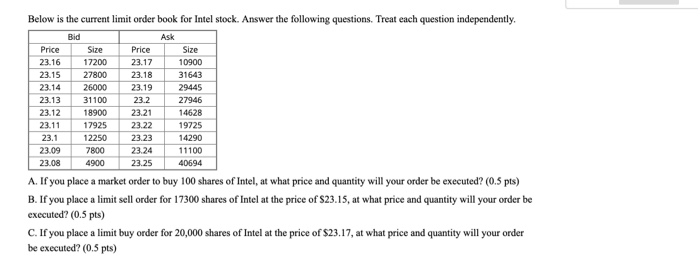

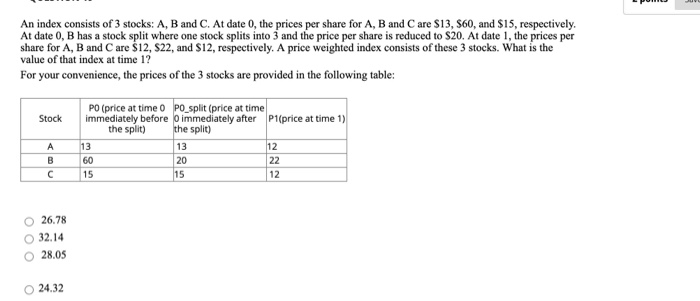

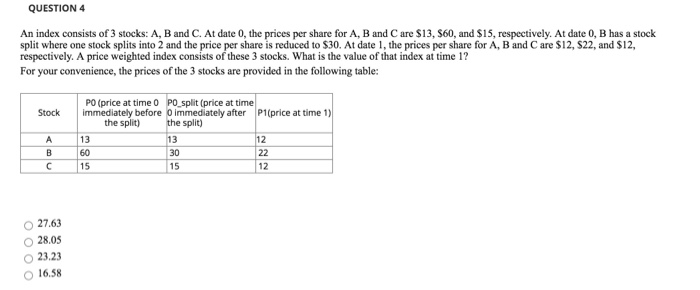

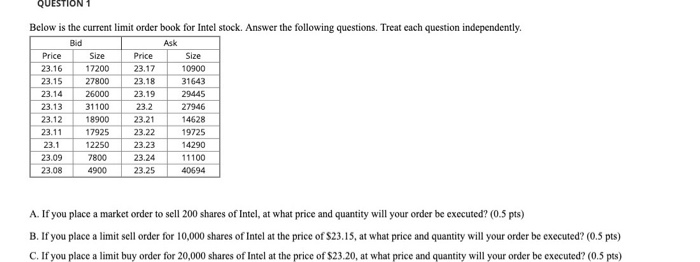

Below is the current limit order book for Intel stock. Answer the following questions. Treat each question independently. Bid Price 23.16 23.15 23.14 23.13 23.12 23.11 23.1 23.09 23.08 Size 17200 27800 26000 31100 18900 17925 12250 7800 4900 Price 23.17 23.18 23.19 23.2 23.21 23.22 23.23 23.24 23.25 Ask Size 10900 31643 29445 27946 14628 19725 14290 11100 40694 A. If you place a market order to buy 100 shares of Intel, at what price and quantity will your order be executed? (0.5 pts) B. If you place a limit sell order for 17300 shares of Intel at the price of $23.15, at what price and quantity will your order be executed? (0.5 pts) C. If you place a limit buy order for 20,000 shares of Intel at the price of $23.17, at what price and quantity will your order be executed? (0.5 pts) An index consists of 3 stocks: A, B and C. At date 0, the prices per share for A, B and Care $13, 560, and $15, respectively. At date 0, B has a stock split where one stock splits into 3 and the price per share is reduced to $20. At date 1, the prices per share for A, B and Care $12, 522, and $12, respectively. A price weighted index consists of these 3 stocks. What is the value of that index at time 1? For your convenience, the prices of the 3 stocks are provided in the following table: Stock PO (price at time 0 PO_split (price at time immediately before o immediately after P1(price at time 1) the split) the split) 13 13 12 60 20 22 15 15 12 B 26.78 32.14 O 28.05 24.32 QUESTION 4 An index consists of 3 stocks: A, B and C. At date 0, the prices per share for A, B and Care $13, 560, and $15, respectively. At date 0, B has a stock split where one stock splits into 2 and the price per share is reduced to $30. At date 1, the prices per share for A, B and Care $12, 822, and $12, respectively. A price weighted index consists of these 3 stocks. What is the value of that index at time 1? For your convenience, the prices of the 3 stocks are provided in the following table: Stock B C PO (price at time 0 PO_split (price at time immediately before o immediately after P1(price at time 1) the split) the split) 13 13 12 60 30 22 15 15 12 27.63 28.05 23.23 16.58 QUESTIC Below is the current limit order book for Intel stock. Answer the following questions. Treat cach question independently. Ask Size Price 23.16 23.15 23.14 23.13 23.12 23.11 23.1 23.09 23.08 Bid Size 17200 27800 26000 31100 18900 17925 12250 7800 4900 Price 23.17 23.18 23.19 23.2 23.21 23.22 23.23 23.24 23.25 10900 31643 29445 27946 14628 19725 14290 11100 40694 A. If you place a market order to sell 200 shares of Intel, at what price and quantity will your order be executed? (0.5 pts) B. If you place a limit sell order for 10,000 shares of Intel at the price of $23.15, at what price and quantity will your order be executed? (0.5 pts) C. If you place a limit buy order for 20,000 shares of Intel at the price of $23.20, at what price and quantity will your order be executed? (0.5 pts)