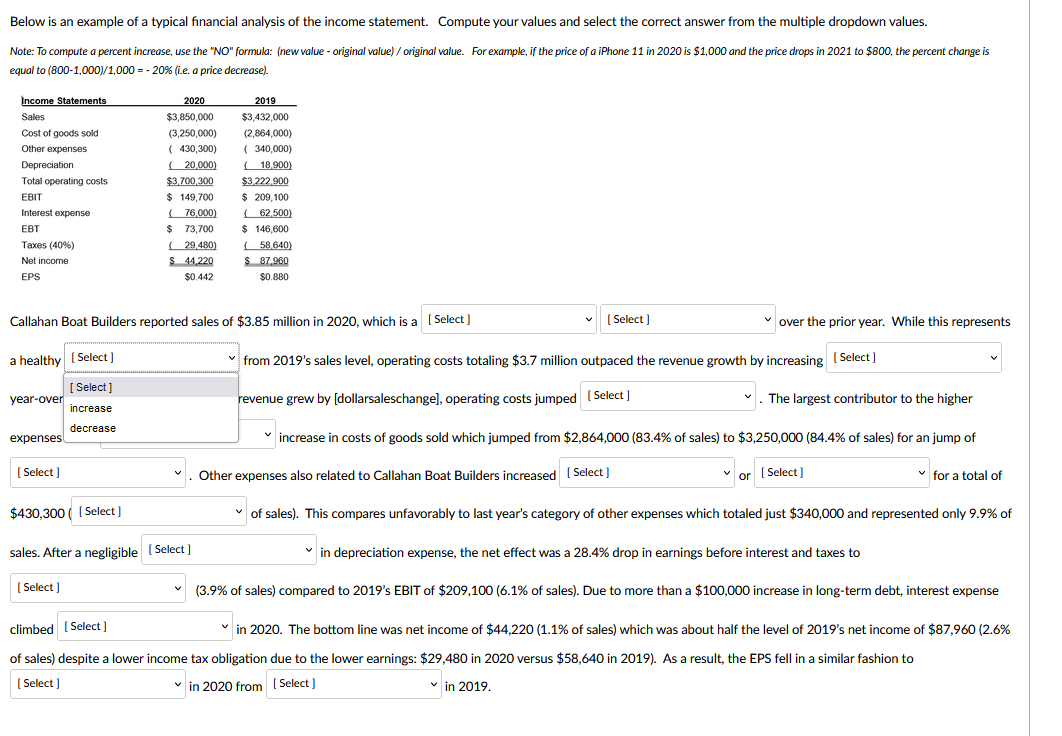

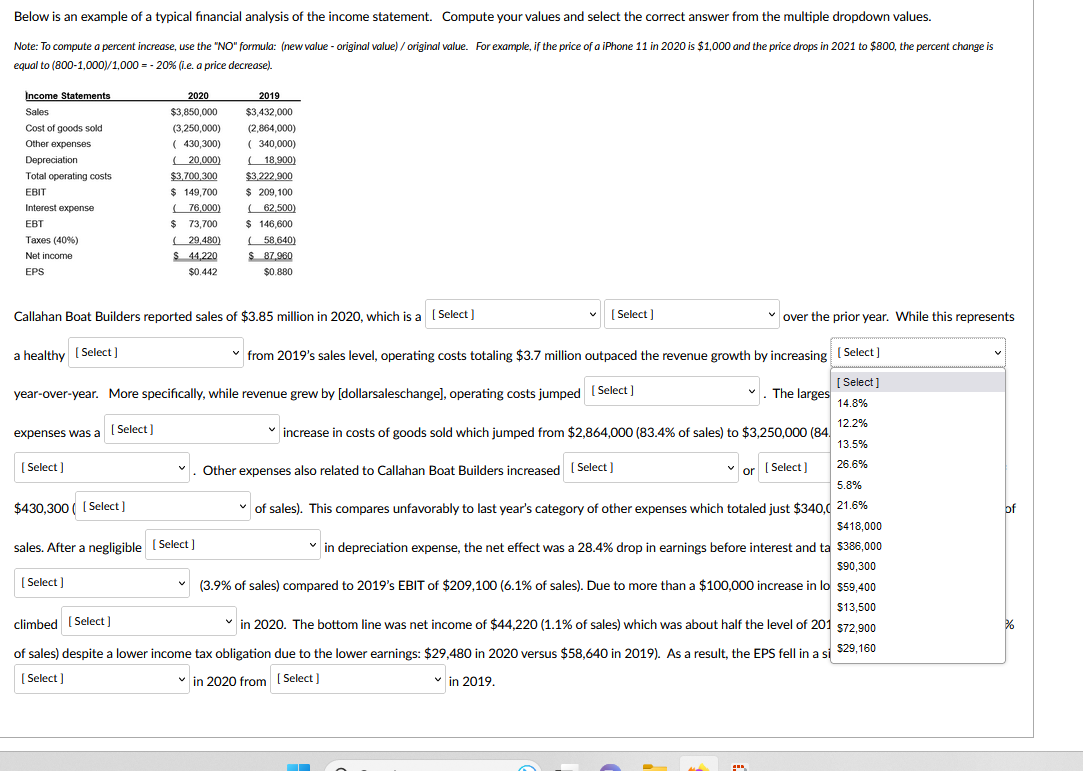

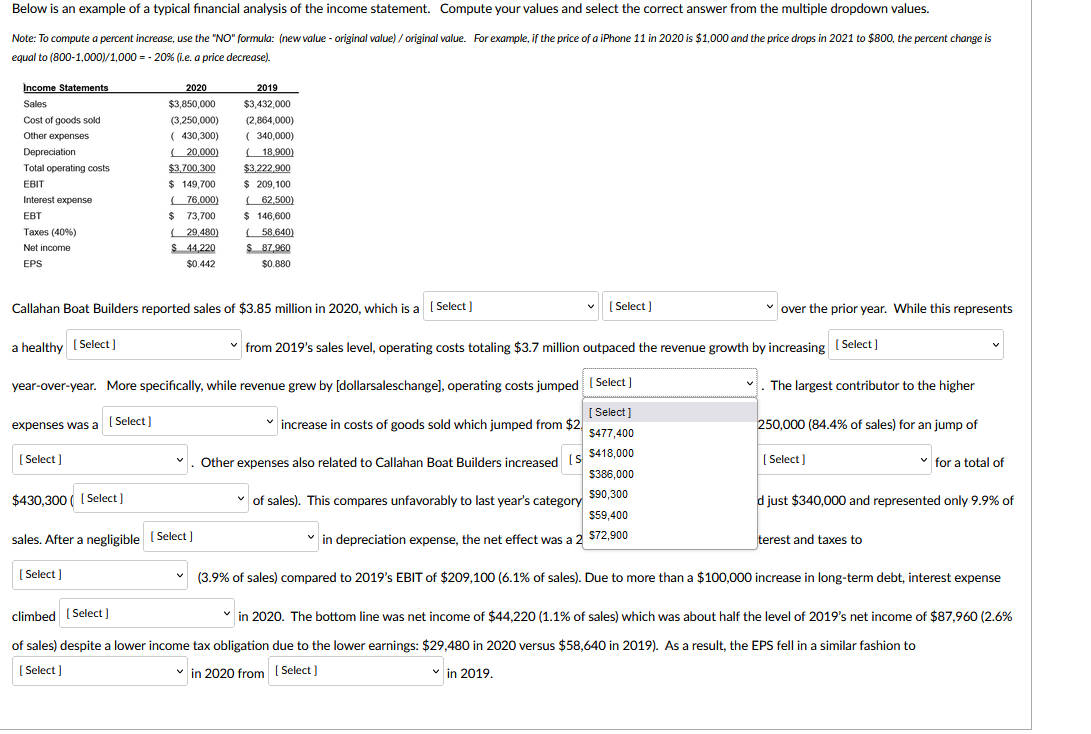

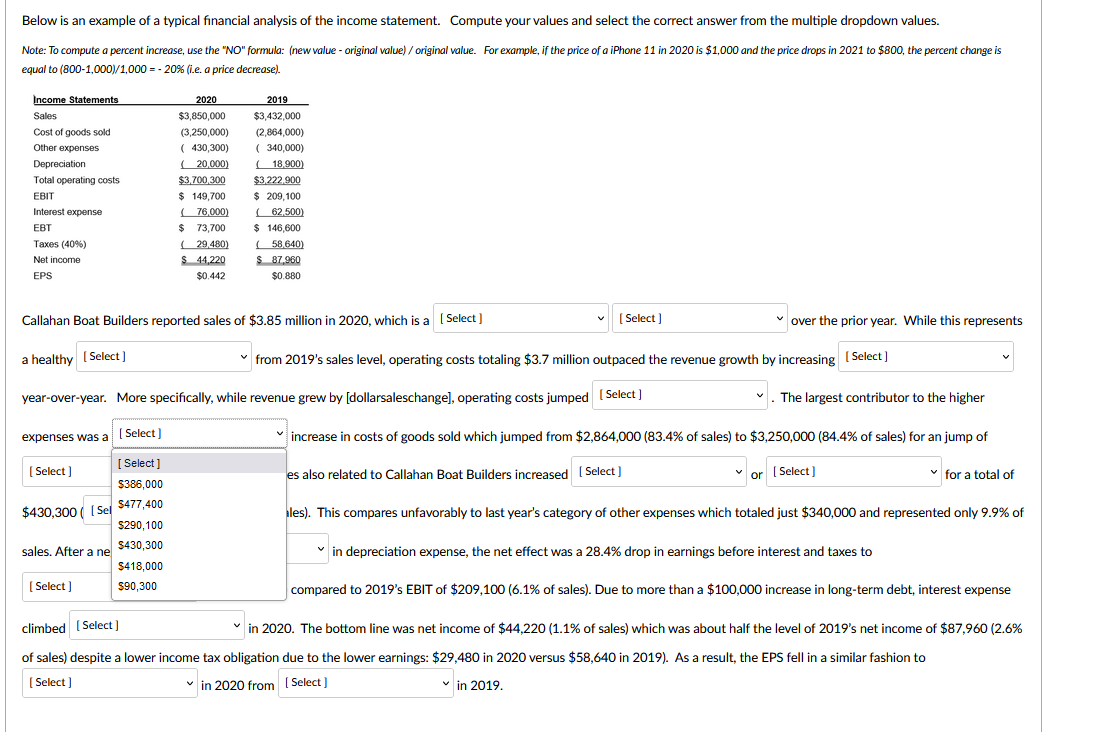

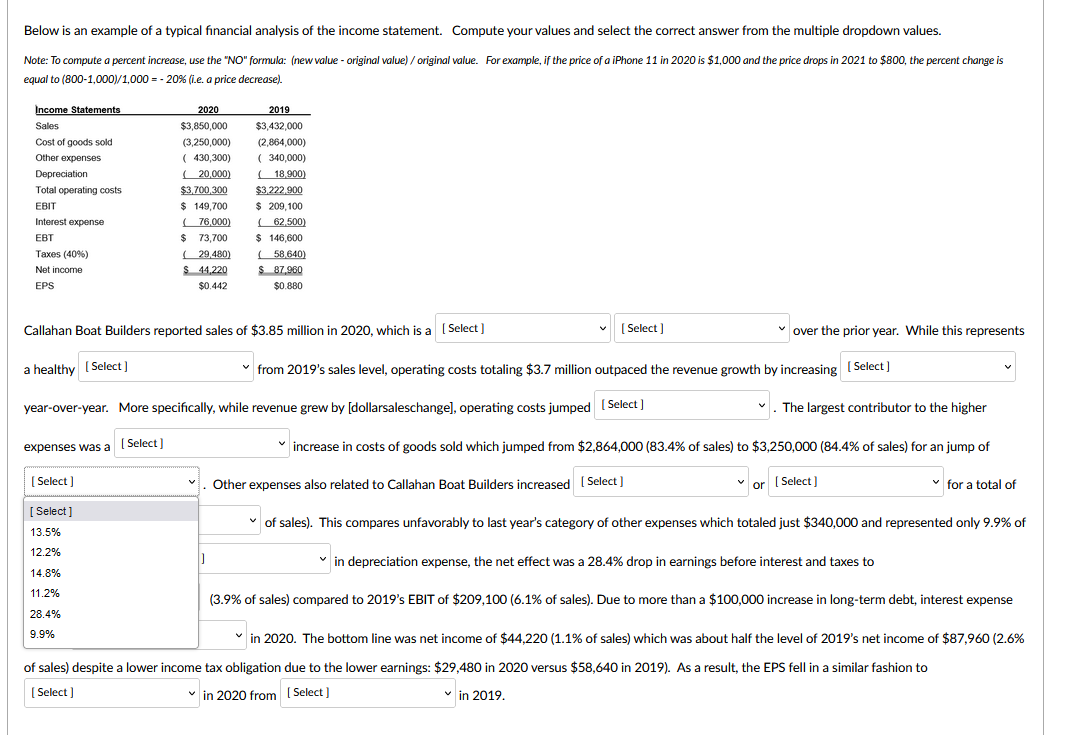

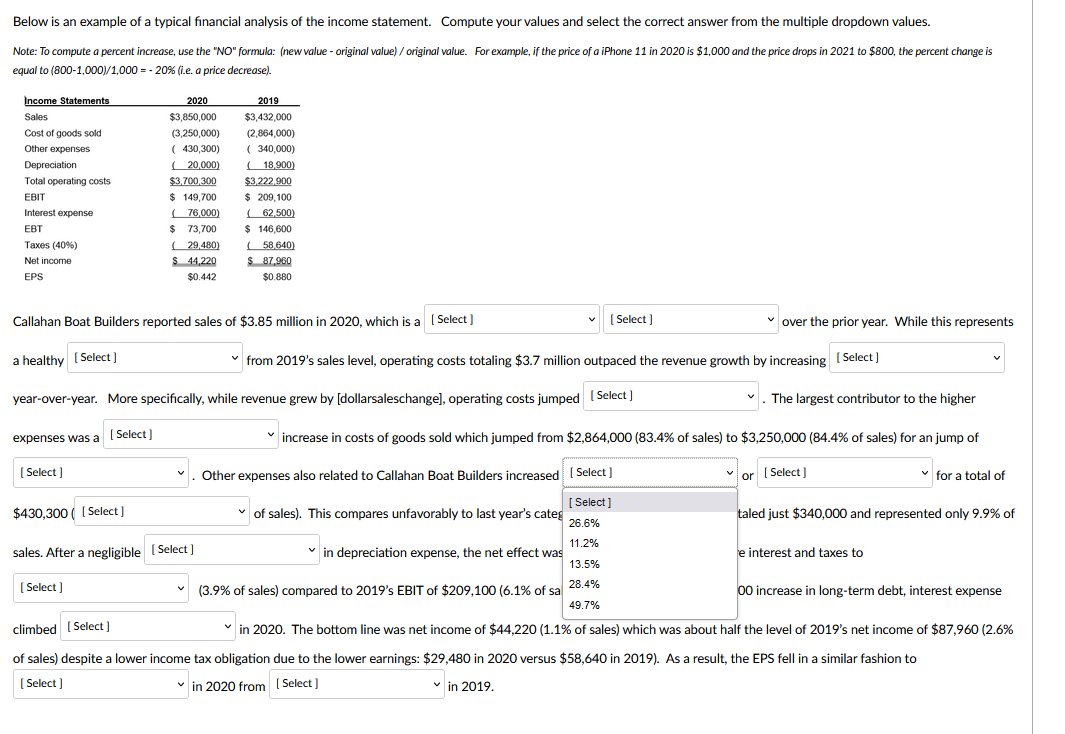

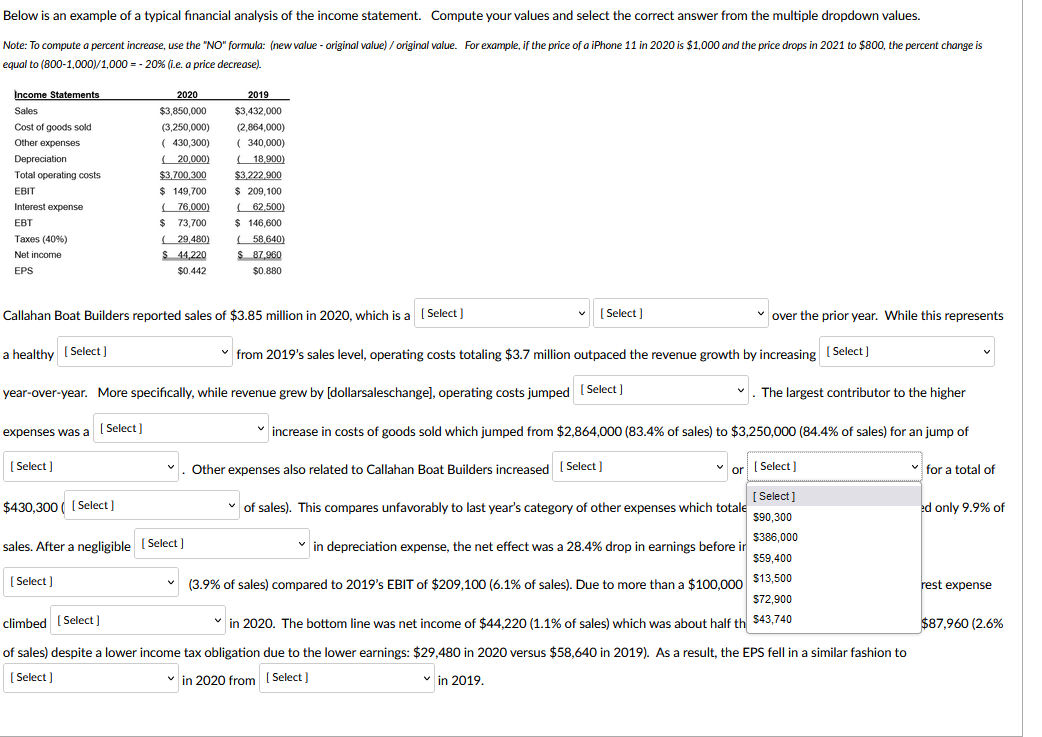

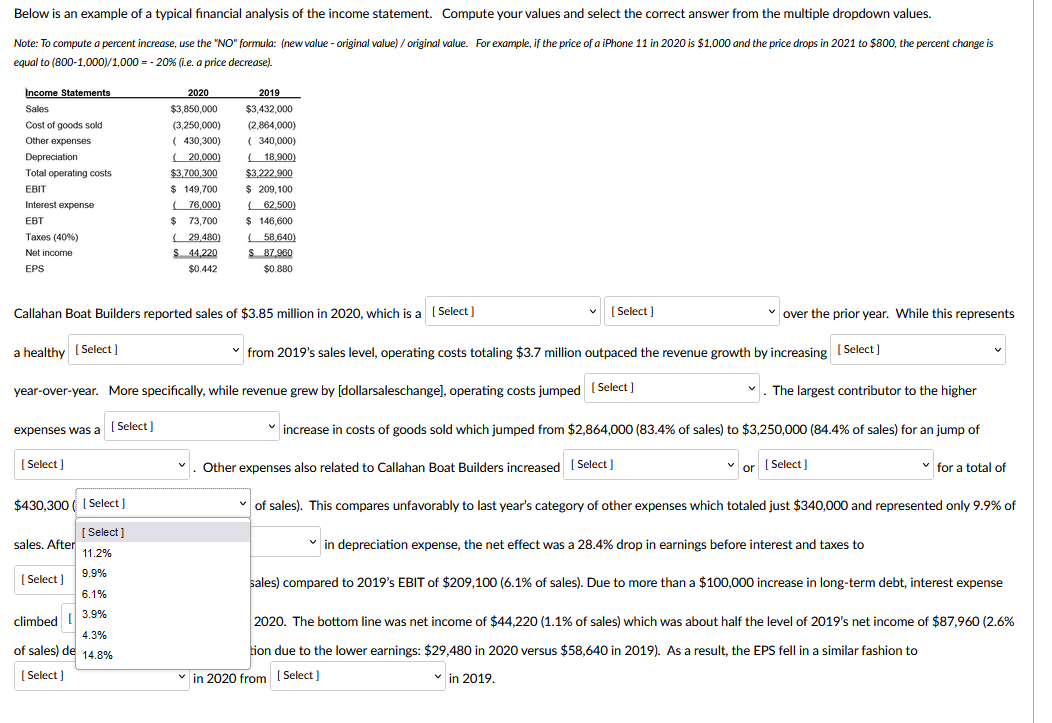

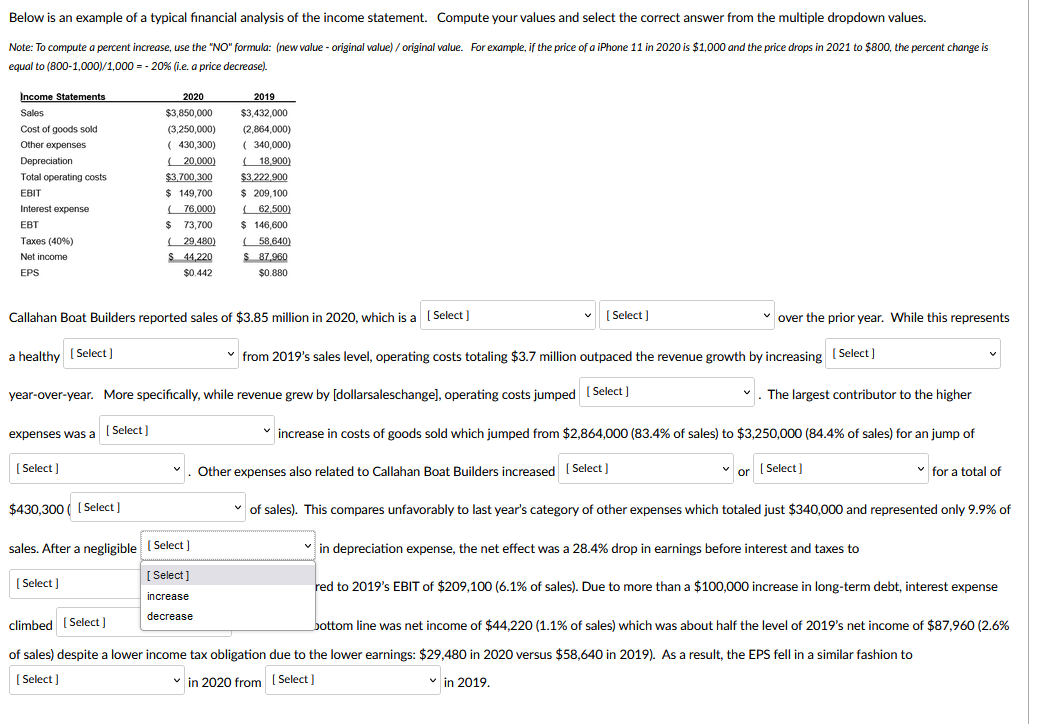

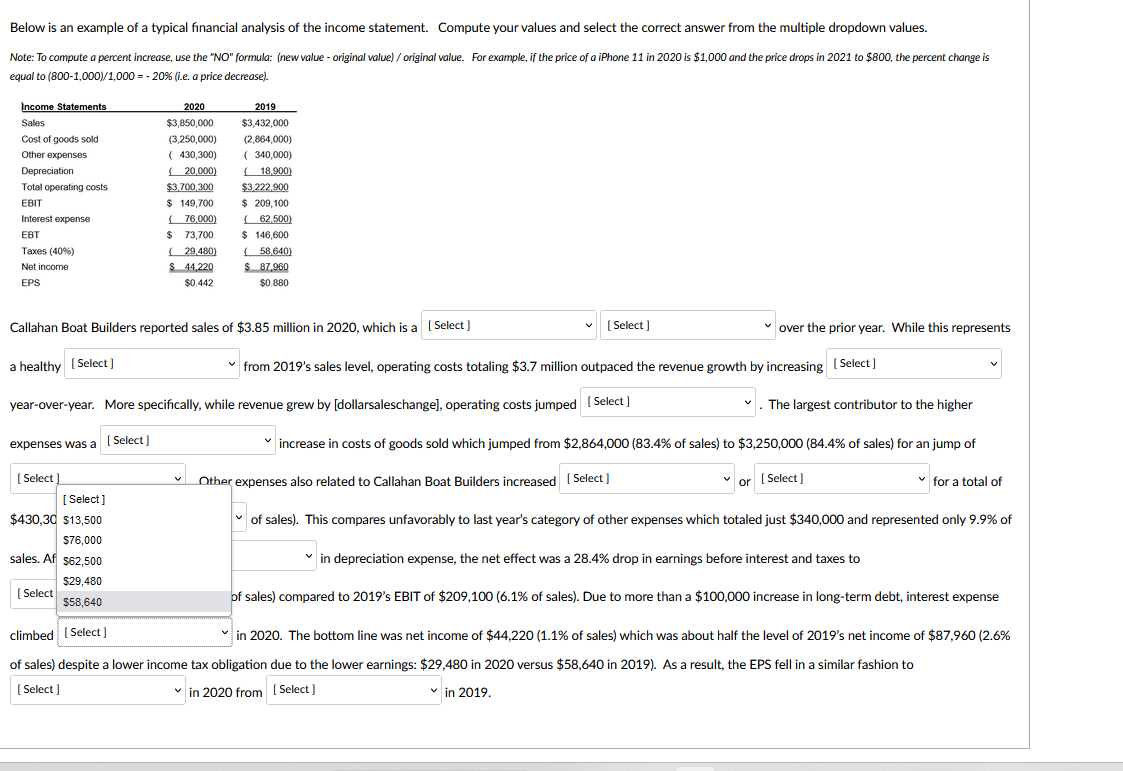

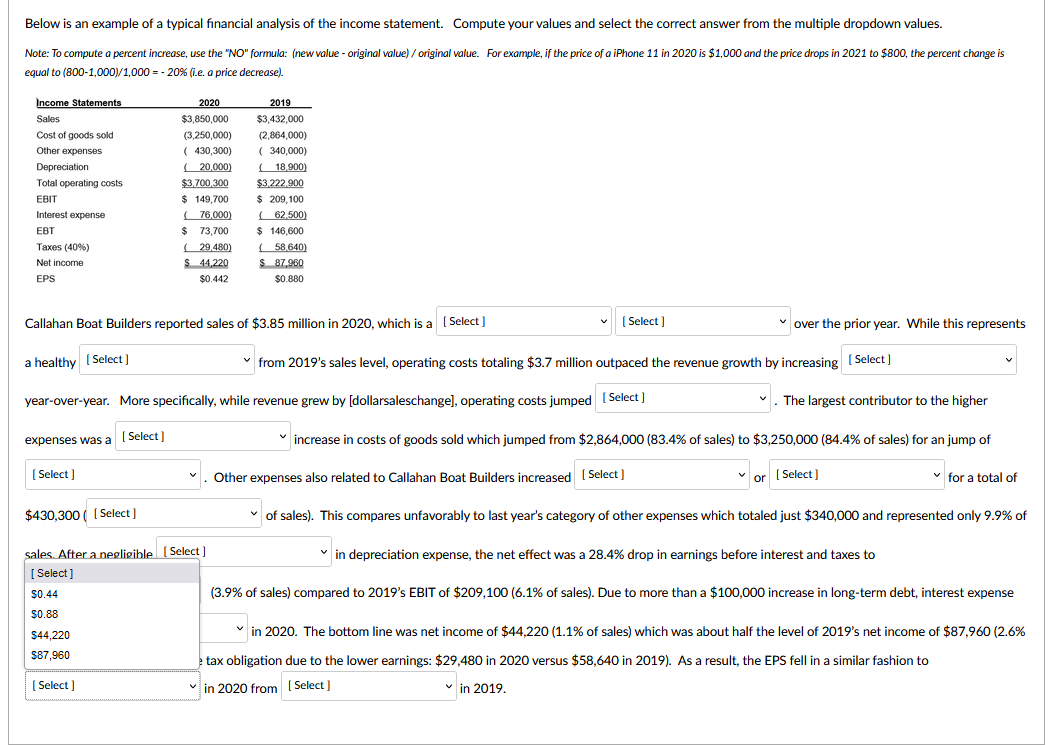

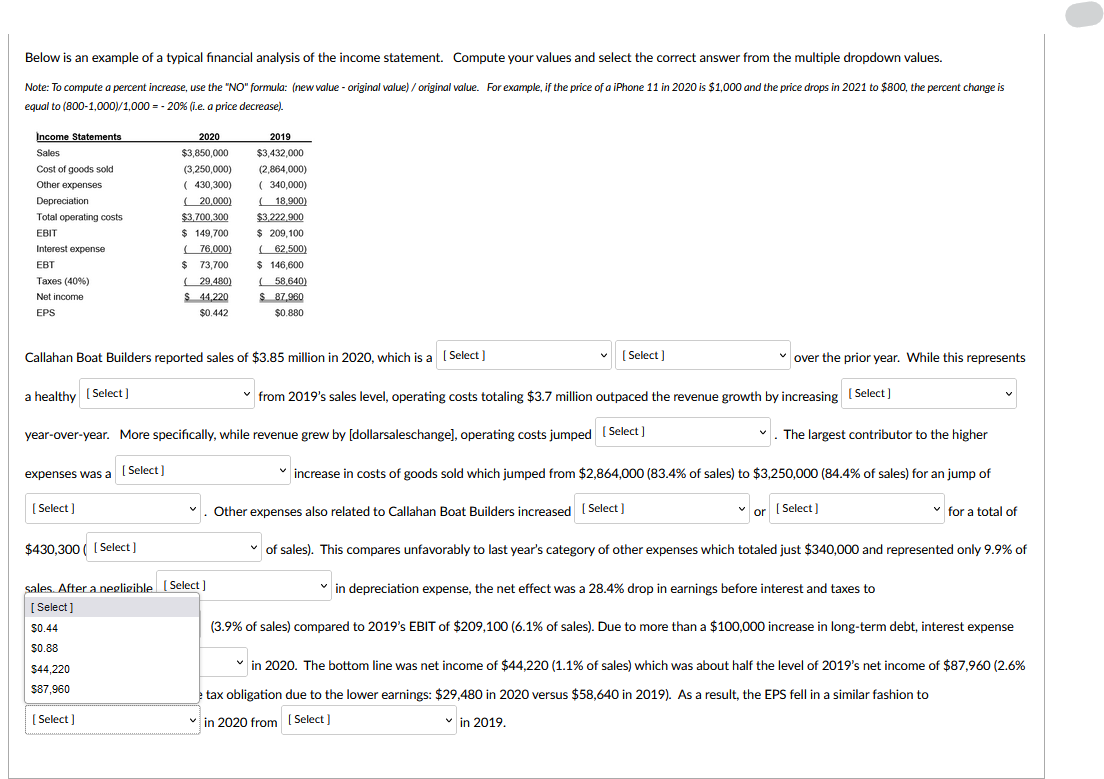

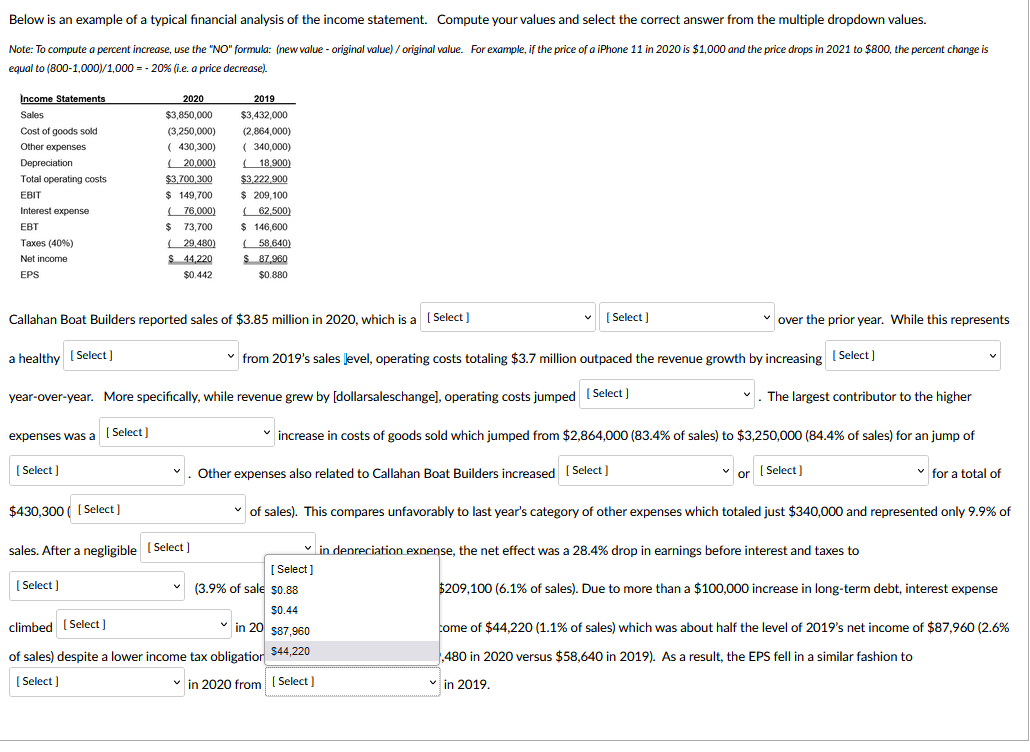

Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease) . Callahan Boat Builders reported sales of $3.85 million in 2020, which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped The largest contributor to the higher expenses was a increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 ( 84.4% of sales) for an jump of . Other expenses also related to Callahan Boat Builders increased or for a total of $430,300 of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of sales. After a negligible in depreciation expense, the net effect was a 28.4% drop in earnings before interest and taxes to (3.9\% of sales) compared to 2019 's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense climbed in 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960 (2.6\% of sales) despite a lower income tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019 ). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a a healthy from 2019's sales level, operatir year-over-year. More specifically, while revenue grew by [dollarsaleschar expenses was a increase in costs of goods . Other expenses also related to Callahan $430,300 sales. After a negligible climbed over the prior year. While this represents tpaced the revenue growth by increasing . The largest contributor to the higher 4,000 ( 83.4% of sales) to $3,250,000 ( 84.4% of sales) for an jump of or for a total of of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of in depreciation expense, the net effect was a 28.4% drop in earnings before interest and taxes to (3.9\% of sales) compared to 2019's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense in 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960 (2.6\% of sales) despite a lower income tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (newvalue - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a a healthy from 2019's sales level, operating costs totaling $3.7 million ou year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped expenses was a $430,3001 sales. After a negligible over the prior year. While this represents creasing he largest contributor to the higher increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 (84.4\% of sales) for an jump of - Other expenses also related to Callahan Boat Builders increased or for a total of of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of in depreciation expense, the net effect was a 28.4% drop in earnings before interest and taxes to (3.9\% of sales) compared to 2019's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense climbed in 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960 (2.6\% Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (newvalue - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a over the prior year. While this represents a healthy year-over expenses from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing evenue grew by [dollarsaleschange], operating costs jumped . The largest contributor to the higher increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 (84.4\% of sales) for an jump of . Other expenses also related to Callahan Boat Builders increased or for a total of of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of in depreciation expense, the net effect was a 28.4% drop in earnings before interest and taxes to (3.9\% of sales) compared to 2019 's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense climbed in 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960 (2.6\% of sales) despite a lower income tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped expenses was a increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 (84 [ Select] 14.8% 12.2% 13.5% . Other expenses also related to Callahan Boat Builders increased or 26.6% 5.8% $430,300 of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,C 21.6% $418,000 sales. After a negligible in depreciation expense, the net effect was a 28.4% drop in earnings before interest and ta $386,000 $90,300 (3.9\% of sales) compared to 2019's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in lo $59,400 $13,500 climbed in 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half the level 201 $72,900 of sales) despite a lower income tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019). As a result, the EPS fell in a si $29,160 in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020, which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumper expenses was a $430,3001 sales. After a negligible sales. After a negligible climbed increase in costs of goods sold which jumped from \$. Other expenses also related to Callahan Boat Builders increased of sales). This compares unfavorably to last year's categor in depreciation expense, the net effect was a . The largest contributor to the higher 250,000(84.4% of sales) for an jump of for a total of 1 just $340,000 and represented only 9.9% of :erest and taxes to (3.9\% of sales) compared to 2019's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense in 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960 (2.6\% of sales) despite a lower income tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019 ). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped . The largest contributor to the higher expenses was a [ Select ] $430,300 [ Se sales. After a ne climbed increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 (84.4\% of sales) for an jump of Is also related to Callahan Boat Builders increased or for a total of es). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of in depreciation expense, the net effect was a 28.4% drop in earnings before interest and taxes to compared to 2019's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense in 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960 (2.6\% of sales) despite a lower income tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019 ). