Answered step by step

Verified Expert Solution

Question

1 Approved Answer

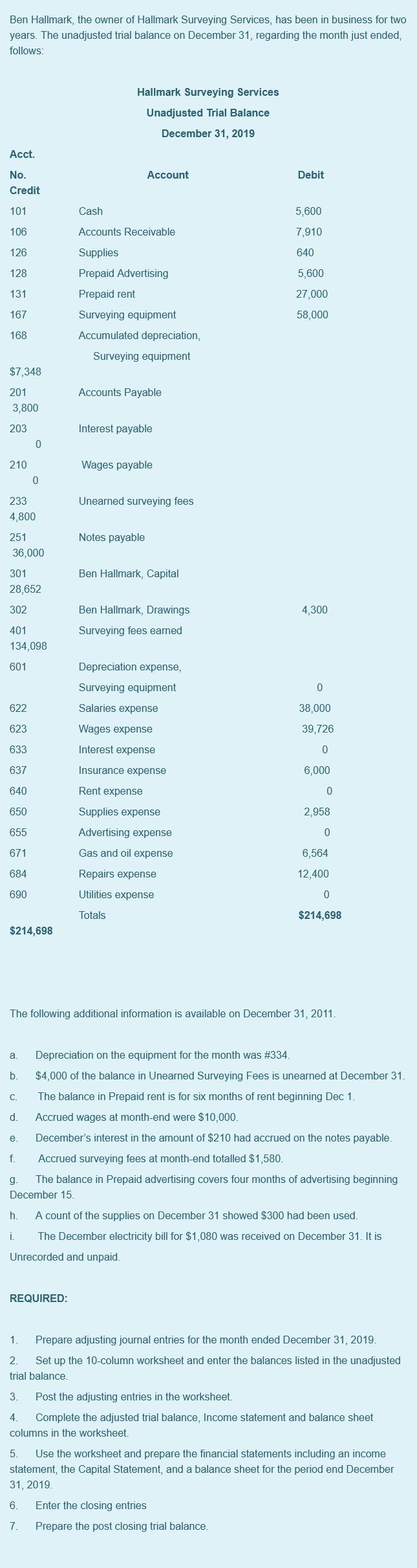

Ben Hallmark, the owner of Hallmark Surveying Services, has been in business for two years. The unadjusted trial balance on December 31, regarding the

Ben Hallmark, the owner of Hallmark Surveying Services, has been in business for two years. The unadjusted trial balance on December 31, regarding the month just ended, follows: Acct. No. Credit 101 106 126 128 131 167 168 $7,348 201 3,800 203 210 233 4,800 251 36,000 622 623 633 637 640 650 655 671 684 690 0 301 28,652 302 401 134,098 601 0 $214,698 a. b. C. Hallmark Surveying Services Unadjusted Trial Balance December 31, 2019 Account Cash Accounts Receivable Supplies Prepaid Advertising Prepaid rent Surveying equipment Accumulated depreciation, Surveying equipment REQUIRED: Accounts Payable Interest payable Wages payable Unearned surveying fees Notes payable Ben Hallmark, Capital Ben Hallmark, Drawings Surveying fees earned Depreciation expense, Surveying equipment Salaries expense Wages expense Interest expense Insurance expense Rent expense Supplies expense Advertising expense Gas and oil expense Repairs expense Utilities expense Totals Debit 5,600 7,910 640 5,600 27,000 58,000 4,300 The following additional information is available on December 31, 2011. 0 38,000 Depreciation on the equipment for the month was # 334. $4,000 of the balance in Unearned Surveying Fees is unearned at December 31. The balance in Prepaid rent is for six months of rent beginning Dec 1. d. Accrued wages at month-end were $10,000. 39,726 0 6,000 0 2,958 0 Enter the closing entries 7. Prepare the post closing trial balance. 6,564 12,400 0 $214,698 e. December's interest in the amount of $210 had accrued on the notes payable. f. Accrued surveying fees at month-end totalled $1,580. g. The balance in Prepaid advertising covers four months of advertising beginning December 15. h. A count of the supplies on December 31 showed $300 had been used. i. The December electricity bill for $1,080 was received on December 31. It is Unrecorded and unpaid. 1 Prepare adjusting journal entries for the month ended December 31, 2019. 2. Set up the 10-column worksheet and enter the balances listed in the unadjusted trial balance. 3. Post the adjusting entries in the worksheet. 4. Complete the adjusted trial balance, Income statement and balance sheet columns in the worksheet. 5. Use the worksheet and prepare the financial statements including an income statement, the Capital Statement, and a balance sheet for the period end December 31, 2019. 6.

Step by Step Solution

★★★★★

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem we will go through each step one by one Lets begin 1 Prepare adjusting journal entries for the month ended December 31 2019 a Depreciation expense Debit Depreciation Expense Surv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started