Answered step by step

Verified Expert Solution

Question

1 Approved Answer

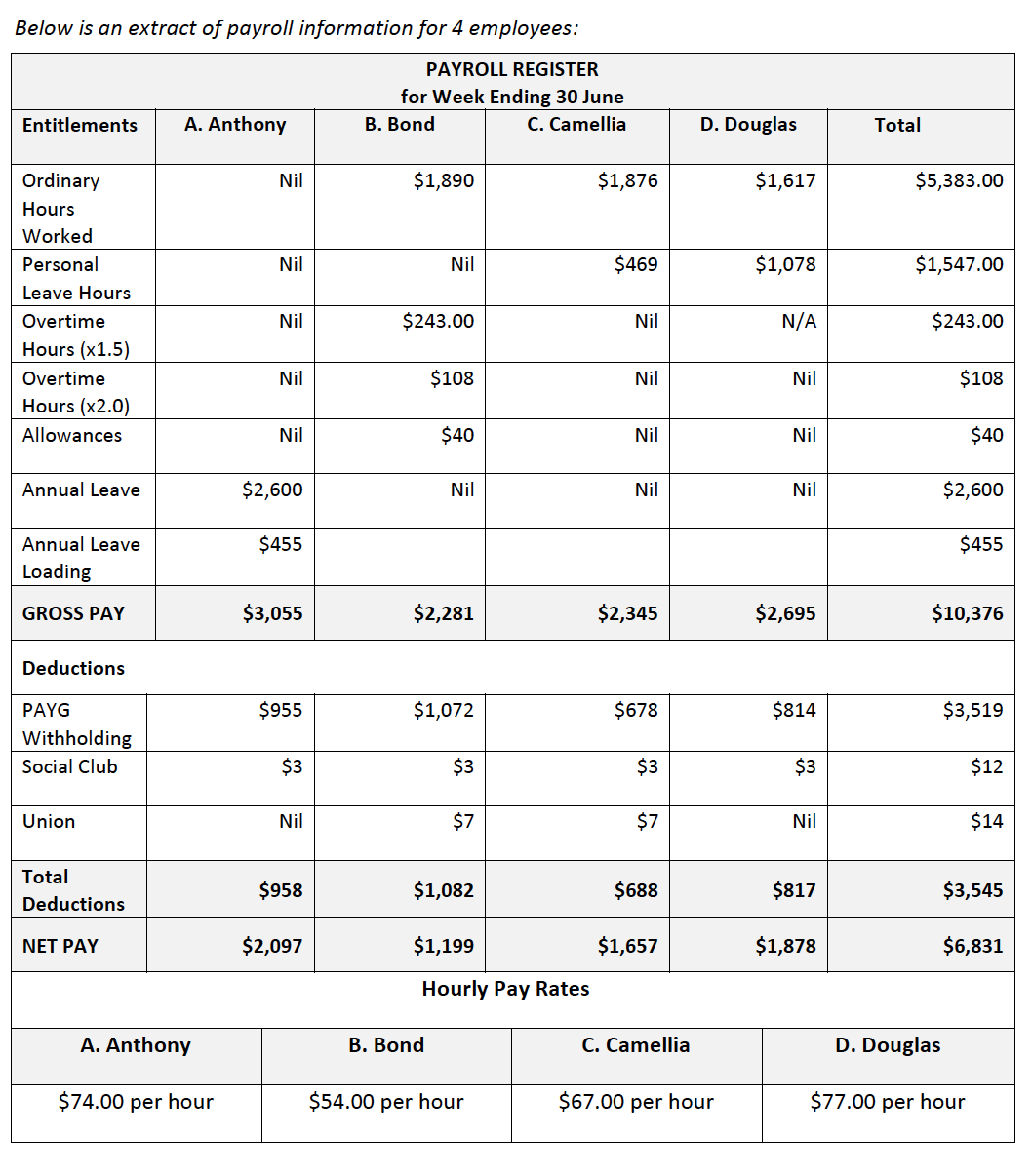

Below is an extract of payroll information for 4 employees: PAYROLL REGISTER for Week Ending 30 June C. Camellia Entitlements Ordinary Hours Worked Personal

