Below is the problem:

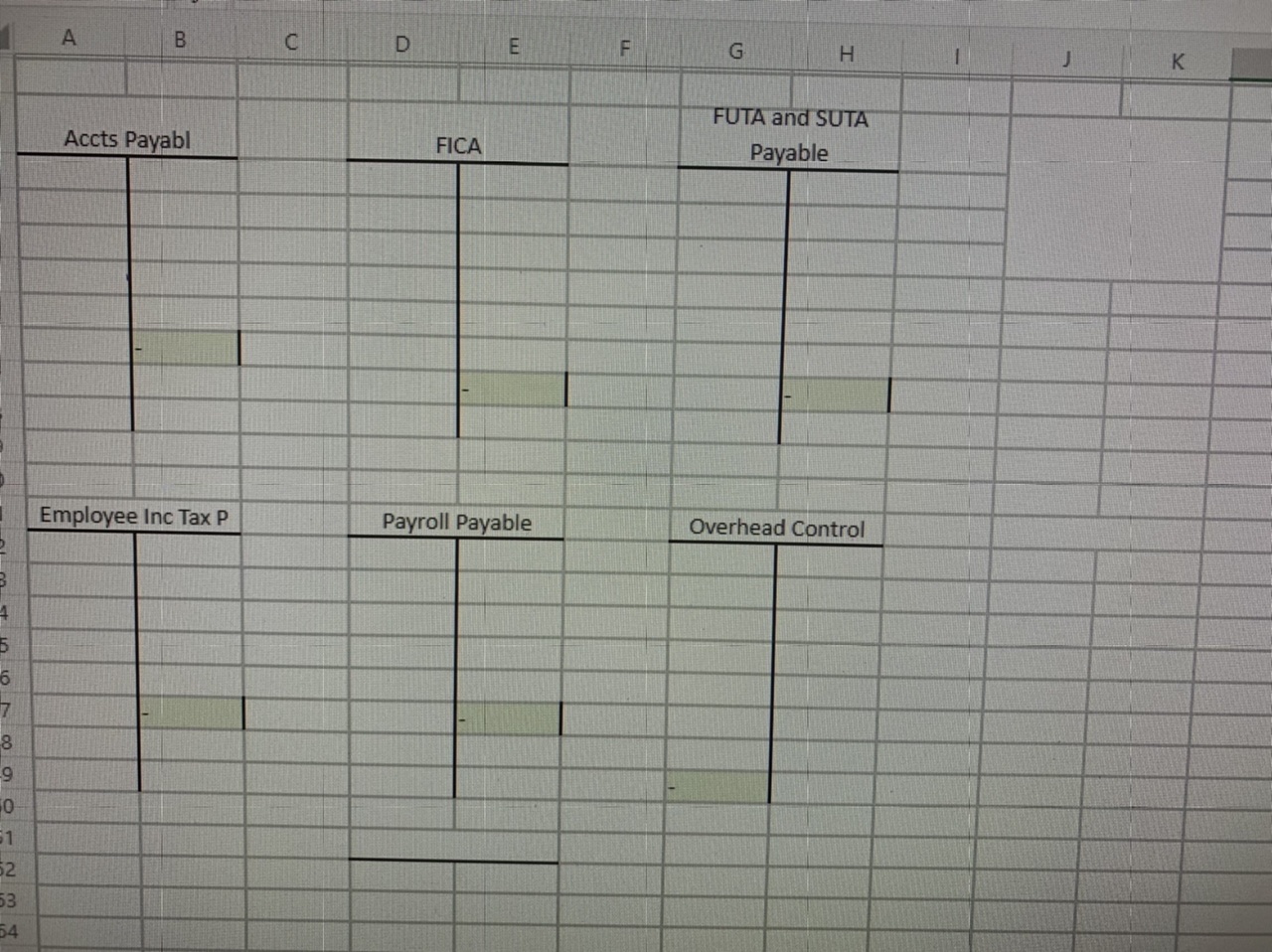

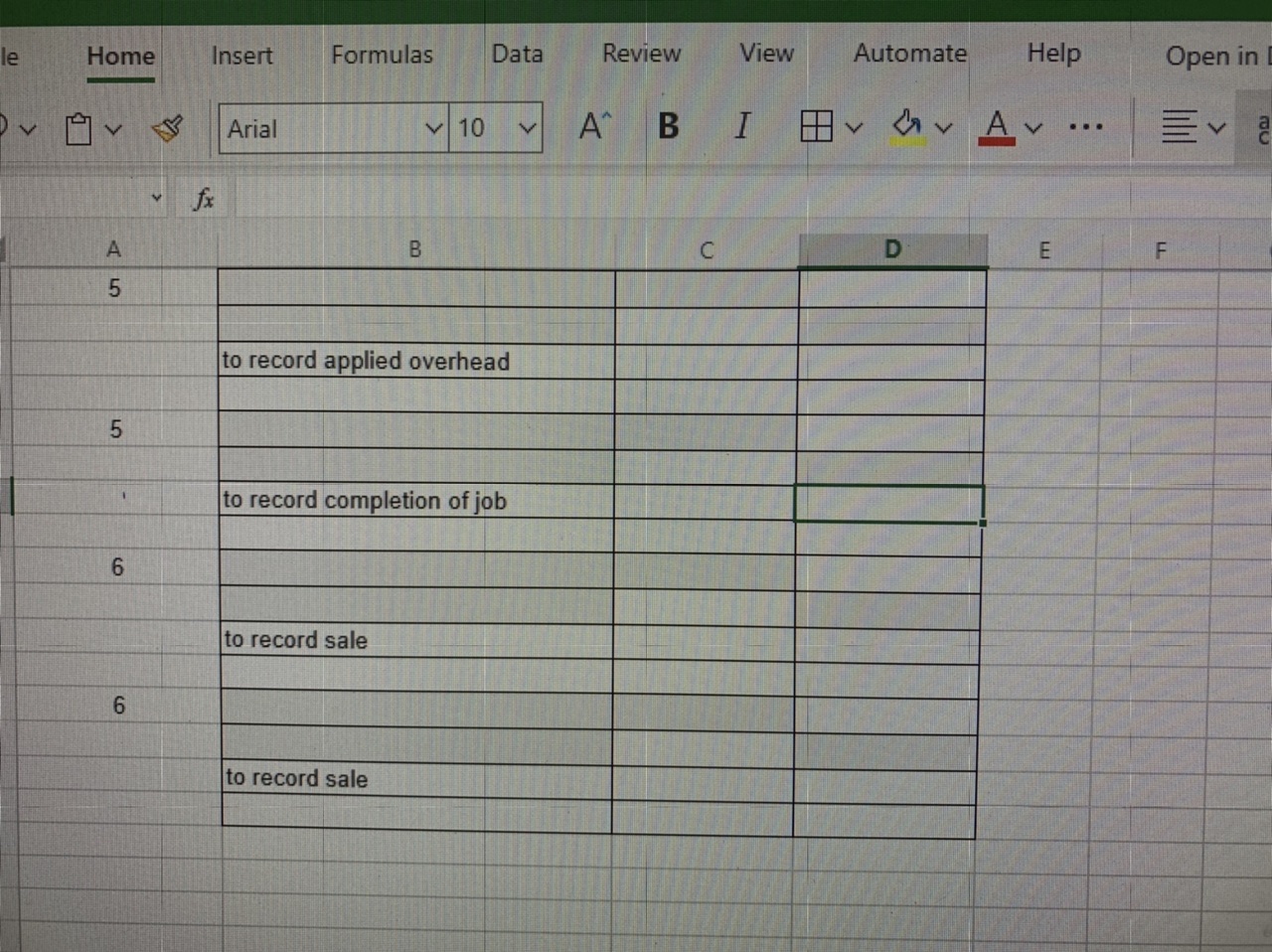

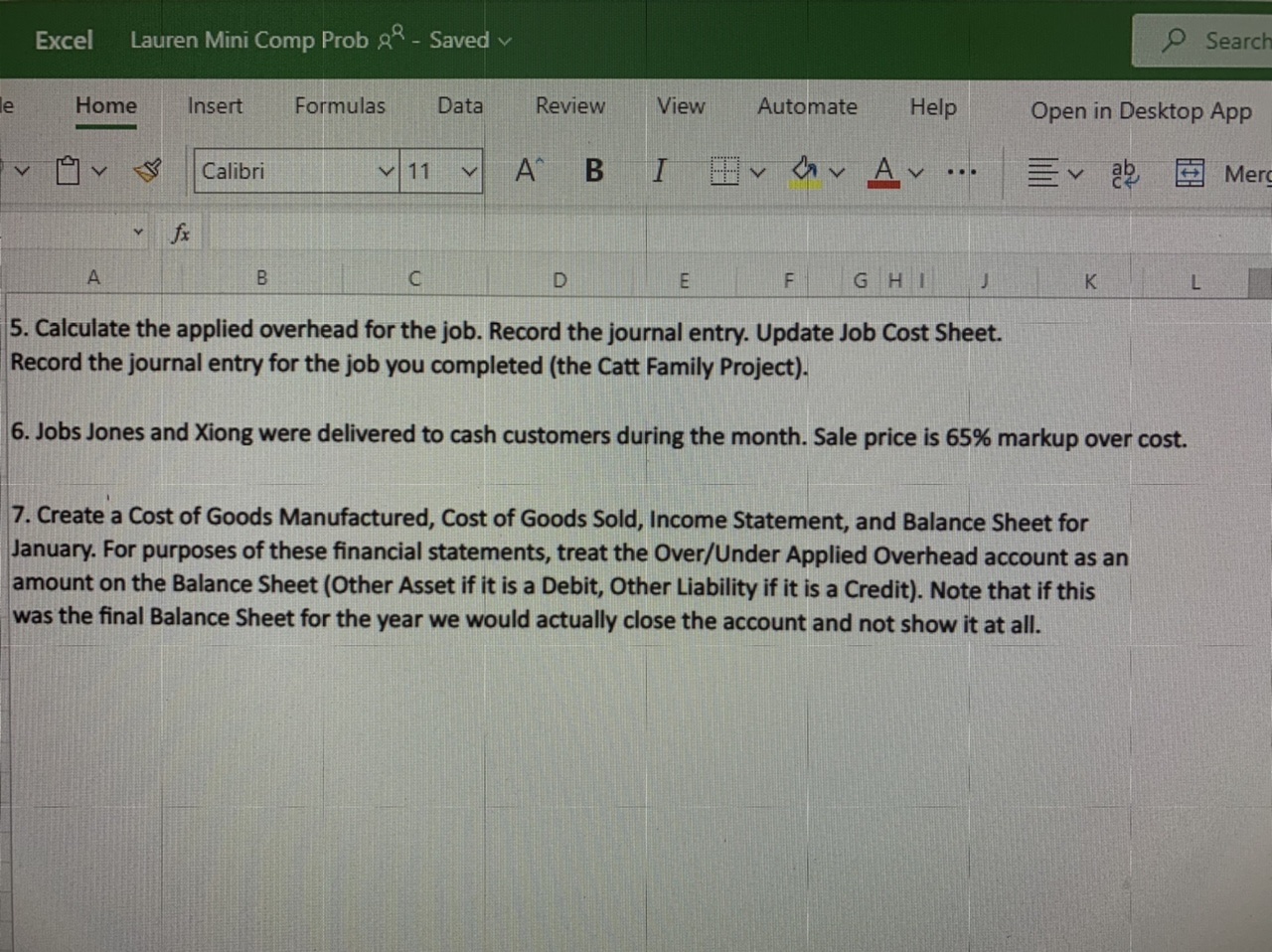

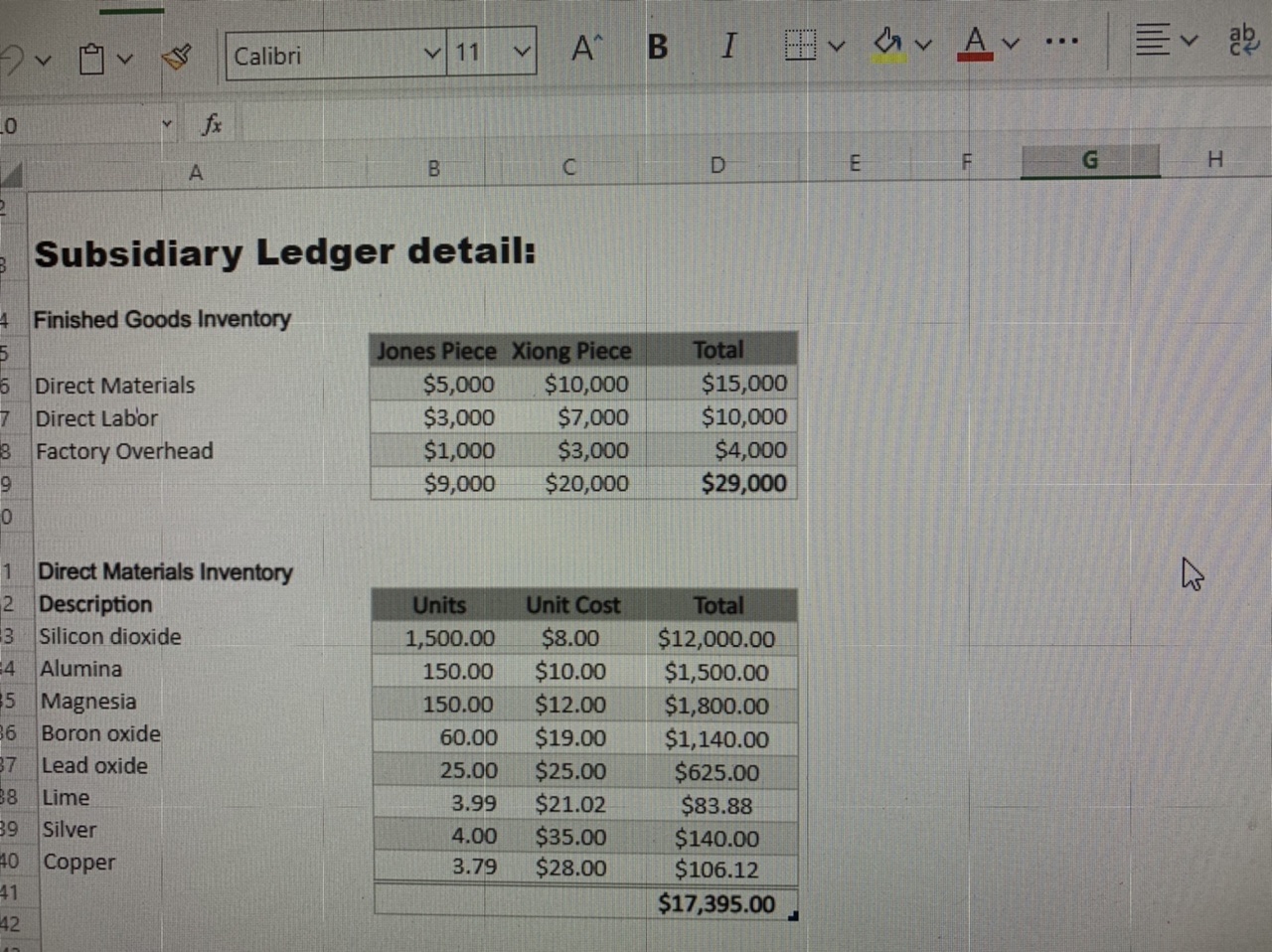

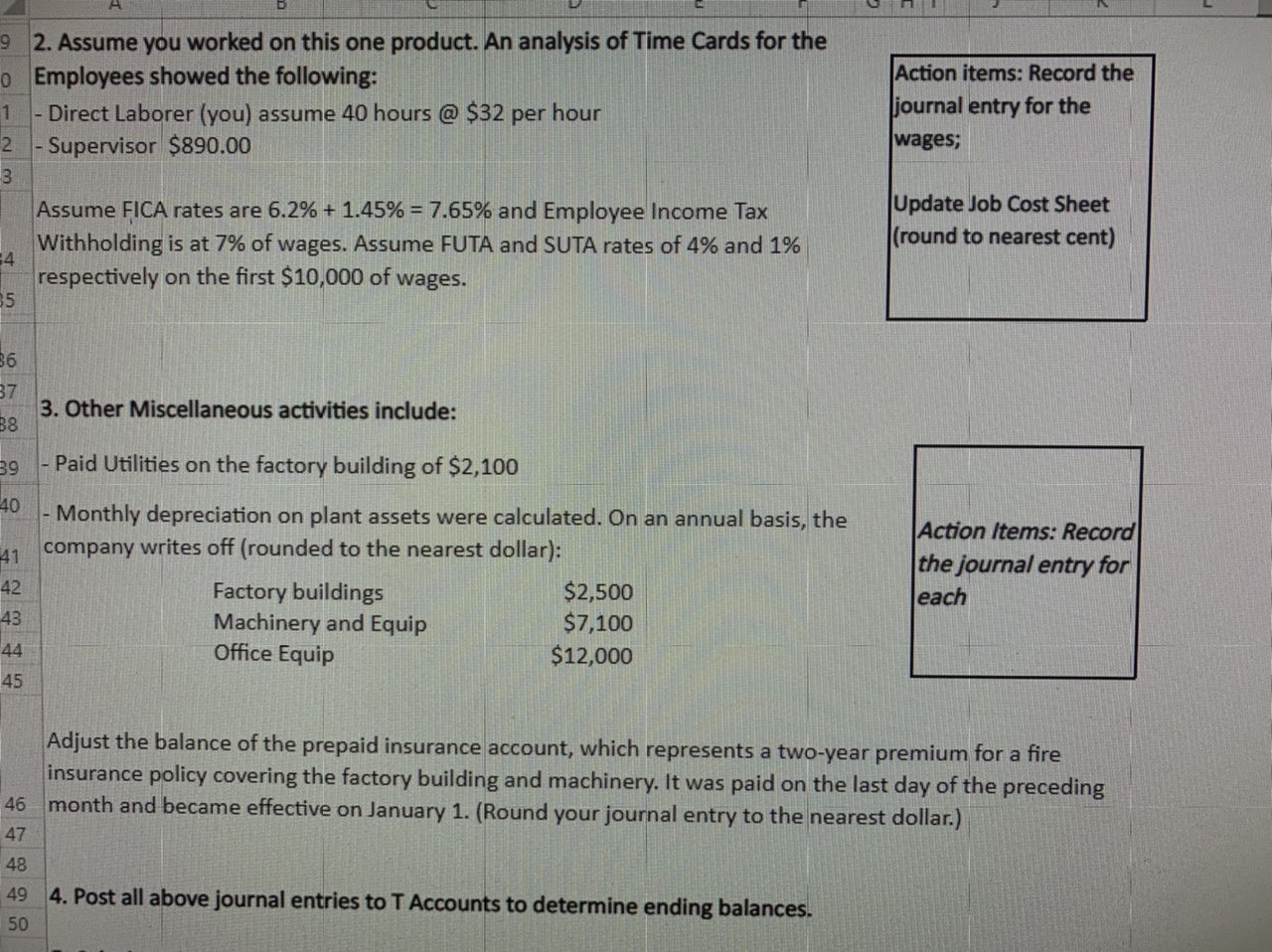

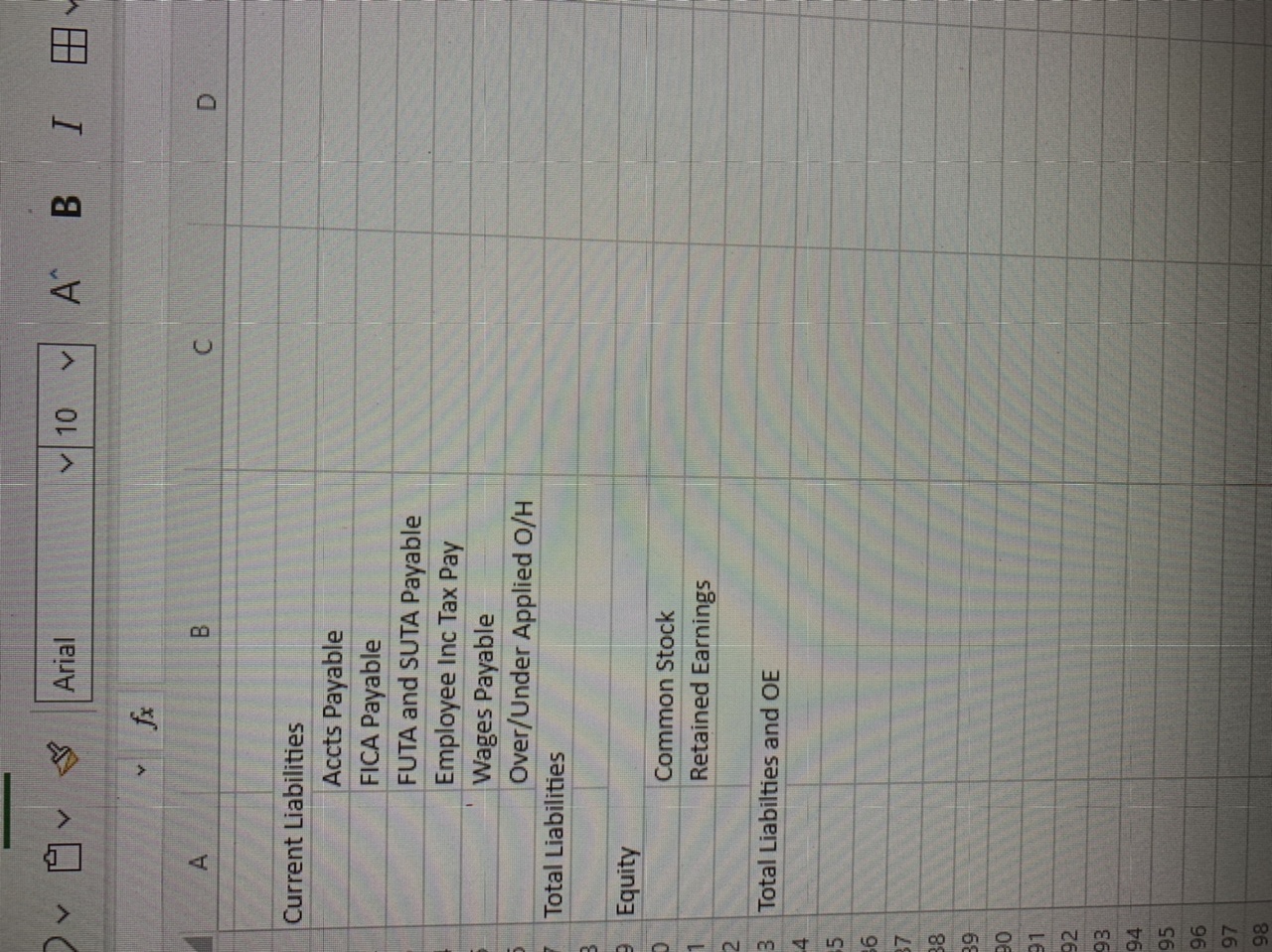

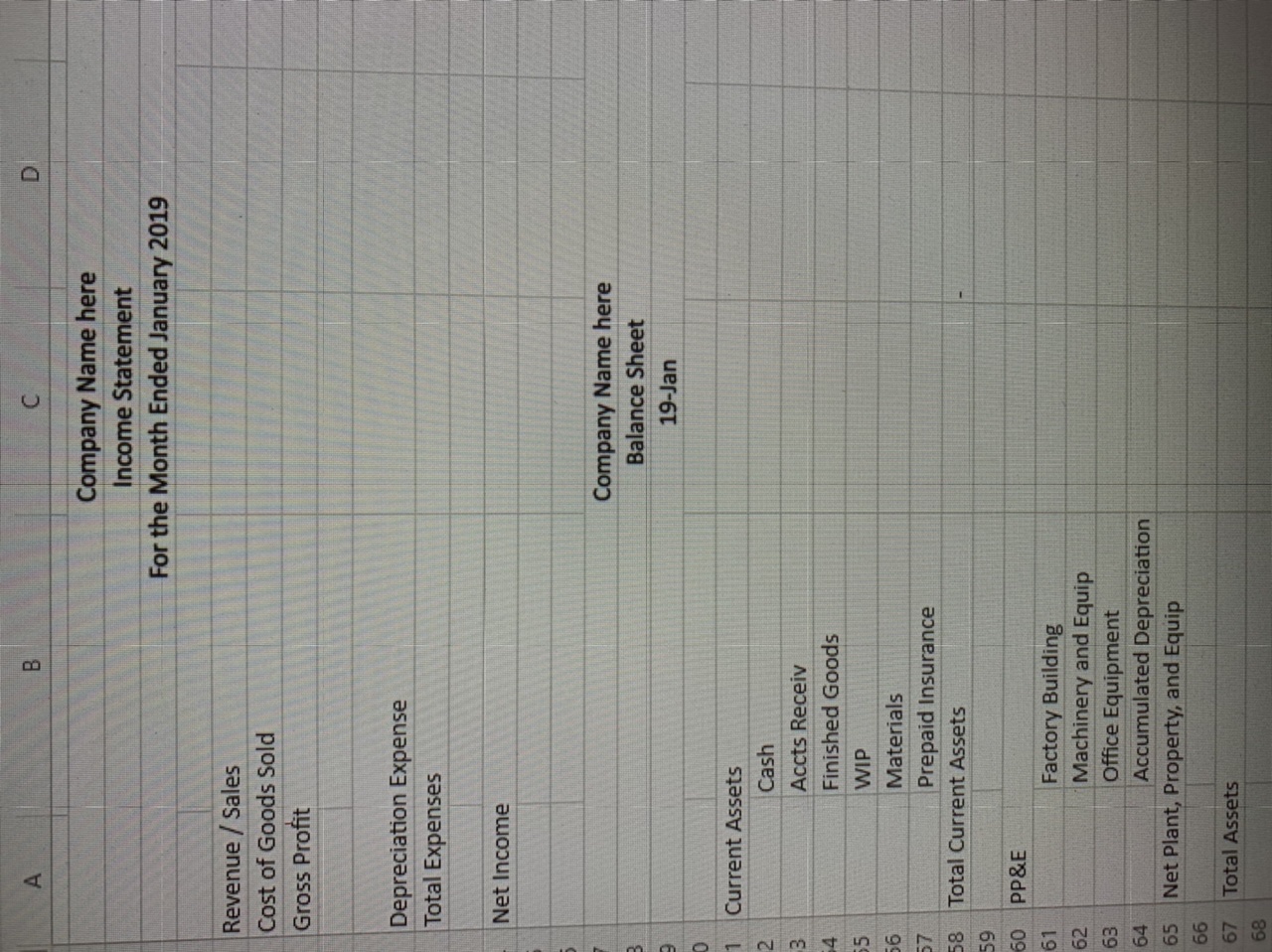

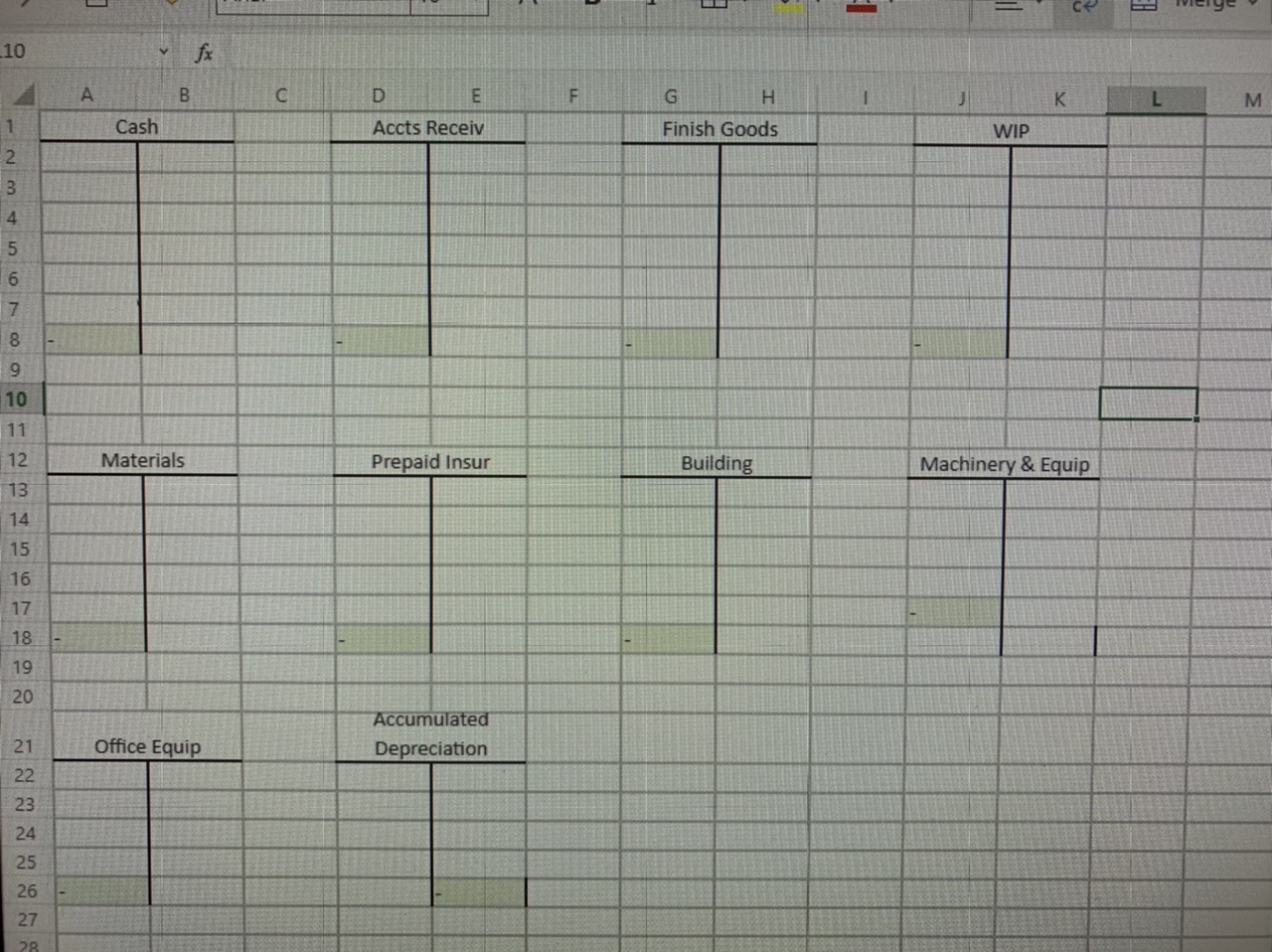

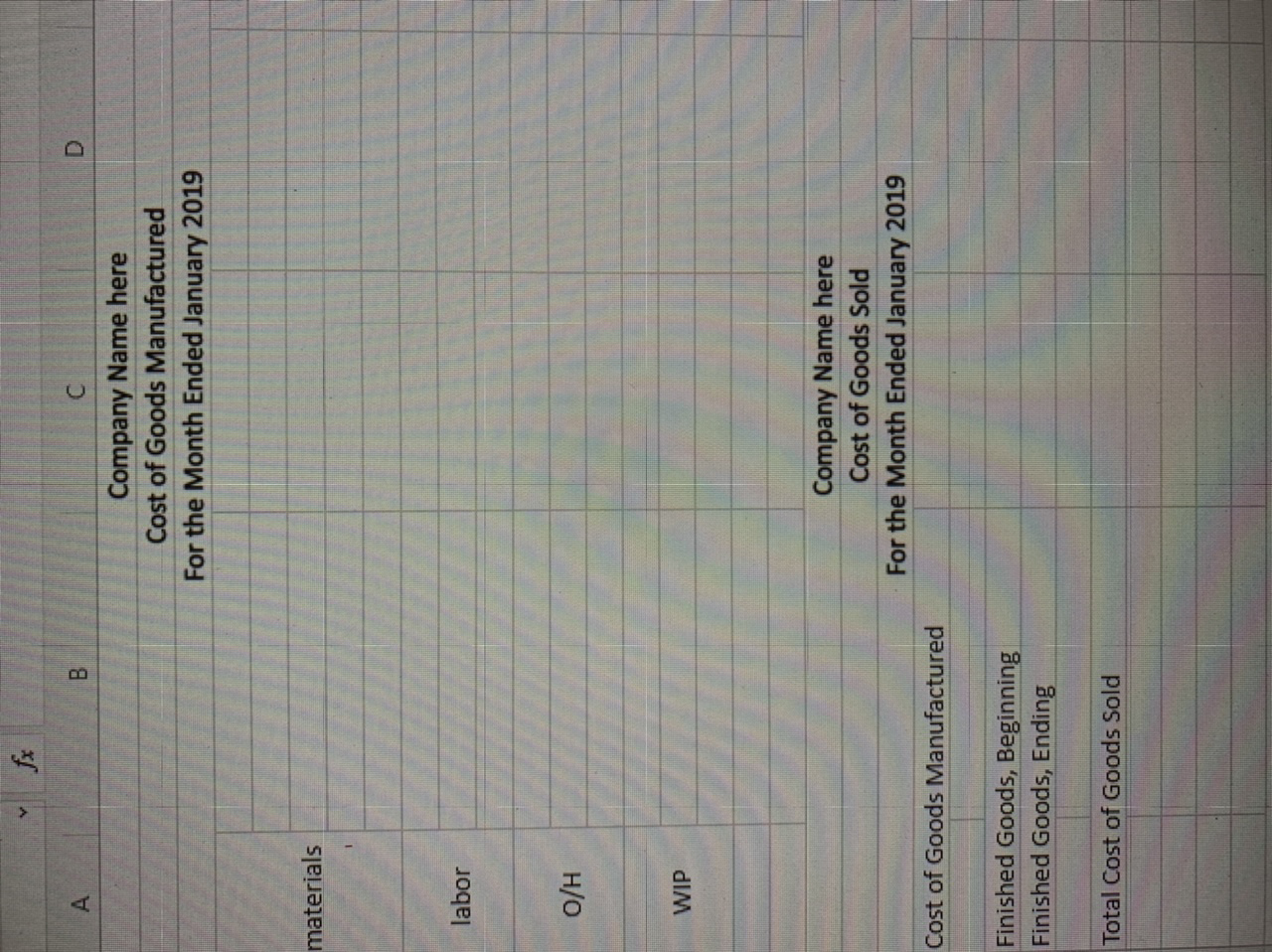

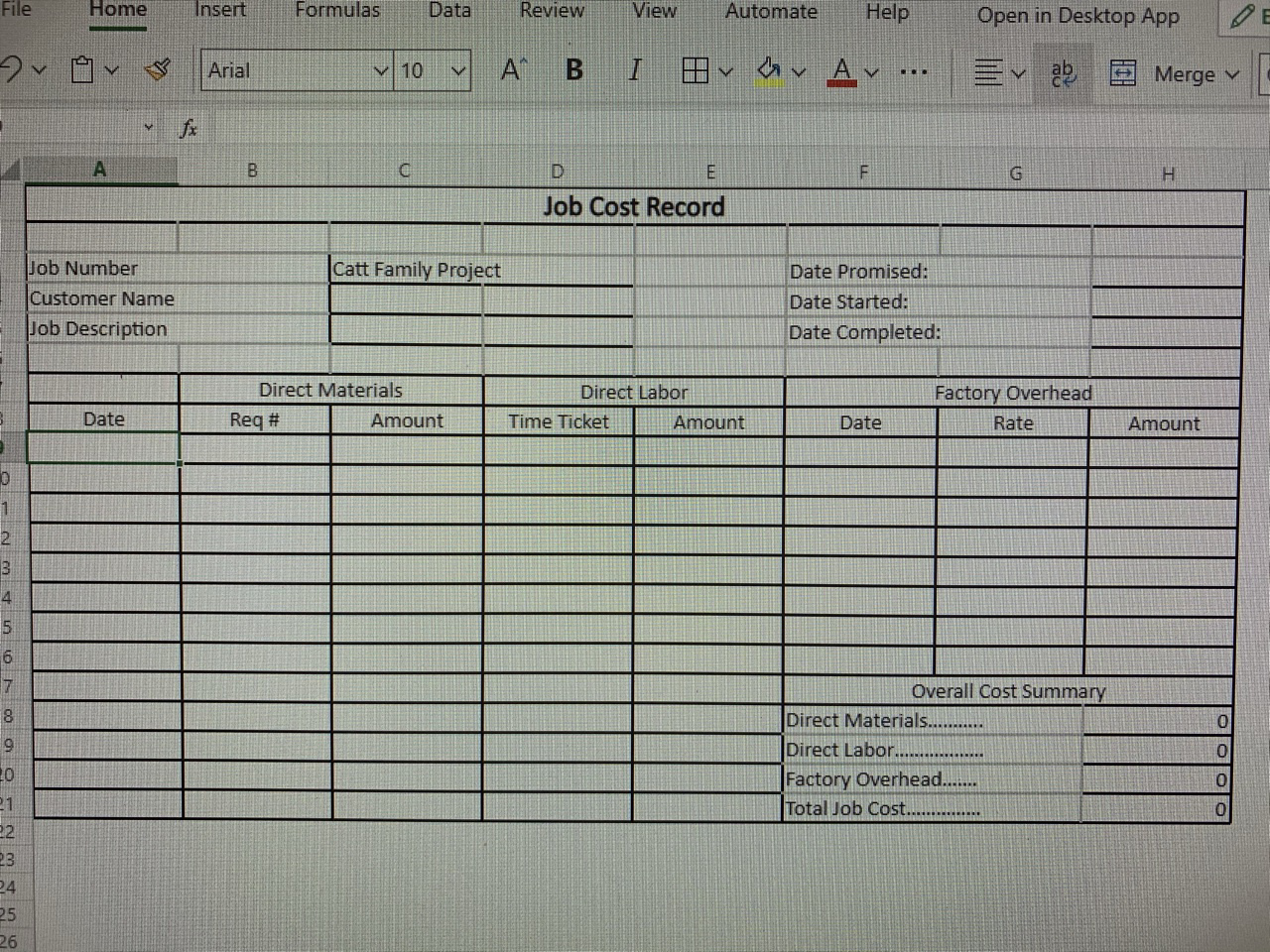

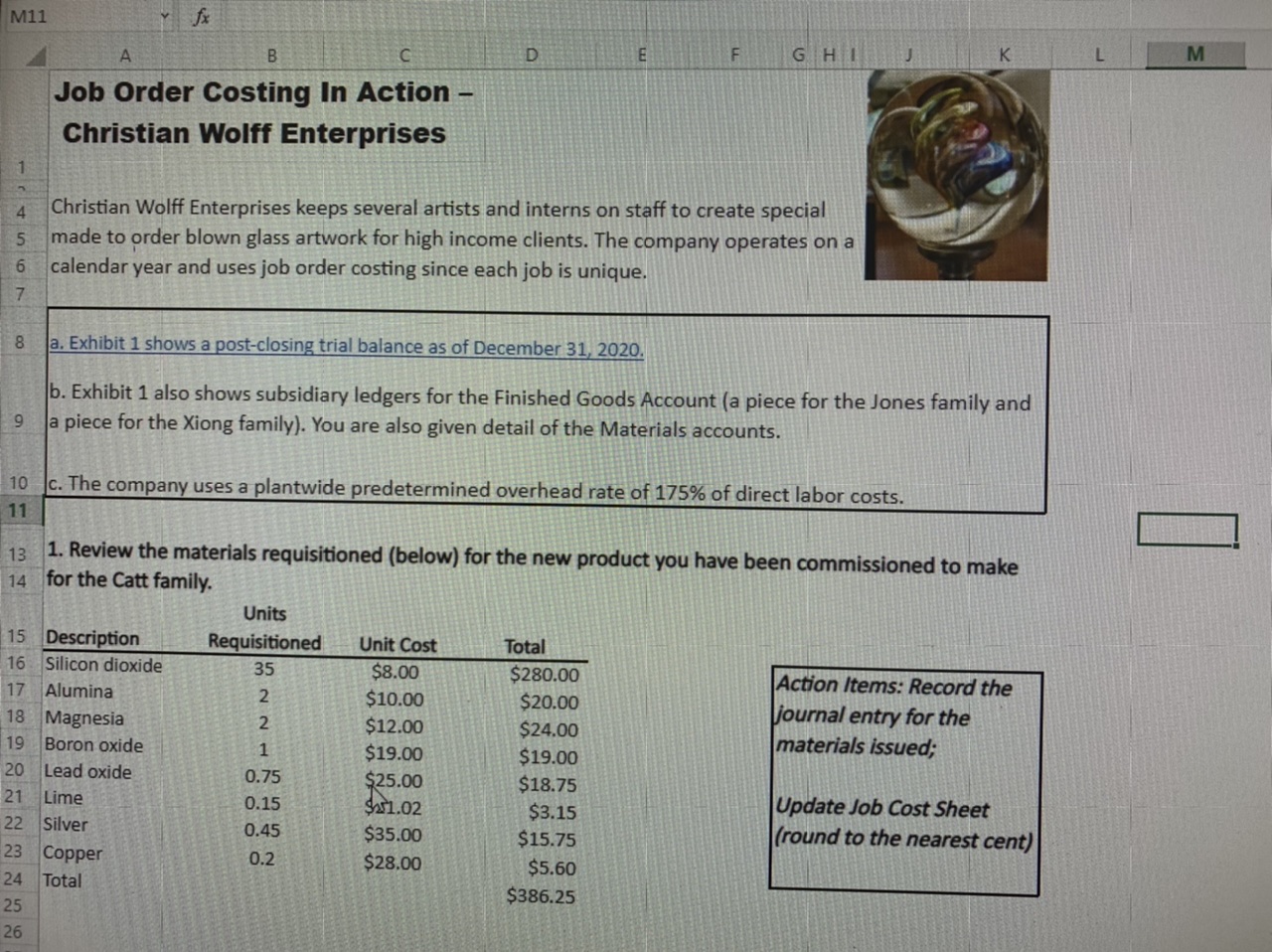

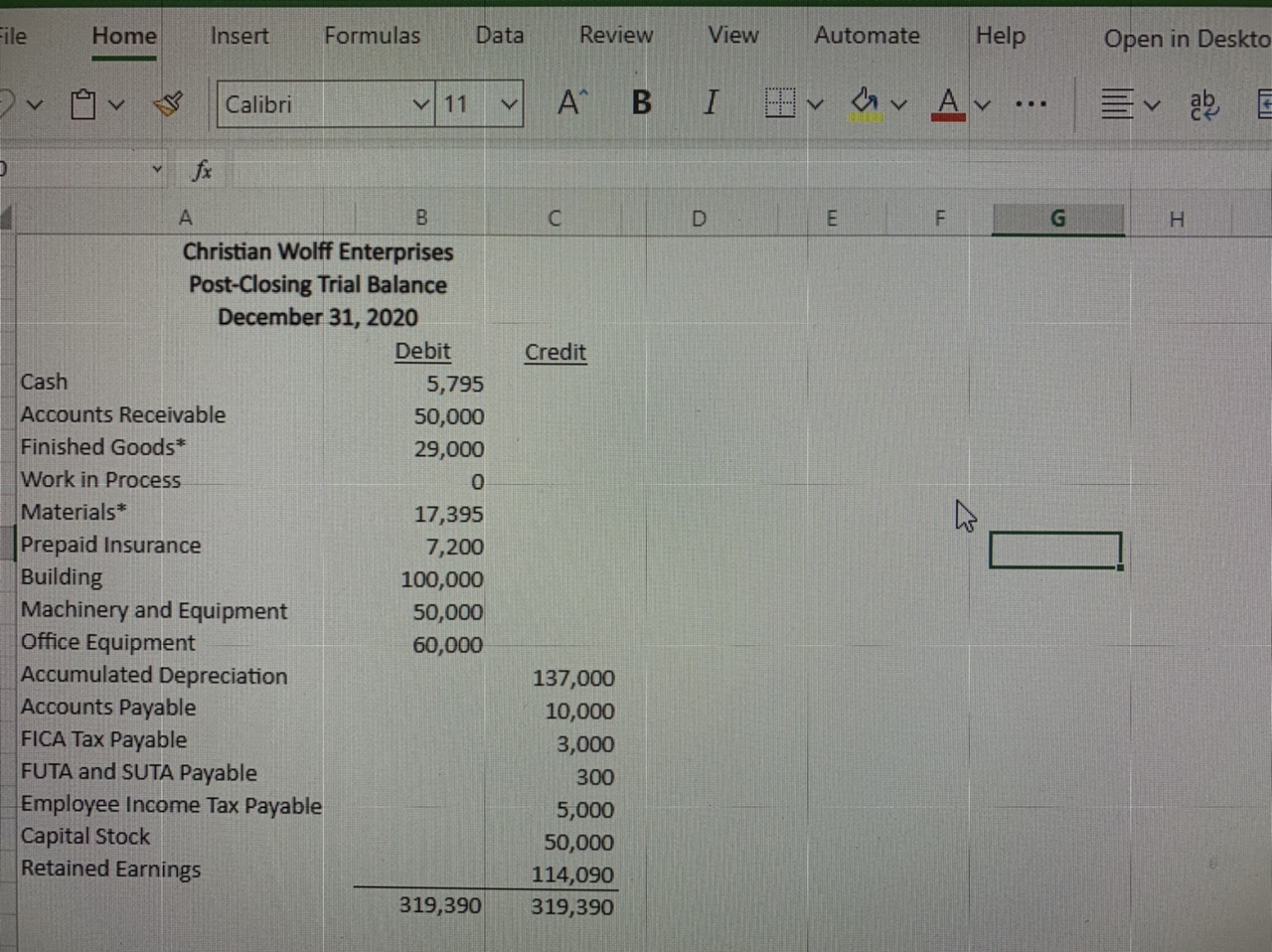

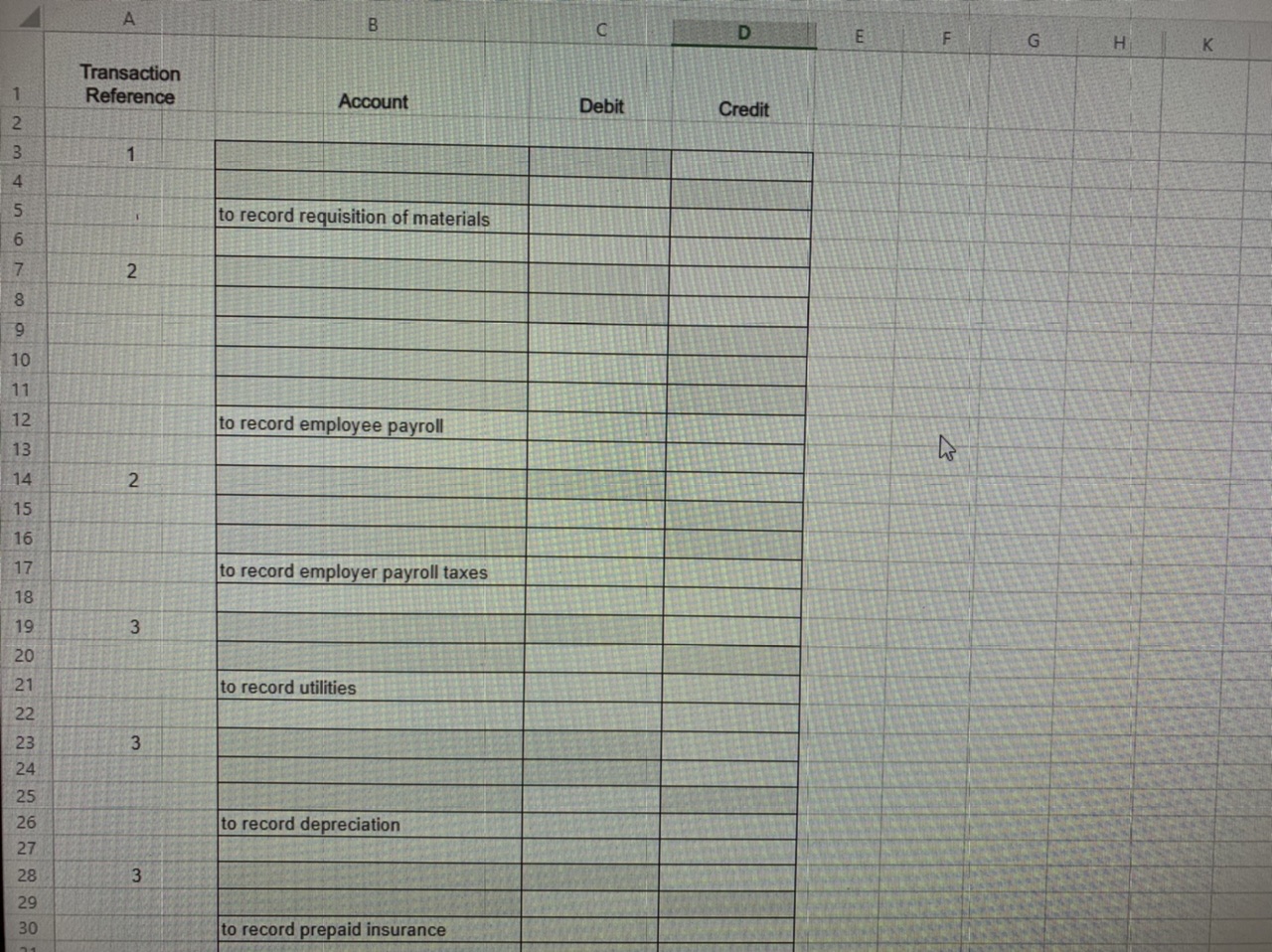

A B C D E F G H K FUTA and SUTA Accts Payabl FICA Payable Employee Inc Tax P Payroll Payable Overhead Control Wle Home Insert Formulas Data Review View Automate Help Open in Arial 10 A B I HavAv ... V a v fx A B C D E F 5 to record applied overhead 5 to record completion of job 6 to record sale 6 to record saleExcel Lauren Mini Comp Prob & - Saved