Answered step by step

Verified Expert Solution

Question

1 Approved Answer

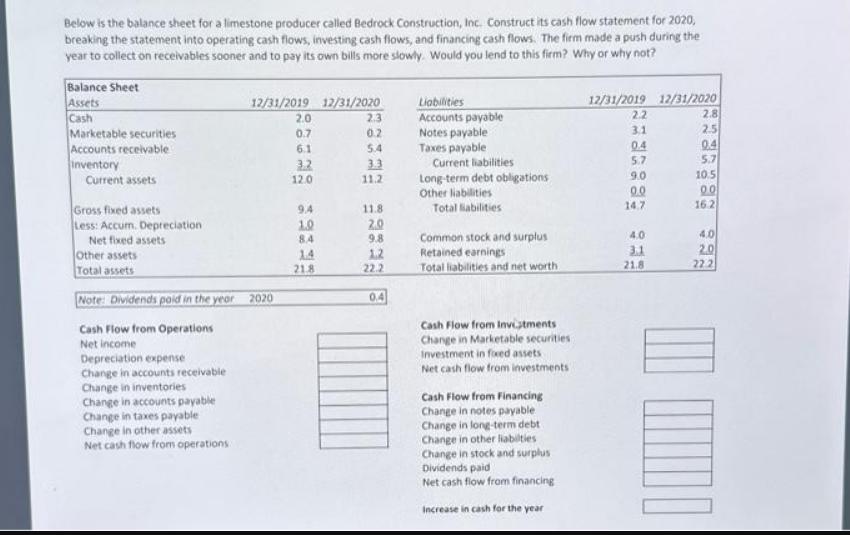

Below is the balance sheet for a limestone producer called Bedrock Construction, Inc. Construct its cash flow statement for 2020, breaking the statement into

Below is the balance sheet for a limestone producer called Bedrock Construction, Inc. Construct its cash flow statement for 2020, breaking the statement into operating cash flows, investing cash flows, and financing cash flows. The firm made a push during the year to collect on receivables sooner and to pay its own bills more slowly. Would you lend to this firm? Why or why not? Balance Sheet Assets Cash Marketable securities Accounts receivable Inventory Current assets Gross fixed assets Less: Accum. Depreciation Net fixed assets Other assets Total assets 12/31/2019 Note: Dividends poid in the year 2020 Cash Flow from Operations Net income Depreciation expense Change in accounts receivable Change in inventories Change in accounts payable Change in taxes payable Change in other assets Net cash flow from operations 2.0 0.7 6.1 3.2 12.0 9.4 1.0 8.4 14 21.8 12/31/2020 2.3 0.2 5.4 3.3 11.2 11.8 2.0 9.8 1.2 22.2 0.4 Liabilities Accounts payable Notes payable Taxes payable Current liabilities Long-term debt obligations Other liabilities Total liabilities Common stock and surplus Retained earnings Total liabilities and net worth Cash Flow from Investments Change in Marketable securities Investment in foxed assets Net cash flow from investments Cash Flow from Financing Change in notes payable Change in long-term debt Change in other liabilties Change in stock and surplus Dividends paid Net cash flow from financing Increase in cash for the year 12/31/2019 12/31/2020 2.2 2.8 3.1 2.5 0.4 0.4 5.7 5.7 9.0 0.0 14.7 4.0 3.1 21.8 10.5 00 16.2 4.0 2.0 22.2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To construct the cash flow statement for Bedrock Construction Inc for the year 2020 we need to analyze the changes in various accounts from the balanc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started