Answered step by step

Verified Expert Solution

Question

1 Approved Answer

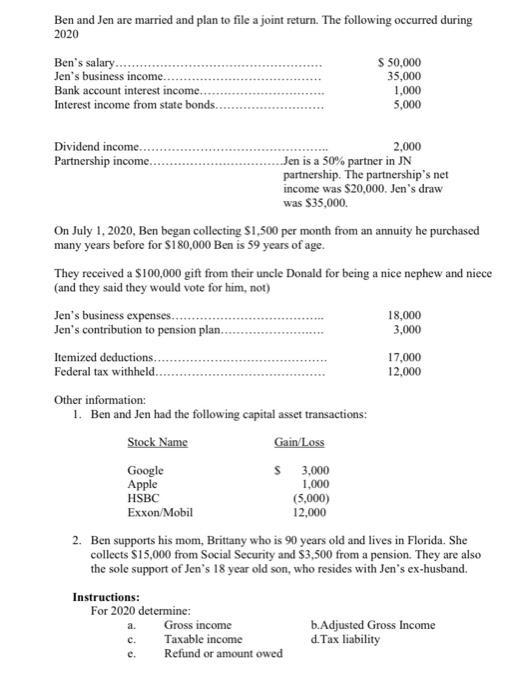

Ben and Jen are married and plan to file a joint return. The following occurred during 2020 Ben's salary... Jen's business income. Bank account

Ben and Jen are married and plan to file a joint return. The following occurred during 2020 Ben's salary... Jen's business income. Bank account interest income... Interest income from state bonds.. Dividend income. Partnership income.. On July 1, 2020, Ben began collecting $1,500 per month from an annuity he purchased many years before for $180,000 Ben is 59 years of age. Jen's business expenses.. Jen's contribution to pension plan... They received a $100,000 gift from their uncle Donald for being a nice nephew and niece (and they said they would vote for him, not) Itemized deductions... Federal tax withheld... Other information: 1. Ben and Jen had the following capital asset transactions: Stock Name Gain/Loss Google Apple HSBC Exxon/Mobil 2,000 Jen is a 50% partner in JN partnership. The partnership's net income was $20,000. Jen's draw was $35,000. Instructions: For 2020 determine: a. C. e. S $ 50,000 35,000 1,000 5,000 3,000 1,000 Gross income Taxable income Refund or amount owed (5,000) 12,000 2. Ben supports his mom, Brittany who is 90 years old and lives in Florida. She collects $15,000 from Social Security and $3,500 from a pension. They are also the sole support of Jen's 18 year old son, who resides with Jen's ex-husband. 18,000 3,000 17,000 12,000 b. Adjusted Gross Income d.Tax liability

Step by Step Solution

★★★★★

3.58 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Test Practice Gross income 1 Bens salary Jens Business income Baink account interest income Divi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started