Answered step by step

Verified Expert Solution

Question

1 Approved Answer

below is the answer question c plz show me how to get numbers in the redbox!! Orion Plc is a cosmetics company making a range

below is the answer question c

plz show me how to get numbers in the redbox!!

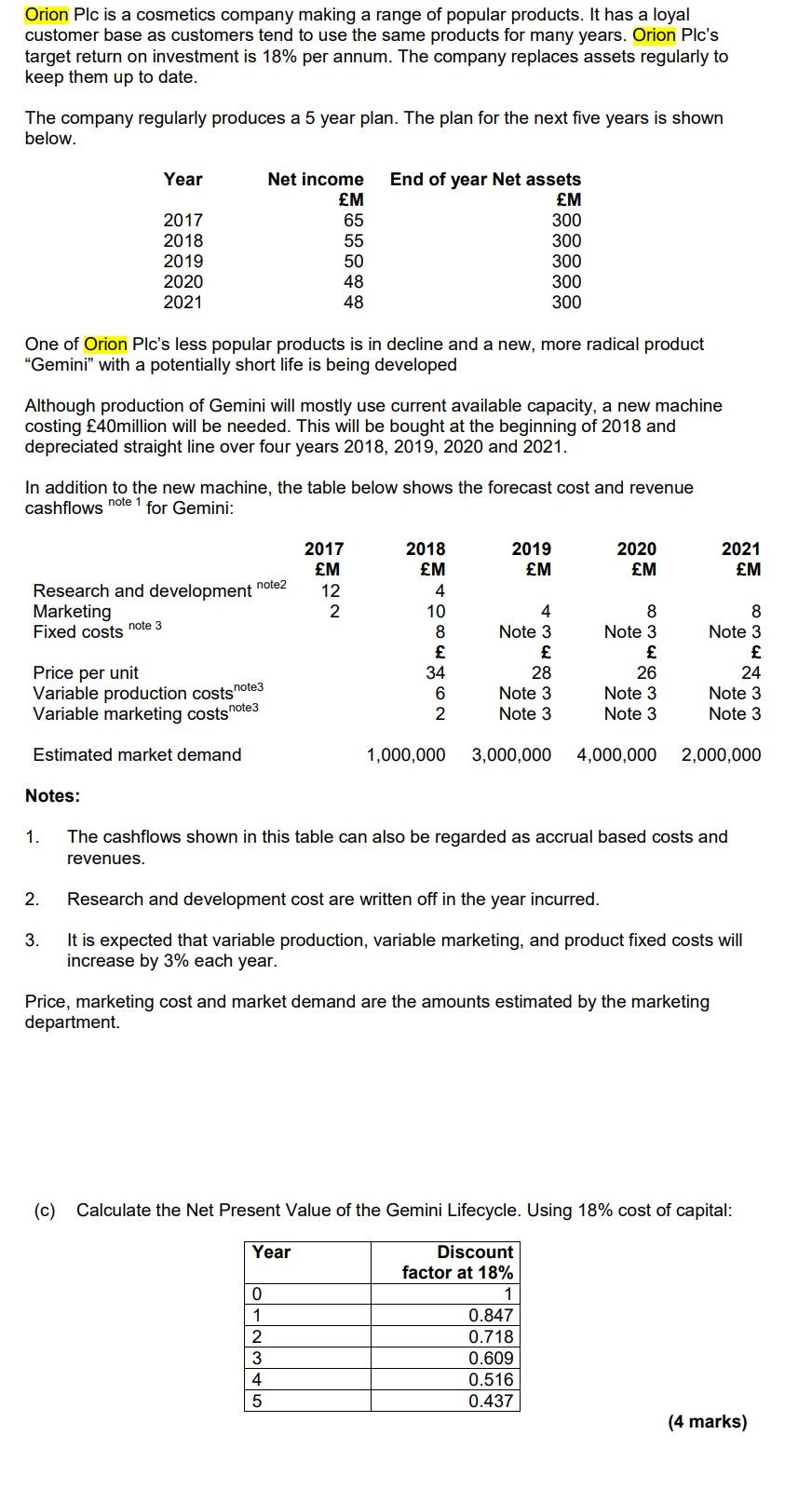

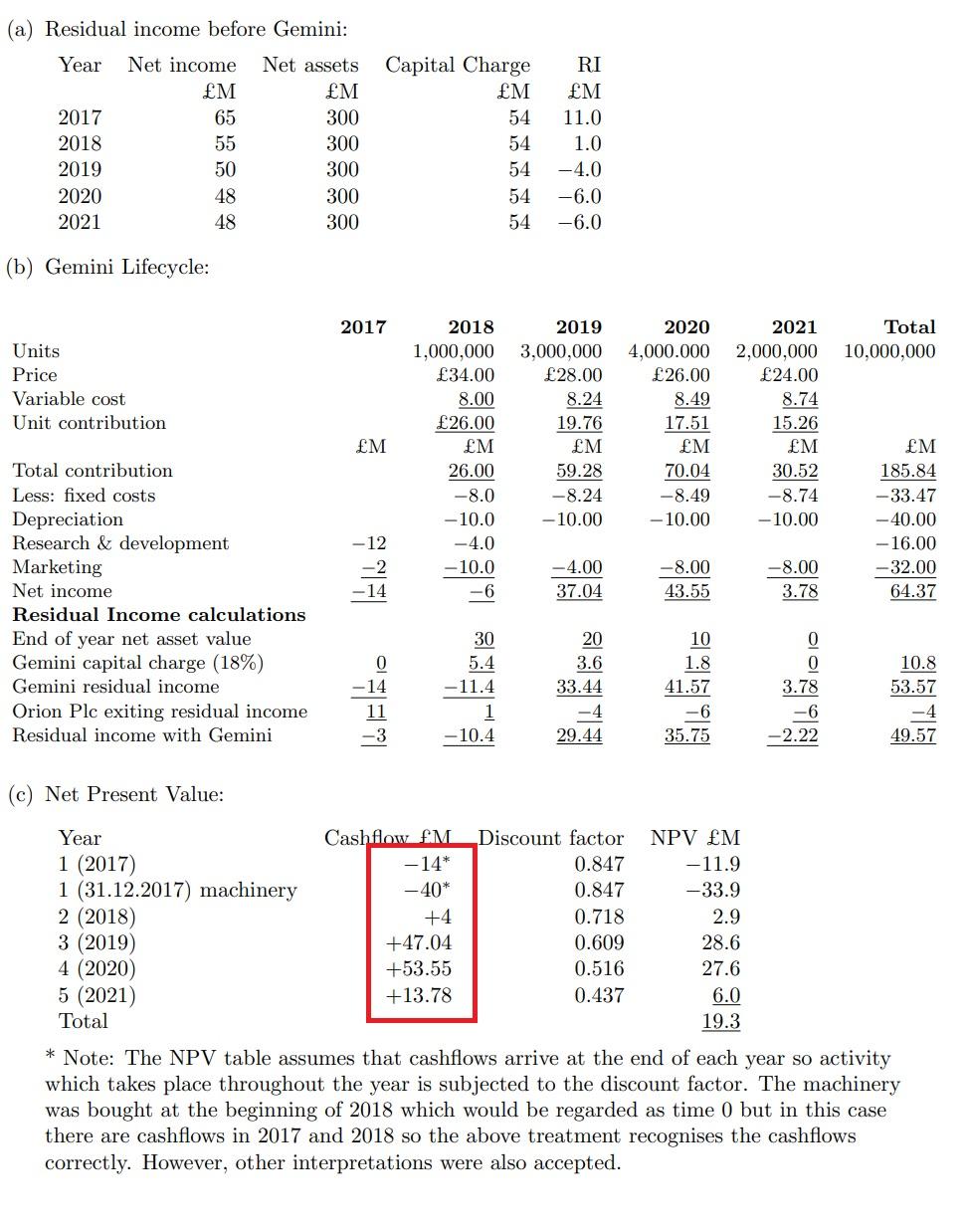

Orion Plc is a cosmetics company making a range of popular products. It has a loyal customer base as customers tend to use the same products for many years. Orion Plc's target return on investment is 18% per annum. The company replaces assets regularly to keep them up to date. The company regularly produces a 5 year plan. The plan for the next five years is shown below. . Year 2017 2018 2019 2020 2021 Net income End of year Net assets M M 65 300 55 300 50 300 48 300 48 300 One of Orion Plc's less popular products is in decline and a new, more radical product "Gemini with a potentially short life is being developed Although production of Gemini will mostly use current available capacity, a new machine costing 40million will be needed. This will be bought at the beginning of 2018 and depreciated straight line over four years 2018, 2019, 2020 and 2021. In addition to the new machine, the table below shows the forecast cost and