Question

Ben and his wife Bell are both 35 years old. They have been married for 7 years and have a one-year-old son Boris. Ben is

Ben and his wife Bell are both 35 years old. They have been married for 7 years and have a one-year-old son Boris. Ben is the General Manager of an IT Firm and has been working there for the past 10 years. Currently his monthly gross income is $7,000 and his take home income after CPF deductions is $5,800. He is entitled to a contractual bonus of 3 months annually.

Bell is a qualified lawyer but since Boris is born, she decided to focus on his upbringing. As such, she takes up a part-time job as a Yoga Instructor, teaching twice a week. Her current gross monthly salary is $3,000 and her take-home income after CPF deductions is $2,400, without any bonus entitlement. The family is currently staying in a rented HDB flat. However, they are awaiting the launch of an executive condominium development near the city fringe towards the end of the year. The estimated value of the purchase is approximated to be at $1,200,000. They have consulted many bankers and the mortgage rate is currently estimated to be 1.2% (3 Months SORA + 0.88%).

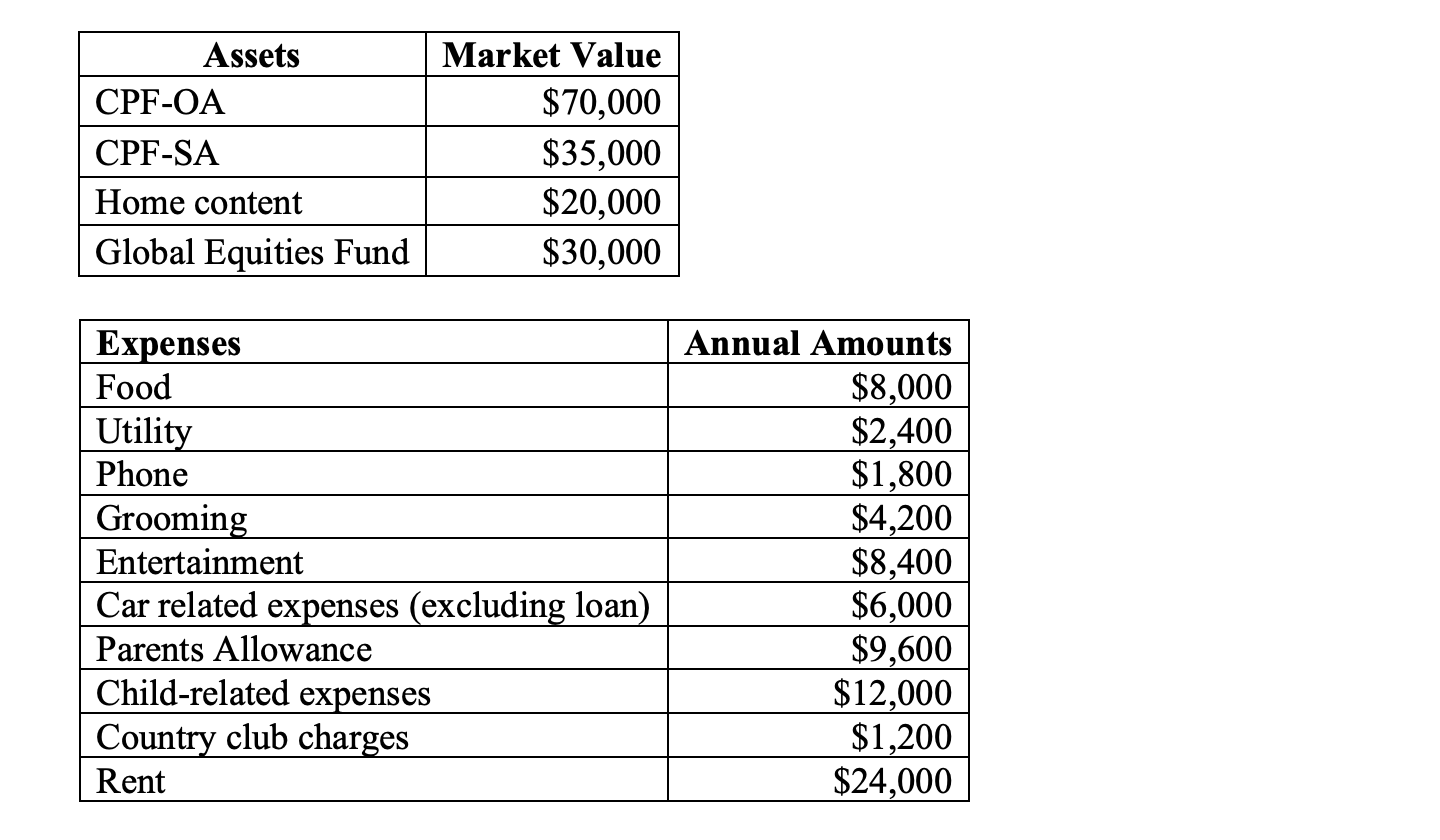

Earlier this month, Ben purchased a new car at a price of $120,000. He took out a 7-year car loan for $80,000 at a flat interest rate of 2%. The information provided you is incomplete. According to Ben, he entered his information into a financial planning software, and was able to generate some financial ratios which he provided below. However, the software was locked after the trial period. The couple were only able to provide you with partial information about their financial information (assets and expenses) below:

Qs 1: Given the information provided, deconstruct the partial information, and construct the personal financial statements (ignore all CPF contribution and taxes) for the couple for the last 12-month period ending 31 July 2022.

Qs 2: Interpret the liquidity situation of the client. How much liquidity can they consider deploying to fund other financial objectives such as financing the purchase of their new home, while maintaining adequate emergency funds?

Qs3: Ben has multiple questions in relation to risk management and insurance products and would like to seek your advice: CPF LIFE is a form of Annuity product. Examine the different types of CPF LIFE options. Which option would be the most suitable for Ben, if he expects to be in the pink of health and physically strong even at the age of 80?

Qs 4: Examine the terms "peril" and "hazard" in the context of risk management. Describe two (2) examples of perils and hazards relevant to personal risk.

Assets CPF-OA CPF-SA Home content Global Equities Fund Expenses Food Utility Phone Market Value $70,000 $35,000 $20,000 $30,000 Grooming Entertainment Car related expenses (excluding loan) Parents Allowance Child-related expenses Country club charges Rent Annual Amounts $8,000 $2,400 $1,800 $4,200 $8,400 $6,000 $9,600 $12,000 $1,200 $24,000

Step by Step Solution

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer Qs 1 Personal Financial Statements Ben and Bells Combined Balance Sheet as of July 31 2022 Assets Market Value CPFOA 70000 CPFSA 35000 Home con...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started