Answered step by step

Verified Expert Solution

Question

1 Approved Answer

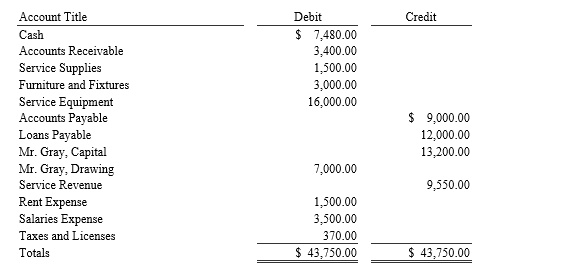

Below is the unadjusted trial balance for Gray Electronic Repair Services; Assumes the following adjustments data have been done after December, 2019 Supplies on hand

Below is the unadjusted trial balance for Gray Electronic Repair Services;

Assumes the following adjustments data have been done after December, 2019

- Supplies on hand $ 600

- They provide a service for $2300 on account.

- The company paid for its utility on account $1800.

- The company had accumulated depreciation $720.

- The company buys new furniture $6000.

- They provide services to a client and receive $1500 cash immediately.

- The company prepaid $2400 for insurance for 12 months starting from 1/1/2020.

- The company buys new supplies for $300.

- The company incurred rent expense for $300.

- The company receives $800 from the client

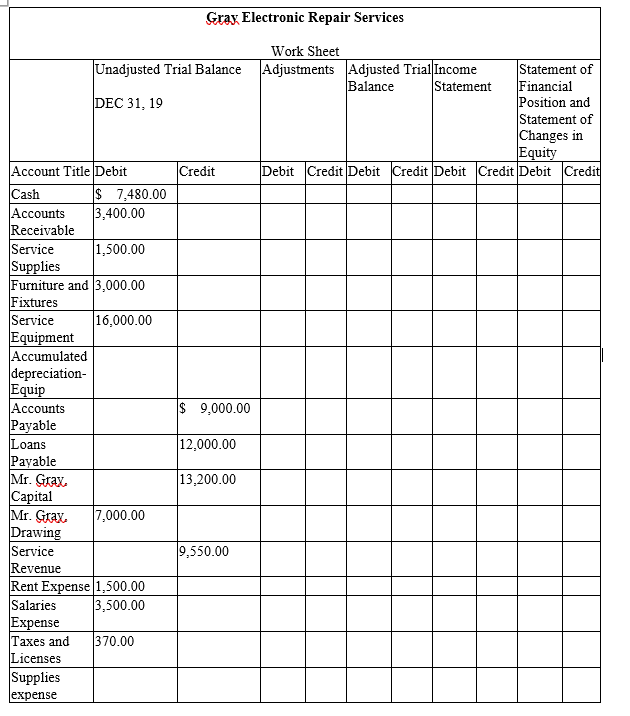

prepare the following in worksheet format.

-Adjusted Trail balance

-Income Statement

-Balance sheet (Financial Position) Statement

total

Credit Debit $ 7,480.00 3,400.00 1,500.00 3,000.00 16,000.00 $ Account Title Cash Accounts Receivable Service Supplies Furniture and Fixtures Service Equipment Accounts Payable Loans Payable Mr. Gray, Capital Mr. Gray, Drawing Service Revenue Rent Expense Salaries Expense Taxes and Licenses Totals 9,000.00 12,000.00 13,200.00 7,000.00 9,550.00 1,500.00 3,500.00 370.00 $ 43,750.00 $ 43,750.00 Gray Electronic Repair Services Unadjusted Trial Balance DEC 31, 19 Work Sheet Adjustments Adjusted Trial Income Statement of Balance Statement Financial Position and Statement of Changes in Equity Debit Credit Debit Credit Debit Credit Debit Credit Credit Account Title Debit Cash $ 7,480.00 Accounts 3,400.00 Receivable Service 1,500.00 Supplies Furniture and 3,000.00 Fixtures Service 16,000.00 Equipment Accumulated depreciation- Equip Accounts Payable Loans Payable 9,000.00 12,000.00 Mr. Gorax 13,200.00 Capital 19.550.00 Mr. Gray 17,000.00 Drawing Service Revenue Rent Expense 1,500.00 Salaries 3,500.00 Expense Taxes and 370.00 Licenses Supplies expenseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started