revenue cashflows note 1 for Gemini: 2019 M 2020 M 2021 M 2017 M 12 2 Research and development note2 Marketing Fixed costs note 3 2018 M 4 4 10 8 34 6 2 4 Note 3 8 Note 3 26 Note 3 Note 3 3 8 Note 3 24 Note 3 Note 3 Price per unit Variable production costs note3 Variable marketing costs note3 28 Note 3 Note 3 Estimated market demand 1,000,000 3,000,000 4,000,000 2,000,000 Notes: 1. The cashflows shown in this table can also be regarded as accrual based costs and revenues. 2. Research and development cost are written off in the year incurred. 3. It is expected that variable production, variable marketing, and product fixed costs will increase by 3% each year. Price, marketing cost and market demand are the amounts estimated by the marketing department (c) Calculate the Net Present Value of the Gemini Lifecycle. Using 18% cost of capital: Year 0 1 2 3 4 5 Discount factor at 18% 1 0.847 0.718 0.609 0.516 0.437 (4 marks) (a) Residual income before Gemini: Year 2017 2018 2019 2020 2021 Net income M 65 55 50 48 48 Net assets M 300 300 300 300 300 Capital Charge AM 54 54 54 54 54 RI M 11.0 1.0 -4.0 -6.0 -6.0 (b) Gemini Lifecycle: 2017 Total 10,000,000 Units Price Variable cost Unit contribution 2018 1,000,000 34.00 8.00 26.00 M 26.00 - 8.0 - 10.0 -4.0 -10.0 -6 2019 3,000,000 28.00 8.24 19.76 AM 