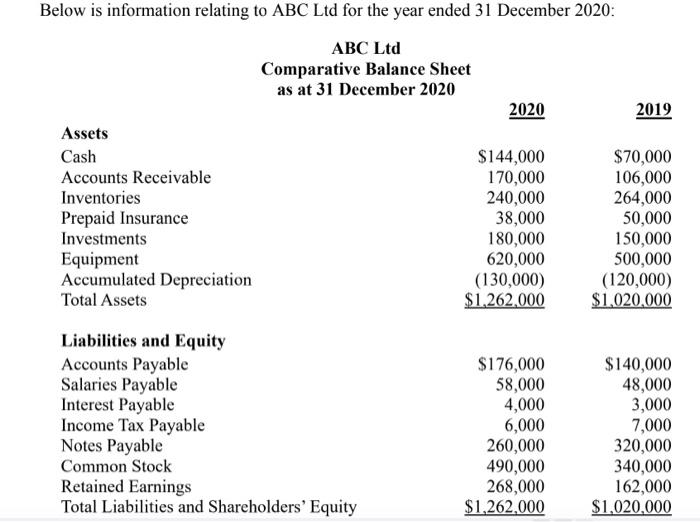

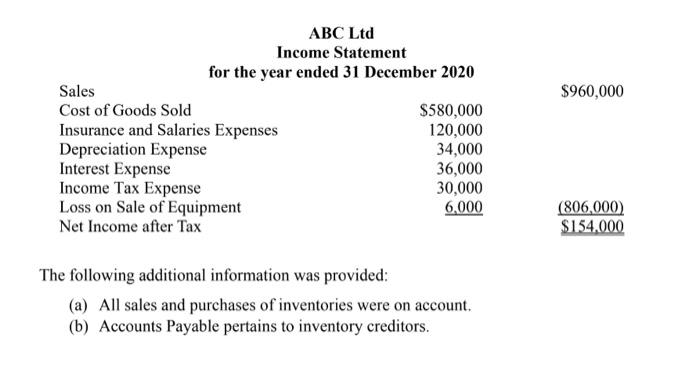

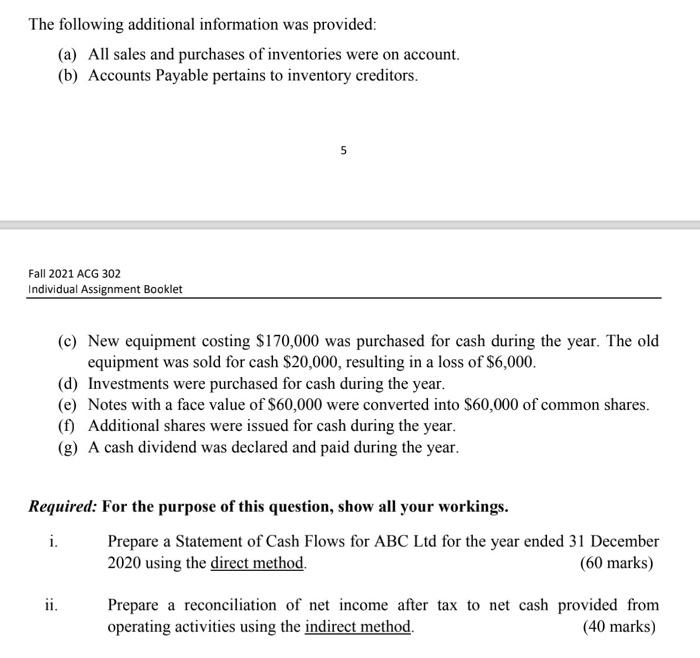

Below is information relating to ABC Ltd for the year ended 31 December 2020: ABC Ltd Comparative Balance Sheet as at 31 December 2020 2020 2019 Assets Cash $144,000 $70,000 Accounts Receivable 170,000 106,000 Inventories 240,000 264,000 Prepaid Insurance 38,000 50,000 Investments 180,000 150,000 Equipment 620,000 500,000 Accumulated Depreciation (130,000) (120,000) Total Assets $1,262,000 $1,020,000 Liabilities and Equity Accounts Payable Salaries Payable Interest Payable Income Tax Payable Notes Payable Common Stock Retained Earnings Total Liabilities and Shareholders' Equity $176,000 58,000 4,000 6,000 260,000 490,000 268,000 $1,262,000 $140,000 48,000 3,000 7,000 320,000 340,000 162,000 $1,020,000 $960,000 ABC Ltd Income Statement for the year ended 31 December 2020 Sales Cost of Goods Sold $580,000 Insurance and Salaries Expenses 120,000 Depreciation Expense 34,000 Interest Expense 36,000 Income Tax Expense 30,000 Loss on Sale of Equipment 6,000 Net Income after Tax (806,000) $154,000 The following additional information was provided: (a) All sales and purchases of inventories were on account. (b) Accounts Payable pertains to inventory creditors. The following additional information was provided: (a) All sales and purchases of inventories were on account. (b) Accounts Payable pertains to inventory creditors. 5 Fall 2021 ACG 302 Individual Assignment Booklet (c) New equipment costing $170,000 was purchased for cash during the year. The old equipment was sold for cash $20,000, resulting in a loss of $6,000. (d) Investments were purchased for cash during the year. (e) Notes with a face value of $60,000 were converted into $60,000 of common shares. (f) Additional shares were issued for cash during the year, (9) A cash dividend was declared and paid during the year. Required: For the purpose of this question, show all your workings. i. Prepare a Statement of Cash Flows for ABC Ltd for the year ended 31 December 2020 using the direct method. (60 marks) ii. Prepare a reconciliation of net income after tax to net cash provided from operating activities using the indirect method. (40 marks)