Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ben has won a $1,000,000 grand prize in a contest. The organizers have offered him 2 payment options and he requires advice on which

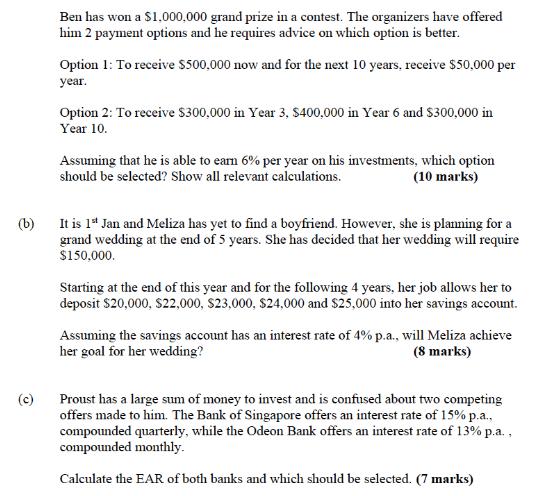

Ben has won a $1,000,000 grand prize in a contest. The organizers have offered him 2 payment options and he requires advice on which option is better. Option 1: To receive $500,000 now and for the next 10 years, receive $50,000 per year. Option 2: To receive $300,000 in Year 3, $400,000 in Year 6 and $300,000 in Year 10. Assuming that he is able to earn 6% per year on his investments, which option should be selected? Show all relevant calculations. (10 marks) (b) It is 1st Jan and Meliza has yet to find a boyfriend. However, she is planning for a grand wedding at the end of 5 years. She has decided that her wedding will require $150,000. Starting at the end of this year and for the following 4 years, her job allows her to deposit $20,000, $22,000, $23,000, $24,000 and $25,000 into her savings account. Assuming the savings account has an interest rate of 4% p.a., will Meliza achieve her goal for her wedding? (8 marks) Proust has a large sum of money to invest and is confused about two competing offers made to him. The Bank of Singapore offers an interest rate of 15% p.a., compounded quarterly, while the Odeon Bank offers an interest rate of 13% p.a., compounded monthly. Calculate the EAR of both banks and which should be selected. (7 marks)

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a Option 1 PV 500000 50000 11100610006 PV 75637570 Option 2 PV 30...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started