Answered step by step

Verified Expert Solution

Question

1 Approved Answer

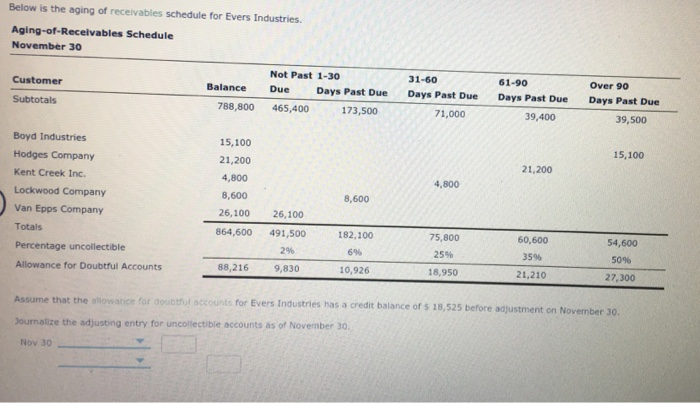

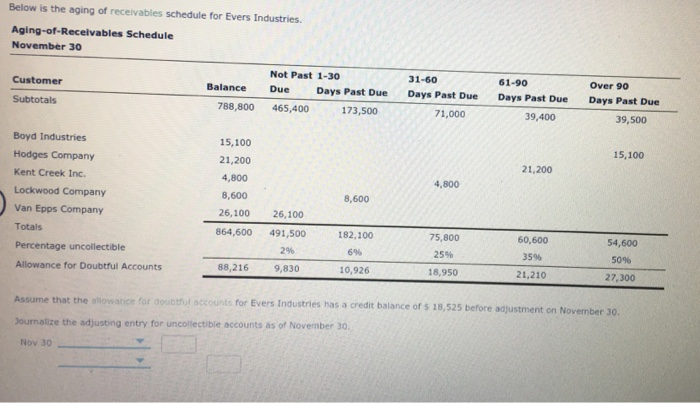

Below is the aging of receivables schedule for Evers Industries Aging-of-Receivables Schedule November 30 Not Past 1-30 Customer Balance Due Days Past Due Subtotals 788,800

