Answered step by step

Verified Expert Solution

Question

1 Approved Answer

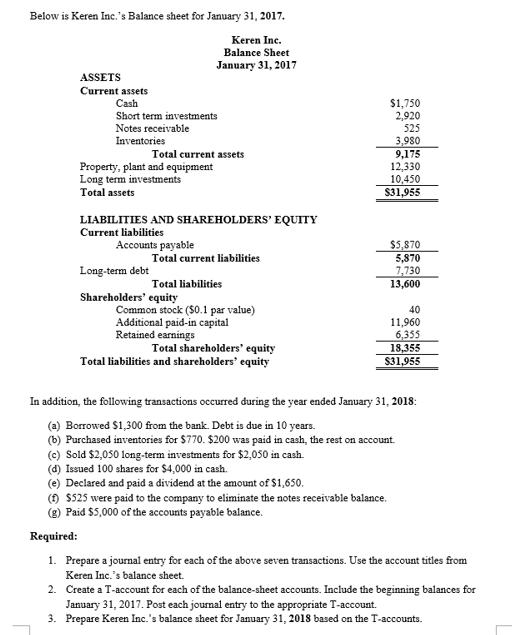

Below is Keren Inc.'s Balance sheet for January 31, 2017. Keren Inc. Balance Sheet January 31, 2017 ASSETS Current assets Cash Short term investments

Below is Keren Inc.'s Balance sheet for January 31, 2017. Keren Inc. Balance Sheet January 31, 2017 ASSETS Current assets Cash Short term investments Notes receivable Inventories Total current assets Property, plant and equipment Long term investments Total assets LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities Accounts payable Long-term debt Total current liabilities Total liabilities Shareholders' equity Common stock ($0.1 par value) Additional paid-in capital Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $1,750 2,920 525 3,980 9,175 12,330 10,450 $31,955 $5,870 5,870 7,730 13,600 40 11,960 6,355 18,355 $31,955 In addition, the following transactions occurred during the year ended January 31, 2018: (a) Borrowed $1,300 from the bank. Debt is due in 10 years. (b) Purchased inventories for $770. $200 was paid in cash, the rest on account. (c) Sold $2,050 long-term investments for $2,050 in cash. (d) Issued 100 shares for $4,000 in cash. (e) Declared and paid a dividend at the amount of $1,650. (f) $525 were paid to the company to eliminate the notes receivable balance. (g) Paid $5,000 of the accounts payable balance. Required: 1. Prepare a journal entry for each of the above seven transactions. Use the account titles from Keren Inc.'s balance sheet. 2. Create a T-account for each of the balance-sheet accounts. Include the beginning balances for January 31, 2017. Post each journal entry to the appropriate T-account. 3. Prepare Keren Inc.'s balance sheet for January 31, 2018 based on the T-accounts.

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started