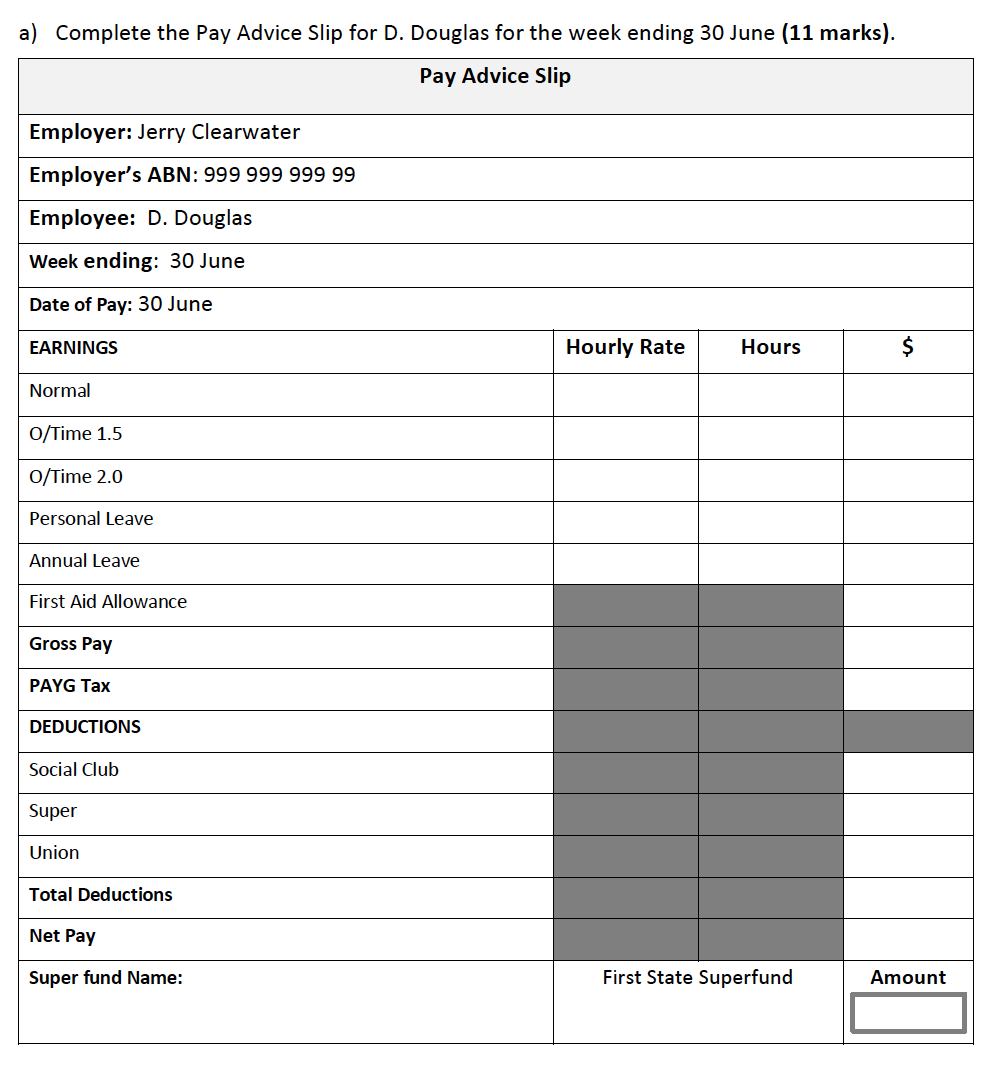

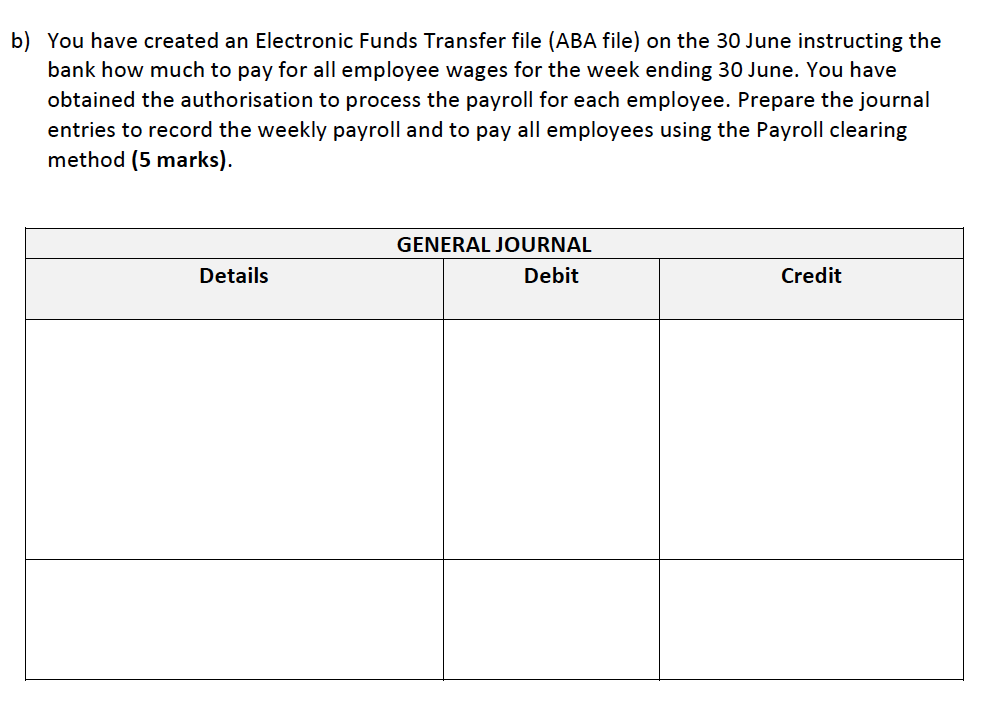

Below is an extract of payroll information for 4 employees: PAYROLL REGISTER for Week Ending 30 June C. Camellia Entitlements Ordinary Hours Worked Personal Leave Hours Overtime Hours (x1.5) Overtime Hours (x2.0) Allowances Annual Leave Annual Leave Loading GROSS PAY Deductions PAYG Withholding Social Club Union Total Deductions NET PAY A. Anthony A. Anthony $74.00 per hour Nil Nil Nil Nil Nil $2,600 $455 $3,055 $955 $3 Nil $958 $2,097 B. Bond $1,890 Nil $243.00 $108 $40 B. Bond Nil $2,281 $1,072 $3 $7 $1,082 $1,199 Hourly Pay Rates $54.00 per hour $1,876 $469 Nil Nil Nil Nil $2,345 $678 $3 $7 $688 $1,657 C. Camellia D. Douglas $67.00 per hour $1,617 $1,078 N/A Nil Nil Nil $2,695 $814 $3 Nil $817 $1,878 Total $5,383.00 $1,547.00 $243.00 $108 $40 $2,600 $455 $10,376 $3,519 $12 D. Douglas $77.00 per hour $14 $3,545 $6,831 a) Complete the Pay Advice Slip for D. Douglas for the week ending 30 June (11 marks). Pay Advice Slip Employer: Jerry Clearwater Employer's ABN: 999 999 999 99 Employee: D. Douglas Week ending: 30 June Date of Pay: 30 June EARNINGS Normal O/Time 1.5 O/Time 2.0 Personal Leave Annual Leave First Aid Allowance Gross Pay PAYG Tax DEDUCTIONS Social Club Super Union Total Deductions Net Pay Super fund Name: Hourly Rate Hours First State Superfund $ Amount b) You have created an Electronic Funds Transfer file (ABA file) on the 30 June instructing the bank how much to pay for all employee wages for the week ending 30 June. You have obtained the authorisation to process the payroll for each employee. Prepare the journal entries to record the weekly payroll and to pay all employees using the Payroll clearing method (5 marks). Details GENERAL JOURNAL Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

b Journal entries to record the weekly payroll using the payroll clearing method GE...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started