Answered step by step

Verified Expert Solution

Question

1 Approved Answer

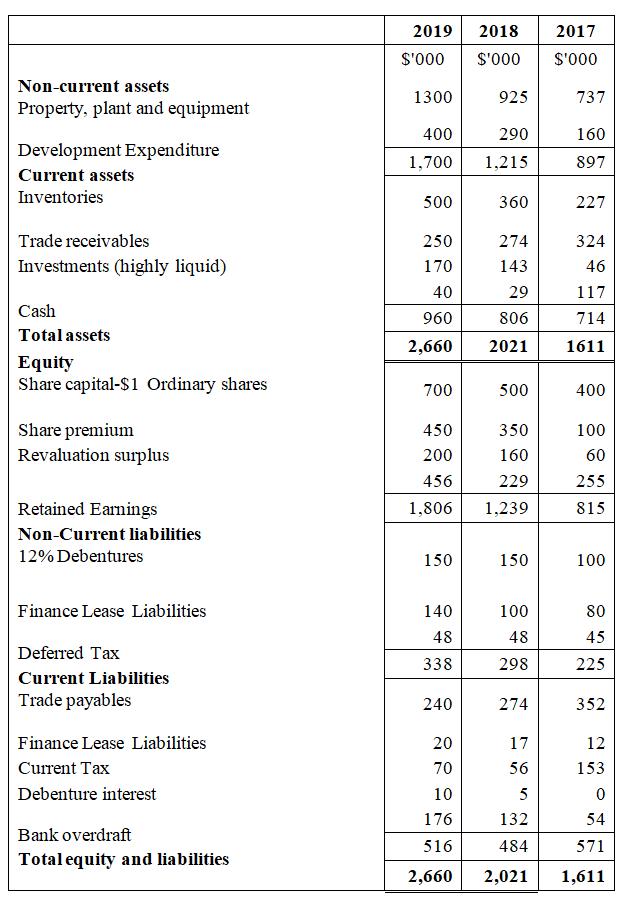

Below is the Statement of Financial Position of Federated Products Limited for the three-year period 2017 to 2019 Comment on the following aspects of the

Below is the Statement of Financial Position of Federated Products Limited for the three-year period 2017 to 2019

Comment on the following aspects of the financial position of the company over the period, using ratios where appropriate:

a) Short term liquidity

b) Capital structure or gearing

c) Growth in total assets over the period

Explain what is a constructive obligation and explain how it is used to determine whether or not a provision should recognised in the financial statements.

2019 2018 2017 S'000 S'000 000.$ Non-current assets 1300 925 737 Property, plant and equipment 400 290 160 Development Expenditure 1,700 1,215 897 Current assets Inventories 500 360 227 Trade receivables 250 274 324 Investments (highly liquid) 170 143 46 40 29 117 Cash 960 806 714 Total assets 2,660 2021 1611 Equity Share capital-$1 Ordinary shares 700 500 400 Share premium Revaluation surplus 450 350 100 200 160 60 456 229 255 Retained Earnings 1,806 1,239 815 Non-Current liabilities 12% Debentures 150 150 100 Finance Lease Liabilities 140 100 80 48 48 45 Deferred Tax 338 298 225 Current Liabilities Trade payables 240 274 352 Finance Lease Liabilities 20 17 12 Current Tax 70 56 153 Debenture interest 10 5 176 132 54 Bank overdraft 516 484 571 Total equity and liabilities 2,660 2,021 1,611

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution Ia Short term liquidity ratios are measures of a firms short term ability to pay maturing obligations Current ratio is the ability to meet its short term obligations is low compared with the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started