Question

Below on the left is a list of bond classifications and terms. Match each item in the list with the statement on the right by

Below on the left is a list of bond classifications and terms. Match each item in the list with the statement on the right by selecting the appropriate statement from the dropdown list.

Convertible Bonds

[ Choose ] The interest rate that is used to calculate the amount of interest to be paid each interest period

The investor has the option of turning in the bond for retirement before maturity date

The principal is paid off in steps (installments).

The entire bond issue matures at a single date

Unsecured bonds

Interest is paid only to owners of record as reflected in the accounts of the issuer

The interest rate that is used to calculate the amount of interest expense each interest period

An alternative name for this type of bond is bearer bond

Bonds that may be turned in to the issuer in exchange for other securities

Interest is paid only in years when the issuer earns a profit

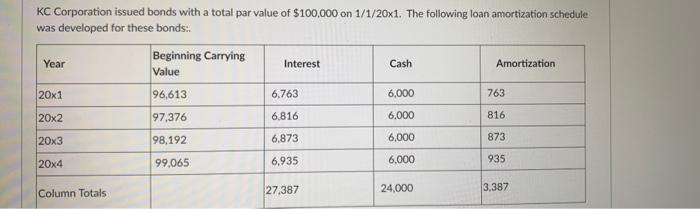

KC Corporation issued bonds with a total par value of $100,000 on 1/1/20x1. The following loan amortization schedule was developed for these bonds:. Year 20x1 20x2 20x3 20x4 Column Totals Beginning Carrying Value 96,613 97,376 98,192 99,065 Interest 6,763 6,816 6,873 6,935 27,387 Cash 6,000 6,000 6,000 6,000 24,000 Amortization 763 816 873 935 3,387

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Convertible Bonds The investor has the option of turning in the bond for retireme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started