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped . The largest contributor to the higher expenses was a increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 (84.4\% of sales) for an jump of . Other expenses also related to Callahan Boat Builders increased or for a total of [ Select] of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of 13.5% in depreciation expense, the net effect was a 28.4% drop in earnings before interest and taxes to 14.8% 11.2% (3.9\% of sales) compared to 2019's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense 28.4% 9.9% in 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960 (2.6\% of sales) despite a lower income tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019 ). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped . The largest contributor to the higher expenses was a increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 ( 84.4% of sales) for an jump of . Other expenses also related to Callahan Boat Builders increased $430,300 sales. After a negligible climbed of sales). This compares unfavorably to last year's cate; in depreciation expense, the net effect wa (3.9\% of sales) compared to 2019's EBIT of $209,100 (6.1\% of sa or :aled just $340,000 and represented only 9.9% o e interest and taxes to JO increase in long-term debt, interest expense of sales) despite a lower income tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019 ). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped . The largest contributor to the higher expenses was a $430,300( sales. After a negligible climbed increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 ( 84.4% of sales) for an jump of . Other expenses also related to Callahan Boat Builders increased or of sales). This compares unfavorably to last year's category of other expenses which totale in depreciation expense, the net effect was a 28.4% drop in earnings before ir (3.9\% of sales) compared to 2019 's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 in 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half th for a total of d only 9.9% of rest expense $87,960(2.6% of sales) despite a lower income tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped . The largest contributor to the higher expenses was a increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 (84.4\% of sales) for an jump of . Other expenses also related to Callahan Boat Builders increased or for a total of $430,300 of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of sales. After in depreciation expense, the net effect was a 28.4% drop in earnings before interest and taxes to sales) compared to 2019 's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960 (2.6\% tion due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20%( (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped . The largest contributor to the higher expenses was a increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 ( 84.4% of sales) for an jump of . Other expenses also related to Callahan Boat Builders increased or for a total of $430,300 of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of sales. After a negligible in depreciation expense, the net effect was a 28.4% drop in earnings before interest and taxes to red to 2019's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense climbed [Select ] bottom line was net income of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960 (2.6\% of sales) despite a lower income tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019 ). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020, which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped The largest contributor to the higher expenses was a increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 ( 84.4% of sales) for an jump of of sales) despite a lower income tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019 ). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (newvalue - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped . The largest contributor to the higher expenses was a increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 (84.4\% of sales) for an jump of . Other expenses also related to Callahan Boat Builders increased or for a total of $430,3001 sales. After a negligible of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of in depreciation expense, the net effect was a 28.4% drop in earnings before interest and taxes to (3.9\% of sales) compared to 2019 's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense in 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960 (2.6\% ! tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped The largest contributor to the higher expenses was a increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 ( 84.4% of sales) for an jump of . Other expenses also related to Callahan Boat Builders increased or for a total of $430,300( sales. After a negligihle of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of in depreciation expense, the net effect was a 28.4% drop in earnings before interest and taxes to (3.9\% of sales) compared to 2019's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense in 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960 (2.6\% tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (newvalue - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price draps in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped . The largest contributor to the higher expenses was a increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 ( 84.4% of sales) for an jump of . Other expenses also related to Callahan Boat Builders increased or for a total of $430,3001 of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of sales. After a negligible n denreciation exnense, the net effect was a 28.4% drop in earnings before interest and taxes to (3.9% of sale i209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense climbed in 20 ome of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960(2.6% of sales) despite a lower income tax obligatior 3,480 in 2020 versus $58,640 in 2019). As a result, the EPS fell in a similar fashion to in 2020 from in 2019

Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease) . Callahan Boat Builders reported sales of $3.85 million in 2020, which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped The largest contributor to the higher expenses was a increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 ( 84.4% of sales) for an jump of . Other expenses also related to Callahan Boat Builders increased or for a total of $430,300 of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of sales. After a negligible in depreciation expense, the net effect was a 28.4% drop in earnings before interest and taxes to (3.9\% of sales) compared to 2019 's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense climbed in 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960 (2.6\% of sales) despite a lower income tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019 ). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a a healthy from 2019's sales level, operatir year-over-year. More specifically, while revenue grew by [dollarsaleschar expenses was a increase in costs of goods . Other expenses also related to Callahan $430,300 sales. After a negligible climbed over the prior year. While this represents tpaced the revenue growth by increasing . The largest contributor to the higher 4,000 ( 83.4% of sales) to $3,250,000 ( 84.4% of sales) for an jump of or for a total of of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of in depreciation expense, the net effect was a 28.4% drop in earnings before interest and taxes to (3.9\% of sales) compared to 2019's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense in 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960 (2.6\% of sales) despite a lower income tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (newvalue - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a a healthy from 2019's sales level, operating costs totaling $3.7 million ou year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped expenses was a $430,3001 sales. After a negligible over the prior year. While this represents creasing he largest contributor to the higher increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 (84.4\% of sales) for an jump of - Other expenses also related to Callahan Boat Builders increased or for a total of of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of in depreciation expense, the net effect was a 28.4% drop in earnings before interest and taxes to (3.9\% of sales) compared to 2019's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense climbed in 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960 (2.6\% Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (newvalue - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a over the prior year. While this represents a healthy year-over expenses from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing evenue grew by [dollarsaleschange], operating costs jumped . The largest contributor to the higher increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 (84.4\% of sales) for an jump of . Other expenses also related to Callahan Boat Builders increased or for a total of of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of in depreciation expense, the net effect was a 28.4% drop in earnings before interest and taxes to (3.9\% of sales) compared to 2019 