Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pioneers International has just released its management forecasts for 2020 and 2021. Income Statement Revenues COGS Gross Profit G&A Expenses Depreciation Operating Profits Interest

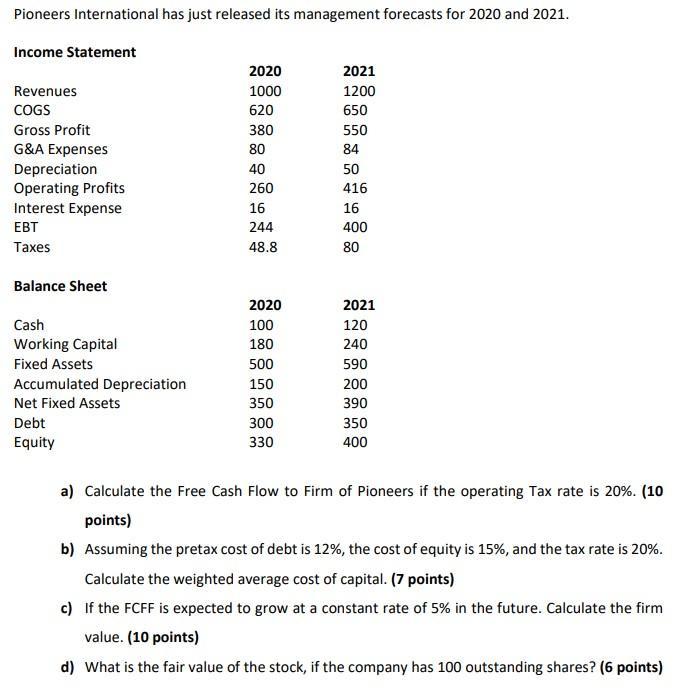

Pioneers International has just released its management forecasts for 2020 and 2021. Income Statement Revenues COGS Gross Profit G&A Expenses Depreciation Operating Profits Interest Expense EBT Taxes Balance Sheet Cash Working Capital Fixed Assets Accumulated Depreciation Net Fixed Assets Debt Equity 2020 1000 620 380 80 40 260 16 244 48.8 2020 100 180 500 150 350 300 330 2021 1200 650 550 84 50 416 16 400 80 2021 120 240 590 200 390 350 400 a) Calculate the Free Cash Flow to Firm of Pioneers if the operating Tax rate is 20%. (10 points) b) Assuming the pretax cost of debt is 12%, the cost of equity is 15%, and the tax rate is 20%. Calculate the weighted average cost of capital. (7 points) c) If the FCFF is expected to grow at a constant rate of 5% in the future. Calculate the firm value. (10 points) d) What is the fair value of the stock, if the company has 100 outstanding shares? (6 points)

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started