Question

Ben Davis is an internal accountant at Solway, Inc., a publicly owned company headquartered in Fresno, California. Ben reports to Chris Hodgins, the controller of

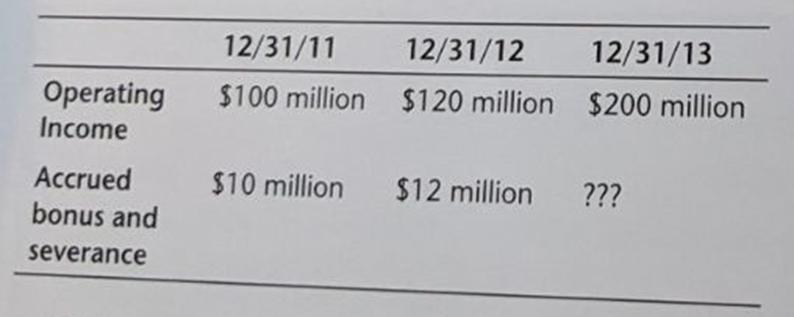

Ben Davis is an internal accountant at Solway, Inc., a publicly owned company headquartered in Fresno, California. Ben reports to Chris Hodgins, the controller of the company; Hodgins reports to the CFO, Harry Benson; and Benson reports to George Lee, the CEO. Solway has a three-person independent audit committee that deals with financial oversight issues, including being a direct access group for matters of concern for the chief internal auditor, Sam Vines. On January 15, 2014, Davis is approached by Hodgins and told to record an accrual for unpaid bonuses and severance payments of $50 million to be included in the December 31, 2013, financial statements. Davis asked Hodgins to explain the reason for what appeared to be an unusually high amount of money and was told the company planned to shut down a division in 2014 and the severance payments would be significant. This was the first Davis heard about a shutdown of any division, and he found it strange because the company's operating income in all divisions had set record levels in fiscal year 2013. Moreover, the bonus and severance amounts are five times the annual payroll of the division. The numbers below show the operating income levels and accruals for 2011 through 2013:

Davis did not commit to recording the accruals because he wanted more time to think about the situation. Fortunately, Hodgins was called away on an urgent matter, bringing the meeting to an abrupt halt.

Davis decided to speak to Gloria Olson, a fellow internal accountant who graduated with Davis from college. Olson also found the amount of accruals unusually high. Davis asked Olson what the projected operating income was for December 31, 2014 based on her recent calculations. Olson told him that it was determined to be $160 million. They briefly talked about the projected decline in operating income after five straight years of increases. Davis wondered whether the reason for this could be attributable to the shutdown of the division mentioned by Hodgins.

Questions

Assume that Davis, Hodgins, Benson, Vines, and Olson are all CPAs and hold the certificate in management accounting (CMA).

1. Review the definitions of earnings management by Schipper, Healy and Wahlen, Dechow and Skinner, and Mckee that are discussed in this chapter. How would you characterize the proposed accrual for unpaid bonuses and severance payments from an earnings management perspective?

2. Place yourself in Ben Davis's shoes and consider the following in deciding whether to support Hodgins's position on the accrual:

a. Who are the stakeholders in this case?

b. What are the accounting issues of concern to you?

c. What are ethical issues of concern to you with respect to your ethical and professional obligations and stakeholder interests?

3. Assume you meet with Hodgins, and he instructs you in no uncertain terms to record the accrual. What would you do and why? Would whistleblowing be a consideration for you? Why or why not?

12/31/11 12/31/12 12/31/13 Operating Income $100 million $120 million $120 million $200 million Accrued $10 million $12 million ??? bonus and severance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here is my analysis of the situation based on the information provided 1 The proposed 50 million acc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started