Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Below is the monthly share price data for Coles Group Ltd (ASX code COL.AX) 2021-2022 financial year (Source https://finance.yahoo.com) Months July Aug Sep Oct

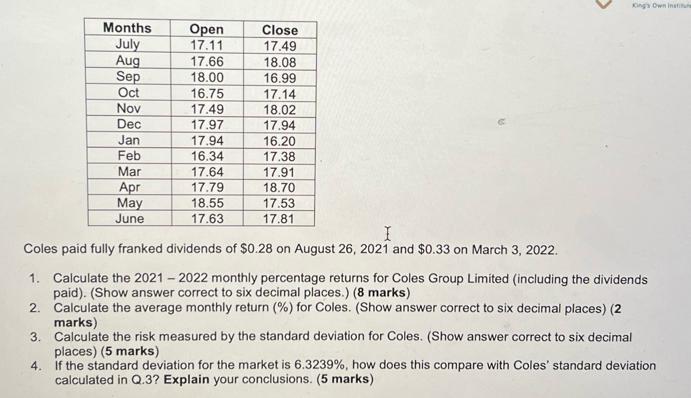

Below is the monthly share price data for Coles Group Ltd (ASX code COL.AX) 2021-2022 financial year (Source https://finance.yahoo.com) Months July Aug Sep Oct Nov Dec Jan Feb Mar Apr May June Open 17.11 17.66 18.00 16.75 17.49 17.97 17.94 16.34 17.64 17.79 18.55 17.63 Close 17.49 18.08 16.99 17.14 18.02 17.94 16.20 17.38 17.91 18.70 17.53 17.81 I dividends of $0.28 on August 26, 2021 and $0.33 on March 3, 2022. King's Own Institu Coles paid fully franked 1. Calculate the 2021- 2022 monthly percentage returns for Coles Group Limited (including the dividends paid). (Show answer correct to six decimal places.) (8 marks) 2. Calculate the average monthly return (%) for Coles. (Show answer correct to six decimal places) (2 marks) 3. Calculate the risk measured by the standard deviation for Coles. (Show answer correct to six decimal places) (5 marks) 4. If the standard deviation for the market is 6.3239%, how does this compare with Coles' standard deviation calculated in Q.3? Explain your conclusions. (5 marks)

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the monthly percentage returns for Coles Group Limited we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started