Below is an extract of the group financial statements for ZCCM-IH Plc for the year ended 31 st March 2018. a) make a horizontal analysis

Below is an extract of the group financial statements for ZCCM-IH Plc for the year ended 31st March 2018.

a) make a horizontal analysis for the Statement of Financial Position and the Statement of Comprehensive Income. ( 20 marks)

b) make a vertical analysis for the Statement of Financial Position and the Statement of Comprehensive Income. ( 20 marks)

c) Compute the following ratios for 2018 and 2017: ( 13 marks)

i. Gross Profit %

ii. Operating profit %

iii. Profit for the Year %

iv. Current Ratio

v. Acid Test Ratio vi. Cash Ratio

vii. Average Debt collection Period in days

viii. Average Creditor Payment Period in days

ix. Average Stock Holding Period in days

x. Total liabilities to Total Equity Ratio

xi. Total liabilities to Total Asset Ratio

xii. Return on Total Assets

xiii. Return on Equity

d) write a report to the Shareholder providing a detailed analysis of the financial performance and financial position of ZCCM-IH Plc using the information from the Annual Report and your answers to (a) to (c) above.

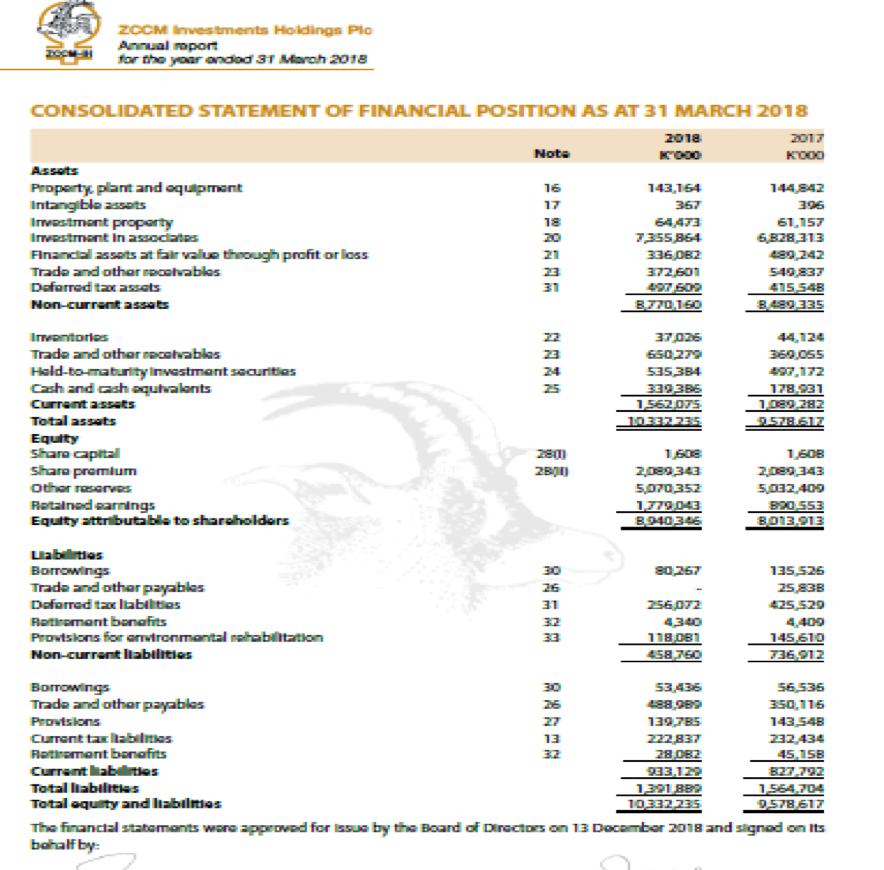

ZCCM Investments Holdings Plo Annual report for the your onded 31 March 2018 CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31 MARCH 2018 2018 K'000 2017 K000 Assets Property, plant and equipment Intangible assets Investment property Investment in associates Financial assets at fair value through profit or loss Trade and other receivables Deferred tax assets Non-current assets Inventories Trade and other receivables Held-to-maturity Investment securities Cash and cash equivalents Current assets Total assets Equity Share capital Share premium Other reserves Retained earnings Equity attributable to shareholders Labelties Borrowings Trade and other payables Deferred tax liabilities Retirement benefits Provisions for environmental rehabilitation Non-current liabilities Borrowings Trade and other payables Provisions Current tax labilmes Retirement benefits Current abilities Total liabilities Total equity and liabilities Note 16 17 18 20 21 23 31 22 23 24 25 28011 2800 30 26 31 32 33 30 26 27 13 32 143,164 367 64,473 7,355,864 336,082 372,601 497, 509 8,770,160 37,026 650,279 535,384 339,386 1,562,075 10.332.235 1,608 2,089,343 5,070,352 1,779,043 8,940,346 80,267 256,072 4,340 118,081 458,760 53,436 488,989 139,785 222,837 28,082 933,129 1,391,889 10,332,235 144,842 396 61,157 6,828,313 489,242 549,837 415,548 8,489,335 44,124 369,055 497,172 178,931 1,089,282 9.578.617 1,608 2,089,343 5,032,409 890.553 8,013,913 135,526 25,838 425,529 4,409 145,610 736,912 56,536 350,116 143,548 232,434 45,158 827,792 1,564,704 9,578,617 The financial statements were approved for issue by the Board of Directors on 13 December 2018 and signed on its behalf by:

Step by Step Solution

3.56 Rating (187 Votes )

There are 3 Steps involved in it

Step: 1

a Horizontal analysis for the Statement of Financial Position 2018 decreased by 09 compared to 2017 for total assets which was mainly due to a decrease in property plant and equipment Current assets d...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started