Question

Below, you will find the Income statement and balance sheet of COBRA Inc for the end of 2016 and a table of industry averages. Calculate

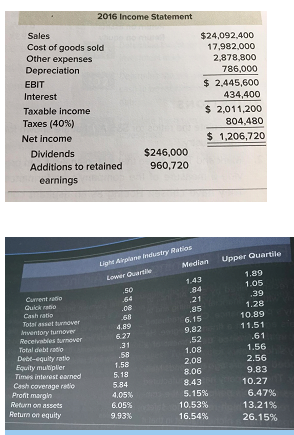

Below, you will find the Income statement and balance sheet of COBRA Inc for the end of 2016 and a table of industry averages. Calculate and interpret the following ratios Current ratio Inventory turnover ratio Total asset turnover ratio Times interest earned Return on assets Sustainable growth rate

For each ratio explain why the ratio can be interpreted as positive or negative compared to the economy. Calculate Return on equity and by using the dupont identity explain why ROE is above/below the industry averages.( Like the comparison between Yahoo and Google example in the slides.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started