Answered step by step

Verified Expert Solution

Question

1 Approved Answer

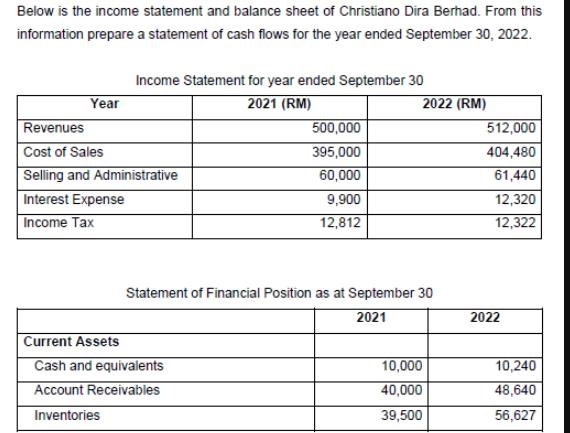

Below is the income statement and balance sheet of Christiano Dira Berhad. From this information prepare a statement of cash flows for the year

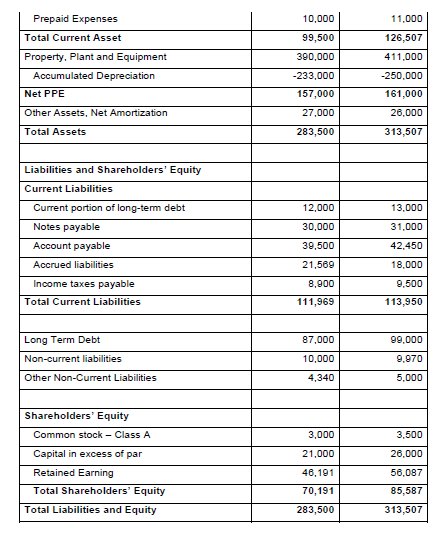

Below is the income statement and balance sheet of Christiano Dira Berhad. From this information prepare a statement of cash flows for the year ended September 30, 2022. Income Statement for year ended September 30 Year Revenues Cost of Sales Selling and Administrative Interest Expense Income Tax 2021 (RM) 2022 (RM) 500,000 512,000 395,000 404,480 60,000 61,440 9,900 12,320 12,812 12,322 Statement of Financial Position as at September 30 Current Assets Cash and equivalents Account Receivables Inventories 2021 2022 10,000 10,240 40,000 48,640 39,500 56,627 Prepaid Expenses 10,000 11,000 Total Current Asset 99,500 126,507 Property, Plant and Equipment 390,000 411,000 Accumulated Depreciation -233,000 -250,000 Net PPE 157,000 161,000 Other Assets, Net Amortization 27,000 26,000 Total Assets 283,500 313,507 Liabilities and Shareholders' Equity Current Liabilities Current portion of long-term debt 12,000 13,000 Notes payable 30,000 31,000 Account payable 39,500 42,450 Accrued liabilities 21,569 18.000 Income taxes payable 8,900 9,500 Total Current Liabilities 111,969 113,950 Long Term Debt 87,000 99,000 Non-current liabilities 10,000 9,970 Other Non-Current Liabilities 4,340 5,000 Shareholders' Equity Common stock - Class A 3,000 3,500 Capital in excess of par 21,000 26,000 Retained Earning 46,191 56,087 Total Shareholders' Equity 70,191 85,587 Total Liabilities and Equity 283,500 313,507

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To prepare the statement of cash flows for Christiano Dira Berhad for the year ended Septembe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started