's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense climbed in 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960 (2.6\% of sales) despite a lower income tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped expenses was a increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 (84 [ Select] 14.8% 12.2% 13.5% . Other expenses also related to Callahan Boat Builders increased or 26.6% 5.8% $430,300 of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,C 21.6% $418,000 sales. After a negligible in depreciation expense, the net effect was a 28.4% drop in earnings before interest and ta $386,000 $90,300 (3.9\% of sales) compared to 2019's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in lo $59,400 $13,500 climbed in 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half the level 201 $72,900 of sales) despite a lower income tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019). As a result, the EPS fell in a si $29,160 in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020, which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumper expenses was a $430,3001 sales. After a negligible sales. After a negligible climbed increase in costs of goods sold which jumped from \$. Other expenses also related to Callahan Boat Builders increased of sales). This compares unfavorably to last year's categor in depreciation expense, the net effect was a . The largest contributor to the higher 250,000(84.4% of sales) for an jump of for a total of 1 just $340,000 and represented only 9.9% of :erest and taxes to (3.9\% of sales) compared to 2019's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense in 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960 (2.6\% of sales) despite a lower income tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019 ). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped . The largest contributor to the higher expenses was a [ Select ] $430,300 [ Se sales. After a ne climbed increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 (84.4\% of sales) for an jump of Is also related to Callahan Boat Builders increased or for a total of es). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of in depreciation expense, the net effect was a 28.4% drop in earnings before interest and taxes to compared to 2019's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense in 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960 (2.6\% of sales) despite a lower income tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019 ). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped . The largest contributor to the higher expenses was a increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 (84.4\% of sales) for an jump of . Other expenses also related to Callahan Boat Builders increased or for a total of [ Select] of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of 13.5% in depreciation expense, the net effect was a 28.4% drop in earnings before interest and taxes to 14.8% 11.2% (3.9\% of sales) compared to 2019's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense 28.4% 9.9% in 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960 (2.6\% of sales) despite a lower income tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019 ). