Question

Below is the foreign currency futures and options contract CURRENCY FUTURES Open High Low Settle Chg Open Interest Canadian Dollar (CME)-CAD100,000: $ per CAD June

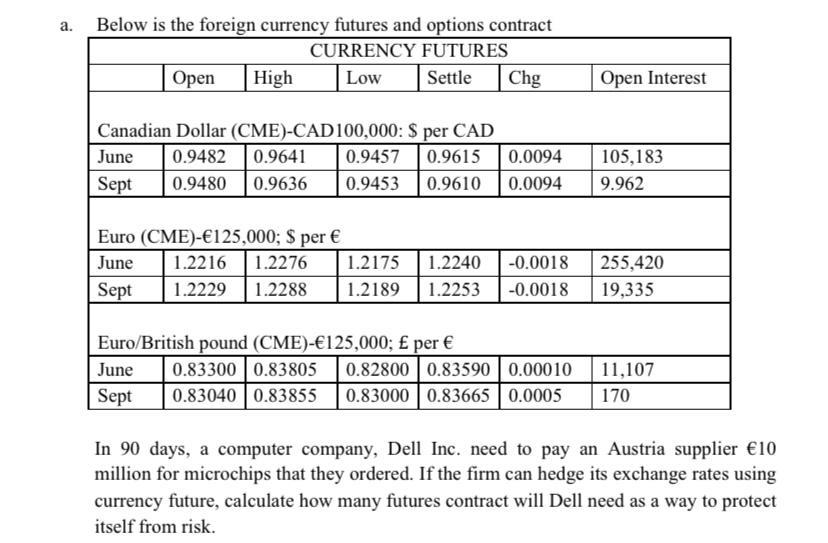

Below is the foreign currency futures and options contract CURRENCY FUTURES Open High Low Settle Chg Open Interest Canadian Dollar (CME)-CAD100,000: $ per CAD June 0.9482 0.9641 0.9457 0.9615 0.0094 105,183 Sept 0.9480 0.9636 0.9453 0.9610 0.0094 9.962 Euro (CME)-125,000; $ per June 1.2216 1.2276 1.2175 1.2240 -0.0018 255,420 Sept 1.2229 1.2288 1.2189 1.2253 -0.0018 19,335 Euro/British pound (CME)-125,000; per June 0.83300 0.83805 0.82800 0.83590 0.00010 11,107 Sept 0.83040 0.83855 0.83000 0.83665 0.0005 170

In 90 days, a computer company, Dell Inc. need to pay an Austria supplier 10 million for microchips that they ordered. If the firm can hedge its exchange rates using currency future, calculate how many futures contract will Dell need as a way to protect itself from risk. (NEED ASAP PLS)

a. Below is the foreign currency futures and options contract CURRENCY FUTURES Open High Low Settle Chg Open Interest Canadian Dollar (CME)-CAD100,000: $ per CAD June 0.9482 0.9641 0.9457 0.9615 Sept 0.9480 0.9636 0.9453 0.9610 0.0094 0.0094 105,183 9.962 Euro (CME)-125,000; $ per June 1.2216 1.2276 Sept 1.2229 1.2288 1.2175 1.2189 1.2240 1.2253 -0.0018 -0.0018 255,420 19,335 Euro/British pound (CME)-125,000; per June 0.83300 0.83805 0.82800 0.83590 0.00010 Sept 0.83040 0.83855 0.83000 0.83665 0.0005 11,107 170 In 90 days, a computer company, Dell Inc. need to pay an Austria supplier 10 million for microchips that they ordered. If the firm can hedge its exchange rates using currency future, calculate how many futures contract will Dell need as a way to protect itself from riskStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started