59.28 -8.24 - 10.00 2020 4,000.000 26.00 8.49 17.51 M 70.04 -8.49 - 10.00 2021 2,000,000 24.00 8.74 15.26 M 30.52 -8.74 -10.00 M M 185.84 -33.47 -40.00 - 16.00 -32.00 64.37 -12 -4.00 37.04 -8.00 43.55 -8.00 3.78 -14 Total contribution Less: fixed costs Depreciation Research & development Marketing Net income Residual Income calculations End of year net asset value Gemini capital charge (18%) Gemini residual income Orion Plc exiting residual income Residual income with Gemini 151515191 30 5.4 -11.4 -14 20 3.6 33.44 -4 29.44 10 1.8 41.57 -6 35.75 3.78 -6 -2.22 010199 10.8 53.57 -4 49.57 - 10.4 (c) Net Present Value: Year Cashflow AM Discount factor NPV M 1 (2017) -14* 0.847 -11.9 1 (31.12.2017) machinery -40* 0.847 -33.9 2 (2018) +4 0.718 2.9 3 (2019) +47.04 0.609 28.6 4 (2020) +53.55 0.516 27.6 5 (2021) +13.78 0.437 6.0 Total 19.3 * Note: The NPV table assumes that cashflows arrive at the end of each year so activity which takes place throughout the year is subjected to the discount factor. The machinery was bought at the beginning of 2018 which would be regarded as time 0 but in this case there are cashflows in 2017 and 2018 so the above treatment recognises the cashflows correctly. However, other interpretations were also acceptedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started