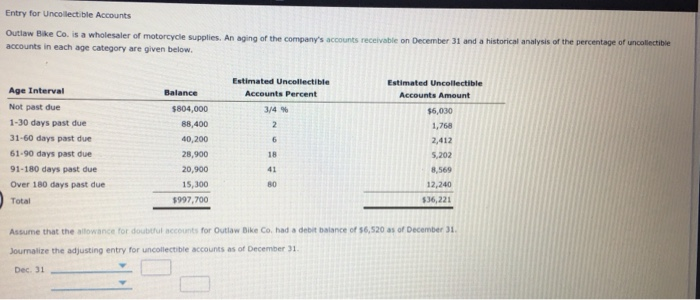

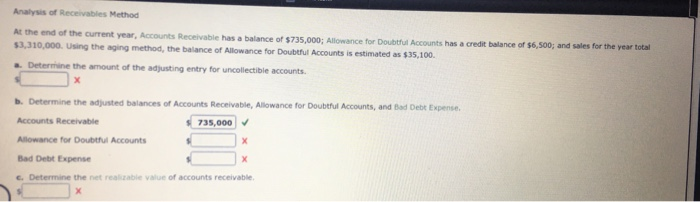

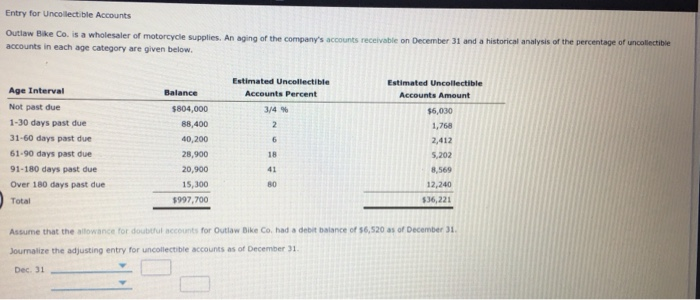

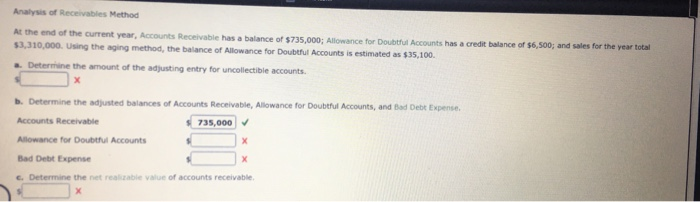

Below is the aging of receivables schedule for Evers Industries Aging-of-Receivables Schedule November 30 Not Past 1-30 Customer Balance Due Days Past Due Subtotals 788,800 465,400 173,500 31-60 Days Past Due 61-90 Days Past Due 39,400 Over 90 Days Past Due 39,500 71,000 15,100 21,200 Boyd Industries Hodges Company Kent Creek Inc. Lockwood Company Van Epps Company Totals Percentage uncollectible Allowance for Doubtful Accounts 15,100 21,200 4,800 8,600 26,100 4,800 8,600 864,600 26,100 491,500 2% 182,100 696 10,926 75,800 25% 54,600 60,600 3596 21,210 5096 88,216 9,830 18,950 27,300 Assume that the allowance for doubtful accounts for Evers Industries has a credit balance of $ 18,525 before adjustment on November 30. Joumalize the adjusting entry for uncollectible accounts as of November 30, Nov 30 Entry for Uncollectible Accounts Outlaw Bike Co. is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31 and a historical analysis of the percentage of uncollectible accounts in each age category are given below. Estimated Uncollectible Accounts Percent 3/4 2 6 Age Interval Not past due 1-30 days past due 31-60 days past due 61-90 days past due 91-180 days past due Over 180 days past due Total Balance $804,000 88,400 40,200 28,900 20,900 15,300 $997,700 Estimated Uncollectible Accounts Amount $6,030 1,768 2,412 5,202 8,569 12,240 $36,221 18 80 Assume that the allowance for doubtful accounts for Outlaw Bike Co had a debit balance of 56,520 as of December 31 Joumalize the adjusting entry for uncollectible accounts as of December 31 Dec. 31 Analysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $735,000; Allowance for Doubtful Accounts has a credit balance of $6,500; and sales for the year total $3,310,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $35,100. . Determine the amount of the adjusting entry for uncollectible accounts. X . Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense, Accounts Receivable 735,000 Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable

Below is the aging of receivables schedule for Evers Industries Aging-of-Receivables Schedule November 30 Not Past 1-30 Customer Balance Due Days Past Due Subtotals 788,800 465,400 173,500 31-60 Days Past Due 61-90 Days Past Due 39,400 Over 90 Days Past Due 39,500 71,000 15,100 21,200 Boyd Industries Hodges Company Kent Creek Inc. Lockwood Company Van Epps Company Totals Percentage uncollectible Allowance for Doubtful Accounts 15,100 21,200 4,800 8,600 26,100 4,800 8,600 864,600 26,100 491,500 2% 182,100 696 10,926 75,800 25% 54,600 60,600 3596 21,210 5096 88,216 9,830 18,950 27,300 Assume that the allowance for doubtful accounts for Evers Industries has a credit balance of $ 18,525 before adjustment on November 30. Joumalize the adjusting entry for uncollectible accounts as of November 30, Nov 30 Entry for Uncollectible Accounts Outlaw Bike Co. is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31 and a historical analysis of the percentage of uncollectible accounts in each age category are given below. Estimated Uncollectible Accounts Percent 3/4 2 6 Age Interval Not past due 1-30 days past due 31-60 days past due 61-90 days past due 91-180 days past due Over 180 days past due Total Balance $804,000 88,400 40,200 28,900 20,900 15,300 $997,700 Estimated Uncollectible Accounts Amount $6,030 1,768 2,412 5,202 8,569 12,240 $36,221 18 80 Assume that the allowance for doubtful accounts for Outlaw Bike Co had a debit balance of 56,520 as of December 31 Joumalize the adjusting entry for uncollectible accounts as of December 31 Dec. 31 Analysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $735,000; Allowance for Doubtful Accounts has a credit balance of $6,500; and sales for the year total $3,310,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $35,100. . Determine the amount of the adjusting entry for uncollectible accounts. X . Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense, Accounts Receivable 735,000 Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started