Answered step by step

Verified Expert Solution

Question

1 Approved Answer

below is the answer for question plz explain why pizza investment is 1500000+1200000/2 4. Freshmeals Ltd has a chain of fast food outlets selling burgers,

below is the answer for question

plz explain why pizza investment is 1500000+1200000/2

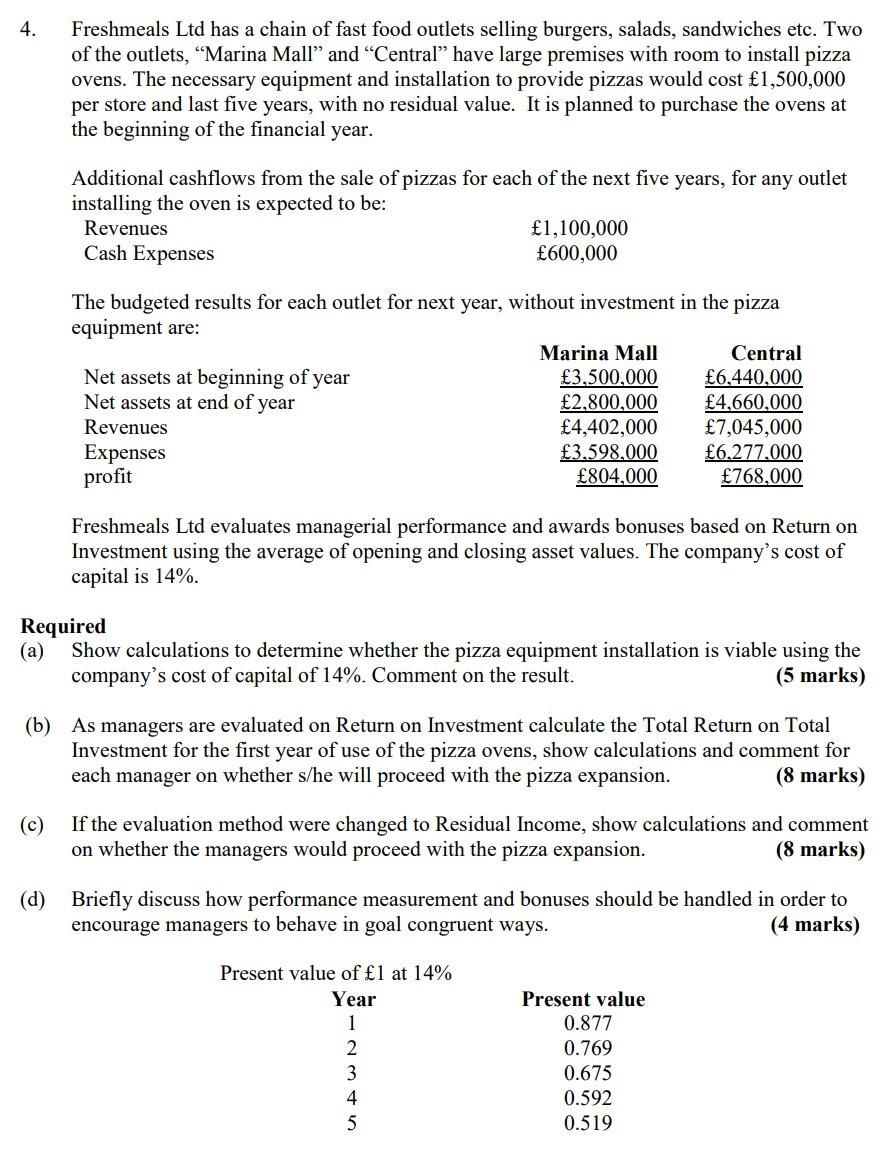

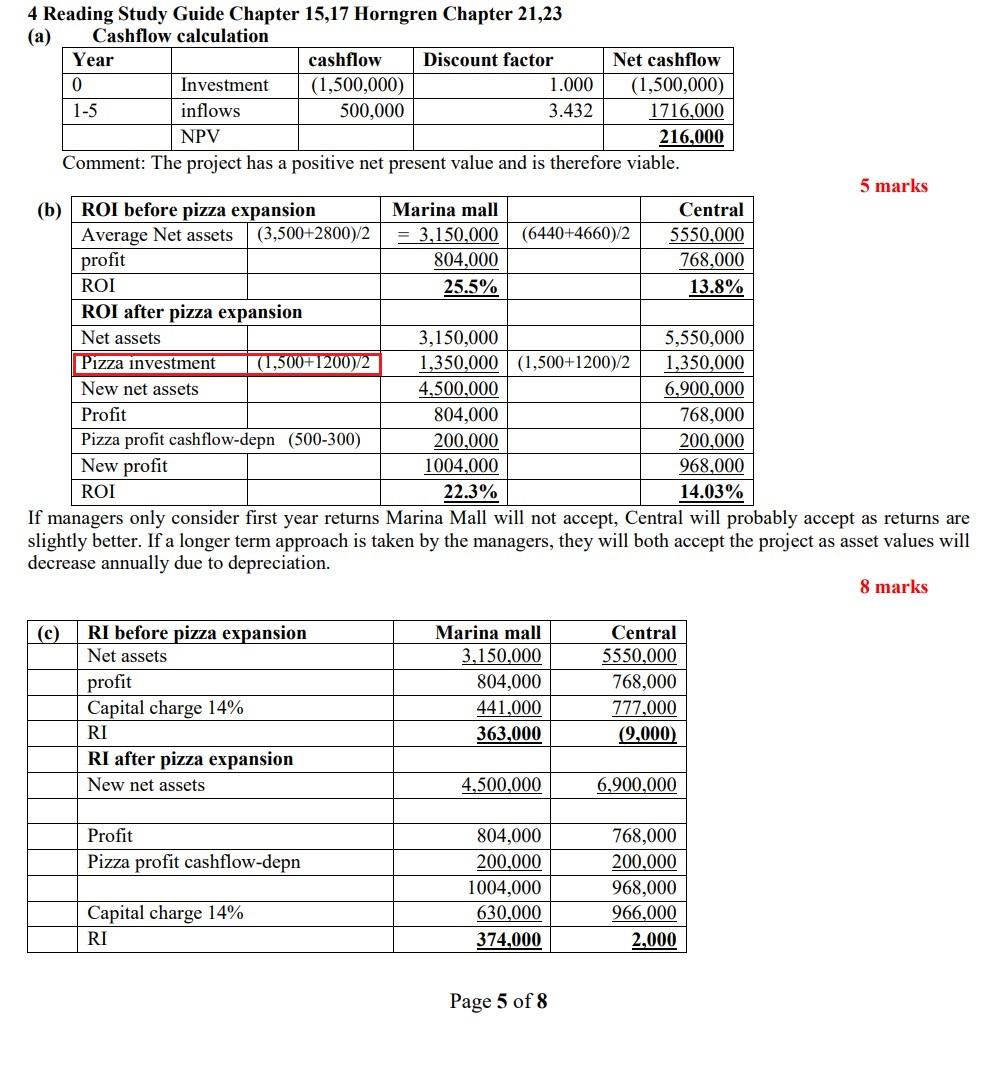

4. Freshmeals Ltd has a chain of fast food outlets selling burgers, salads, sandwiches etc. Two of the outlets, Marina Mall and Central have large premises with room to install pizza ovens. The necessary equipment and installation to provide pizzas would cost 1,500,000 per store and last five years, with no residual value. It is planned to purchase the ovens at the beginning of the financial year. Additional cashflows from the sale of pizzas for each of the next five years, for any outlet installing the oven is expected to be: Revenues 1,100,000 Cash Expenses 600,000 The budgeted results for each outlet for next year, without investment in the pizza equipment are: Marina Mall Central Net assets at beginning of year 3,500,000 6,440,000 Net assets at end of year 2,800,000 4,660,000 Revenues 4,402,000 7,045,000 Expenses 3.598.000 6.277.000 profit 804,000 768,000 Freshmeals Ltd evaluates managerial performance and awards bonuses based on Return on Investment using the average of opening and closing asset values. The company's cost of capital is 14%. Required (a) Show calculations to determine whether the pizza equipment installation is viable using the company's cost of capital of 14%. Comment on the result. (5 marks) (b) As managers are evaluated on Return on Investment calculate the Total Return on Total Investment for the first year of use of the pizza ovens, show calculations and comment for each manager on whether s/he will proceed with the pizza