v Search le Home Insert Formulas Data Review View Automate Help Open in Desktop App V Calibri 11 V A B I Gv Av ... Ev ab Mer fx A B C D E F GHI K L 5. Calculate the applied overhead for the job. Record the journal entry. Update Job Cost Sheet. Record the journal entry for the job you completed (the Catt Family Project). 6. Jobs Jones and Xiong were delivered to cash customers during the month. Sale price is 65% markup over cost. 7. Create a Cost of Goods Manufactured, Cost of Goods Sold, Income Statement, and Balance Sheet for January. For purposes of these financial statements, treat the Over/Under Applied Overhead account as an amount on the Balance Sheet (Other Asset if it is a Debit, Other Liability if it is a Credit). Note that if this was the final Balance Sheet for the year we would actually close the account and not show it at all.2 v V Calibri 11 v A B I v Vv Av . .. 0 fx A B D E F G H Subsidiary Ledger detail: Finished Goods Inventory Jones Piece Xiong Piece Total Direct Materials $5,000 $10,000 $15,000 Direct Labor $3,000 $7,000 $10,000 Factory Overhead $1,000 $3,000 $4,000 $9,000 $20,000 $29,000 Direct Materials Inventory 2 Description Units Unit Cost Total 3 Silicon dioxide 1,500.00 $8.00 $12,000.00 Alumina 150.00 $10.00 $1,500.00 5 Magnesia 150.00 $12.00 $1,800.00 16 Boron oxide 60.00 $19.00 $1,140.00 37 Lead oxide 25.00 $25.00 $625.00 18 Lime 3.99 $21.02 $83.88 19 Silver 4.00 $35.00 $140.00 40 Copper 3.79 $28.00 $106.12 41 $17,395.002. Assume you worked on this one product. An analysis of Time Cards for the Employees showed the following: Action items: Record the - Direct Laborer (you) assume 40 hours @ $32 per hour journal entry for the - Supervisor $890.00 wages; Assume FICA rates are 6.2% + 1.45% = 7.65% and Employee Income Tax Update Job Cost Sheet Withholding is at 7% of wages. Assume FUTA and SUTA rates of 4% and 1% (round to nearest cent) respectively on the first $10,000 of wages. 