Answered step by step

Verified Expert Solution

Question

1 Approved Answer

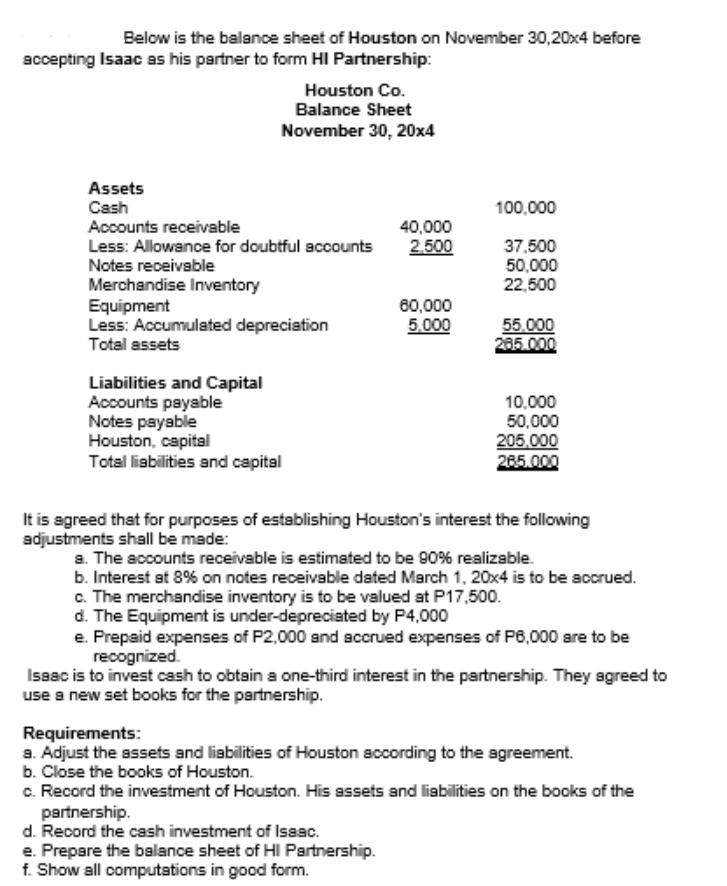

Below is the balance sheet of Houston on November 30,20x4 before accepting Isaac as his partner to form HI Partnership: Houston Co. Balance Sheet

Below is the balance sheet of Houston on November 30,20x4 before accepting Isaac as his partner to form HI Partnership: Houston Co. Balance Sheet November 30, 20x4 Assets Cash Accounts receivable Less: Allowance for doubtful sccounts 100.000 40,000 2.500 37,500 50,000 22,500 Notes receivable Merchandise Inventory Equipment Less: Accumulated depreciation 80,000 5.000 55.000 285.000 Total assets Liabilities and Capital Accounts payable Notes payable Houston, capital Total liabilities and capital 10.000 50,000 205,000 285.000 It is agreed that for purposes of establishing Houston's interest the following adjustments shall be made: a. The accounts receivable is estimated to be 90% realizable. b. Interest at 8% on notes receivable dated March 1, 20x4 is to be accrued. c. The merchandise inventory is to be valued at P17,500. d. The Equipment is under-depreciated by P4,000 e. Prepaid expenses of P2,000 and accrued expenses of P6,000 are to be recognized. Issac is to invest cash to obtain a one-third interest in the partnership. They sgreed to use a new set books for the partnership. Requirements: a. Adjust the sssets and liabilities of Houston according to the agreement. b. Close the books of Houston. c. Record the investment of Houston. His assets and liabilities on the books of the partnership. d. Record the cash investment of Isaac. e. Prepare the balance sheet of HI Partnership. f. Show all computations in good form.

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

answers 1 Journal Entris to Adjust asset and liabil...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started