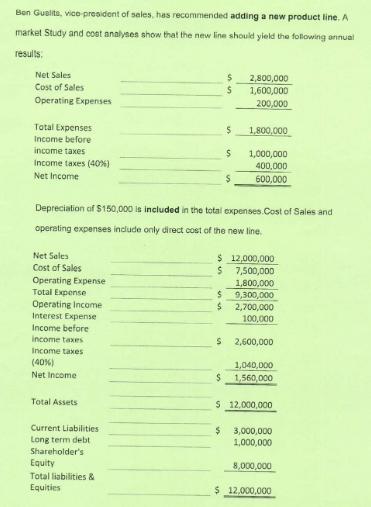

Ben Gualita, vice-president of seles, has recommended adding a new product line. A market Study and cost analyses show that the new line should

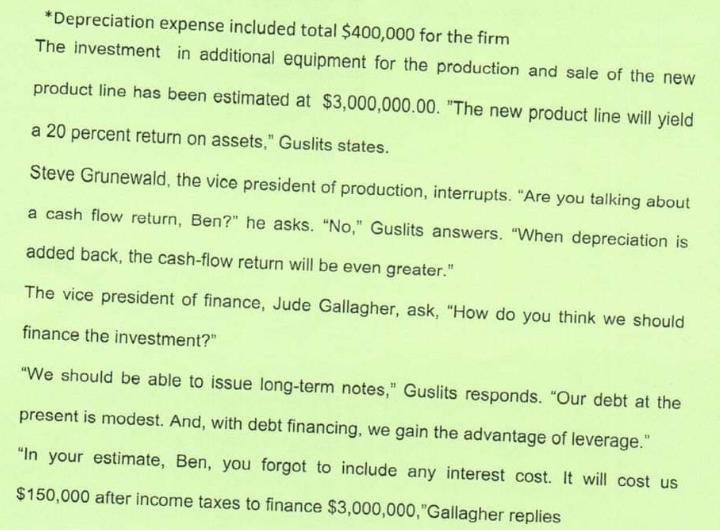

Ben Gualita, vice-president of seles, has recommended adding a new product line. A market Study and cost analyses show that the new line should yield the following annual results. Net Sales Cost of Sales Operating Expenses Total Expenses Income before income taxes income taxes (40%) Net Income Net Sales Cost of Sales Operating Expense Total Expense Operating Income Interest Expense Income before income taxes Income taxes (40%) Net Income Total Assets Current Liabilities Long term debt Shareholder's Equity Total liabilities & Equities $ $ $ $ Depreciation of $150,000 is included in the total expenses.Cost of Sales and operating expenses include only direct cost of the new line. $ $ $ $ 2,800,000 1,600,000 200,000 1,800,000 1,000,000 400,000 600,000 $ 12,000,000 $ 7,500,000 1,800,000 9,300,000 2,700,000 100,000 S 2,600,000 1,040,000 $ 1,560,000 $ 12,000,000 3,000,000 1,000,000 8,000,000 $ 12,000,000 *Depreciation expense included total $400,000 for the firm The investment in additional equipment for the production and sale of the new product line has been estimated at $3,000,000.00. "The new product line will yield a 20 percent return on assets," Guslits states. Steve Grunewald, the vice president of production, interrupts. "Are you talking about a cash flow return, Ben?" he asks. "No," Guslits answers. "When depreciation is added back, the cash-flow return will be even greater." The vice president of finance, Jude Gallagher, ask, "How do you think we should finance the investment?" "We should be able to issue long-term notes," Guslits responds. "Our debt at the present is modest. And, with debt financing, we gain the advantage of leverage." "In your estimate, Ben, you forgot to include any interest cost. It will cost us $150,000 after income taxes to finance $3,000,000,"Gallagher replies Examine and comment on Guslits' strategy to finance the investment. Is it likely that shareholders will impressed with the investment? Why?

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Guslits strategy to finance the investment is to use ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started