15 3. Other Miscellaneous activities include: 39 - Paid Utilities on the factory building of $2,100 10 - Monthly depreciation on plant assets were calculated. On an annual basis, the Action Items: Record company writes off (rounded to the nearest dollar): the journal entry for Factory buildings $2,500 each 43 Machinery and Equip $7,100 Office Equip $12,000 45 Adjust the balance of the prepaid insurance account, which represents a two-year premium for a fire insurance policy covering the factory building and machinery. It was paid on the last day of the preceding 46 month and became effective on January 1. (Round your journal entry to the nearest dollar.) 47 48 49 4. Post all above journal entries to T Accounts to determine ending balances. 50Arial > v U Current Liabilities Accts Payable FICA Payable FUTA and SUTA Payable Employee Inc Tax Pay Wages Payable Over/Under Applied O/H Total Liabilities Equity Common Stock Retained Earnings m Total Liabilties and OECompany Name here Income Statement For the Month Ended January 2019 Revenue / Sales Cost of Goods Sold Gross Profit Depreciation Expense Total Expenses Net Income Company Name here Balance Sheet 19-Jan Current Assets Cash m Accts Receiv Finished Goods WIP Materials Prepaid Insurance Total Current Assets PP&E Factory Building Machinery and Equip Office Equipment Accumulated Depreciation Net Plant, Property, and Equip 18 6 Total Assets10 fx A B C D E F G H K L M Cash Accts Receiv Finish Goods WIP W 10 11 12 Materials Prepaid Insur Building Machinery & Equip 13 14 15 16 00 19 20 Accumulated 21 Office Equip Depreciation 22 23 24 25 26 27U Company Name here Cost of Goods Manufactured For the Month Ended January 2019 materials labor O/H WIP Company