expansion. (8 marks) (c) If the evaluation method were changed to Residual Income, show calculations and comment on whether the managers would proceed with the pizza expansion. (8 marks) (d) Briefly discuss how performance measurement and bonuses should be handled in order to encourage managers to behave in goal congruent ways. (4 marks) Present value of 1 at 14% Year 1 2 3 4 5 Present value 0.877 0.769 0.675 0.592 0.519 mtn 4 Reading Study Guide Chapter 15,17 Horngren Chapter 21,23 (a) Cashflow calculation Year cashflow Discount factor Net cashflow 0 Investment (1,500,000) 1.000 (1,500,000) 1-5 inflows 500,000 3.432 1716,000 NPV 216,000 Comment: The project has a positive net present value and is therefore viable. 5 marks (b) ROI before pizza expansion Marina mall Central Average Net assets (3,500+2800)/2 = 3,150,000 (6440+4660)/2 5550,000 profit 804,000 768,000 ROI 25.5% 13.8% ROI after pizza expansion Net assets 3,150,000 5,550,000 Pizza investment (1,500+120072 1,350,000 (1,500+1200)/2 1,350,000 New net assets 4,500,000 6,900,000 Profit 804,000 768,000 Pizza profit cashflow-depn (500-300) 200,000 200,000 New profit 1004,000 968,000 ROI 22.3% 14.03% If managers only consider first year returns Marina Mall will not accept, Central will probably accept as returns are slightly better. If a longer term approach is taken by the managers, they will both accept the project as asset values will decrease annually due to depreciation. 8 marks (c) RI before pizza expansion Net assets profit Capital charge 14% RI RI after pizza expansion New net assets Marina mall 3,150,000 804,000 441,000 363,000 Central 5550,000 768,000 777,000 (9,000) 4,500,000 6,900,000 Profit Pizza profit cashflow-depn 804,000 200,000 1004,000 630,000 374,000 768,000 200,000 968,000 966,000 2,000 Capital charge 14% RI Page 5 of 8Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started