Answered step by step

Verified Expert Solution

Question

1 Approved Answer

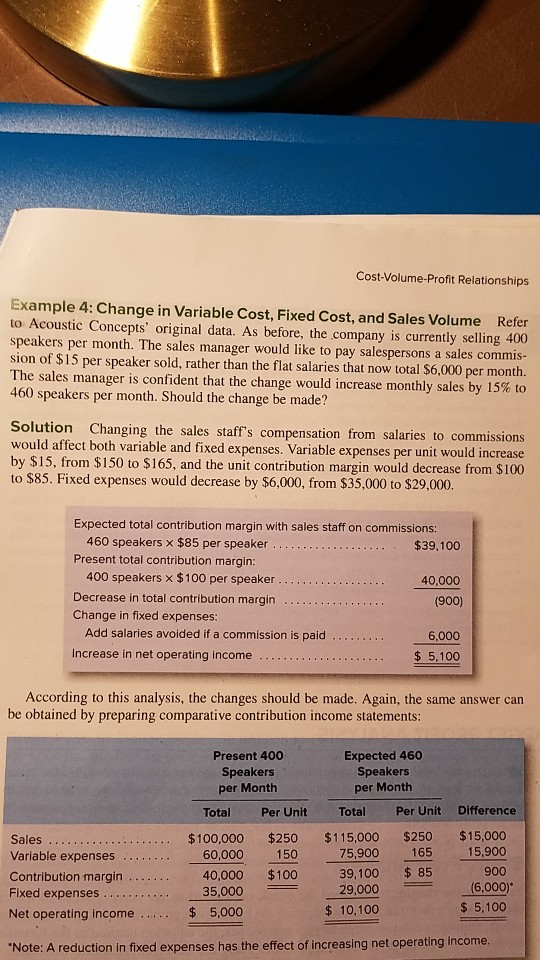

Below solution it shows there is a increase in net income. under change in fixed expenses I need help understanding why are they adding salaries

Below solution it shows there is a increase in net income. under change in fixed expenses I need help understanding why are they adding salaries avoided to (900) to get a result of 5100 increase in NI? I understand the verification of this increase through the income statement. however the short cut I dont understand even though everything adds up.

Cost-Volume-Profit Relationships Example 4: Change in Variable Cost, Fixed Cost, and Sales Volume to Acoustic Concepts' original data. As before, the company is currently selling 400 speakers per month. The sales manager would like to pay salespersons a sales commis- sion of $15 per speaker sold, rather than the flat salaries that now total $6,000 per month. The sales manager is confident that the change would increase monthly sales by 15% to 460 speakers per month. Should the change be made? Refer Solution Changing the sales staff's compensation from salaries to commissions would affect both variable and fixed expenses. Variable expenses per unit would increase by $15, from $150 to $165, and the unit contribution margin would decrease from $100 to $85. Fixed expenses would decrease by $6,000, from $35,000 to $29,000. Expected total contribution margin with sales staff on commissions: 460 speakers x $85 per speaker $39,100 Present total contribution margin: 400 speakers x $100 per speaker 40,000 Decrease in total contribution margin (900) Change in fixed expenses: Add salaries avoided if a commission is paid 6,000 Increase in net operating income $ 5,100 According to this analysis, the changes should be made. Again, the same answer can be obtained by preparing comparative contribution income statements: Expected 460 Speakers Present 400 Speakers per Month per Month Difference Per Unit Per Unit Total Total $15,000 15,900 $100,000 60,000 $250 $250 $115,000 75,900 Sales 165 150 Variable expenses $ 85 39,100 29,000 900 40,000 35,000 $100 Contribution margin Fixed expenses (6,000)* 5,100 $ 10,100 $ 5,000 Net operating income Note: A reduction in fixed expenses has the effect of increasing net operating incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started