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped . The largest contributor to the higher expenses was a increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 ( 84.4% of sales) for an jump of . Other expenses also related to Callahan Boat Builders increased $430,300 sales. After a negligible climbed of sales). This compares unfavorably to last year's cate; in depreciation expense, the net effect wa (3.9\% of sales) compared to 2019's EBIT of $209,100 (6.1\% of sa or :aled just $340,000 and represented only 9.9% o e interest and taxes to JO increase in long-term debt, interest expense of sales) despite a lower income tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019 ). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped . The largest contributor to the higher expenses was a $430,300( sales. After a negligible climbed increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 ( 84.4% of sales) for an jump of . Other expenses also related to Callahan Boat Builders increased or of sales). This compares unfavorably to last year's category of other expenses which totale in depreciation expense, the net effect was a 28.4% drop in earnings before ir (3.9\% of sales) compared to 2019 's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 in 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half th for a total of d only 9.9% of rest expense $87,960(2.6% of sales) despite a lower income tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped . The largest contributor to the higher expenses was a increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 (84.4\% of sales) for an jump of . Other expenses also related to Callahan Boat Builders increased or for a total of $430,300 of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of sales. After in depreciation expense, the net effect was a 28.4% drop in earnings before interest and taxes to sales) compared to 2019 's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960 (2.6\% tion due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20%( (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped . The largest contributor to the higher expenses was a increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 ( 84.4% of sales) for an jump of . Other expenses also related to Callahan Boat Builders increased or for a total of $430,300 of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of sales. After a negligible in depreciation expense, the net effect was a 28.4% drop in earnings before interest and taxes to red to 2019's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense climbed [Select ] bottom line was net income of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960 (2.6\% of sales) despite a lower income tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019 ). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020, which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped The largest contributor to the higher expenses was a increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 ( 84.4% of sales) for an jump of of sales) despite a lower income tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019 ). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (newvalue - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped . The largest contributor to the higher expenses was a increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 (84.4\% of sales) for an jump of . Other expenses also related to Callahan Boat Builders increased or for a total of $430,3001 sales. After a negligible of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of in depreciation expense, the net effect was a 28.4% drop in earnings before interest and taxes to (3.9\% of sales) compared to 2019 's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense in 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960 (2.6\% ! tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price drops in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped The largest contributor to the higher expenses was a increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 ( 84.4% of sales) for an jump of . Other expenses also related to Callahan Boat Builders increased or for a total of $430,300( sales. After a negligihle of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of in depreciation expense, the net effect was a 28.4% drop in earnings before interest and taxes to (3.9\% of sales) compared to 2019's EBIT of $209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense in 2020. The bottom line was net income of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960 (2.6\% tax obligation due to the lower earnings: $29,480 in 2020 versus $58,640 in 2019). As a result, the EPS fell in a similar fashion to in 2020 from in 2019. Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (newvalue - original value) / original value. For example, if the price of a iPhone 11 in 2020 is $1,000 and the price draps in 2021 to $800, the percent change is equal to (8001,000)/1,000=20% (i.e. a price decrease). Callahan Boat Builders reported sales of $3.85 million in 2020 , which is a over the prior year. While this represents a healthy from 2019's sales level, operating costs totaling $3.7 million outpaced the revenue growth by increasing year-over-year. More specifically, while revenue grew by [dollarsaleschange], operating costs jumped . The largest contributor to the higher expenses was a increase in costs of goods sold which jumped from $2,864,000 (83.4\% of sales) to $3,250,000 ( 84.4% of sales) for an jump of . Other expenses also related to Callahan Boat Builders increased or for a total of $430,3001 of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of sales. After a negligible n denreciation exnense, the net effect was a 28.4% drop in earnings before interest and taxes to (3.9% of sale i209,100 (6.1\% of sales). Due to more than a $100,000 increase in long-term debt, interest expense climbed in 20 ome of $44,220 (1.1\% of sales) which was about half the level of 2019 's net income of $87,960(2.6% of sales) despite a lower income tax obligatior 3,480 in 2020 versus $58,640 in 2019). As a result, the EPS fell in a similar fashion to in 2020 from in 2019 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started