Name here Cost of Goods Sold For the Month Ended January 2019 Cost of Goods Manufactured Finished Goods, Beginning Finished Goods, Ending Total Cost of Goods Soldile Home Insert Formulas Data Review View Automate Help Open in Desktop App V Arial 10 An B I Brav Av ... Merge fx A B C D E G H Job Cost Record Job Number Catt Family Project Date Promised: Customer Name Date Started: Job Description Date Completed: Direct Materials Direct Labor Factory Overhead Date Reg # Amount Time Ticket Date Rate Amount Overall Cost Summary Direct Materials....... Direct Labor... Factory Overhead...... Total Job Cost.......... in t wM11 fx D GHI A C F K M Job Order Costing In Action - Christian Wolff Enterprises Christian Wolff Enterprises keeps several artists and interns on staff to create special made to order blown glass artwork for high income clients. The company operates on a 6 calendar year and uses job order costing since each job is unique. 7 8 a. Exhibit 1 shows a post-closing trial balance as of December 31, 2020. b. Exhibit 1 also shows subsidiary ledgers for the Finished Goods Account (a piece for the Jones family and 9 a piece for the Xiong family). You are also given detail of the Materials accounts. 10 c. The company uses a plantwide predetermined overhead rate of 175% of direct labor costs. 11 13 1. Review the materials requisitioned (below) for the new product you have been commissioned to make 14 for the Catt family. Units 15 Description Requisitioned Unit Cost Total Silicon dioxide 35 $8.00 $280.00 Action Items: Record the 17 Alumina N $10.00 $20.00 journal entry for the 18 Magnesia 2 $12.00 $24.00 19 Boron oxide 1 $19.00 materials issued; $19.00 20 Lead oxide 0.75 $25.00 $18.75 21 Lime 0.15 Sar1.02 $3.15 Update Job Cost Sheet 22 Silver 0.45 $35.00 $15.75 (round to the nearest cent) 23 Copper 0.2 $28.00 $5.60 24 Total $386.25 25 26file Home Insert Formulas Data Review View Automate Help Open in Deskto Calibri 11 A B I vav Av ... Ev ab fx A B C D E F G H Christian Wolff Enterprises Post-Closing Trial Balance December 31, 2020 Debit Credit Cash 5,795 Accounts Receivable 50,000 Finished Goods* 29,000 Work in Process 0 Materials* 17,395 hs Prepaid Insurance 7,200 Building 100,000 Machinery and Equipment 50,000 Office Equipment 60,000 Accumulated Depreciation 137,000 Accounts Payable 10,000 FICA Tax Payable 3,000 FUTA and SUTA Payable 300 Employee Income Tax Payable 5,000 Capital Stock 50,000 Retained Earnings 114,090 319,390 319,390B C D E F G H K Transaction Reference Account Debit Credit WN to record requisition of materials 2 to record employee payroll DWN 2 to record employer payroll taxes 3 20 N to record utilities 22 23 3 24 25 26 to record depreciation 27 28 3 29 30 to record prepaid insurance