Answered step by step

Verified Expert Solution

Question

1 Approved Answer

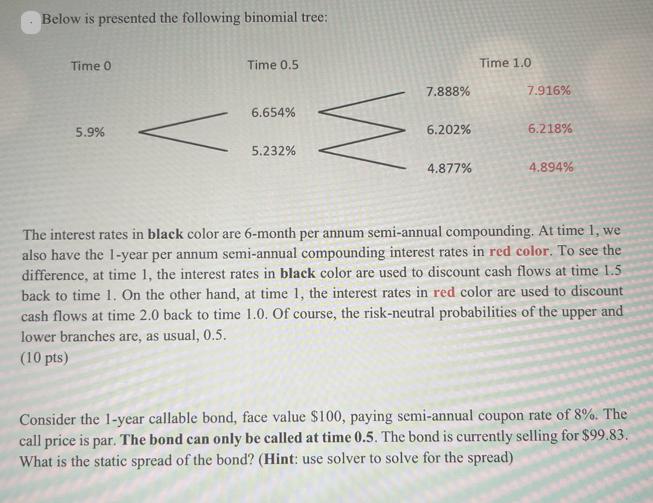

Below is presented the following binomial tree: Time 0 5.9% Time 0.5 6.654% 5.232% M 7.888% 6.202% 4.877% Time 1.0 7.916% 6.218% 4.894% The

Below is presented the following binomial tree: Time 0 5.9% Time 0.5 6.654% 5.232% M 7.888% 6.202% 4.877% Time 1.0 7.916% 6.218% 4.894% The interest rates in black color are 6-month per annum semi-annual compounding. At time 1, we also have the 1-year per annum semi-annual compounding interest rates in red color. To see the difference, at time 1, the interest rates in black color are used to discount cash flows at time 1.5 back to time 1. On the other hand, at time 1, the interest rates in red color are used to discount cash flows at time 2.0 back to time 1.0. Of course, the risk-neutral probabilities of the upper and lower branches are, as usual, 0.5. (10 pts) Consider the 1-year callable bond, face value $100, paying semi-annual coupon rate of 8%. The call price is par. The bond can only be called at time 0.5. The bond is currently selling for $99.83. What is the static spread of the bond? (Hint: use solver to solve for the spread)

Step by Step Solution

★★★★★

3.31 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the static spread of the bond we need to find the spread that makes the present value o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started