Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. Crizpie Berhad (CB), a Malaysian resident company since 1999. Its business is dealing with retailing household groceries and CB has many outlets all

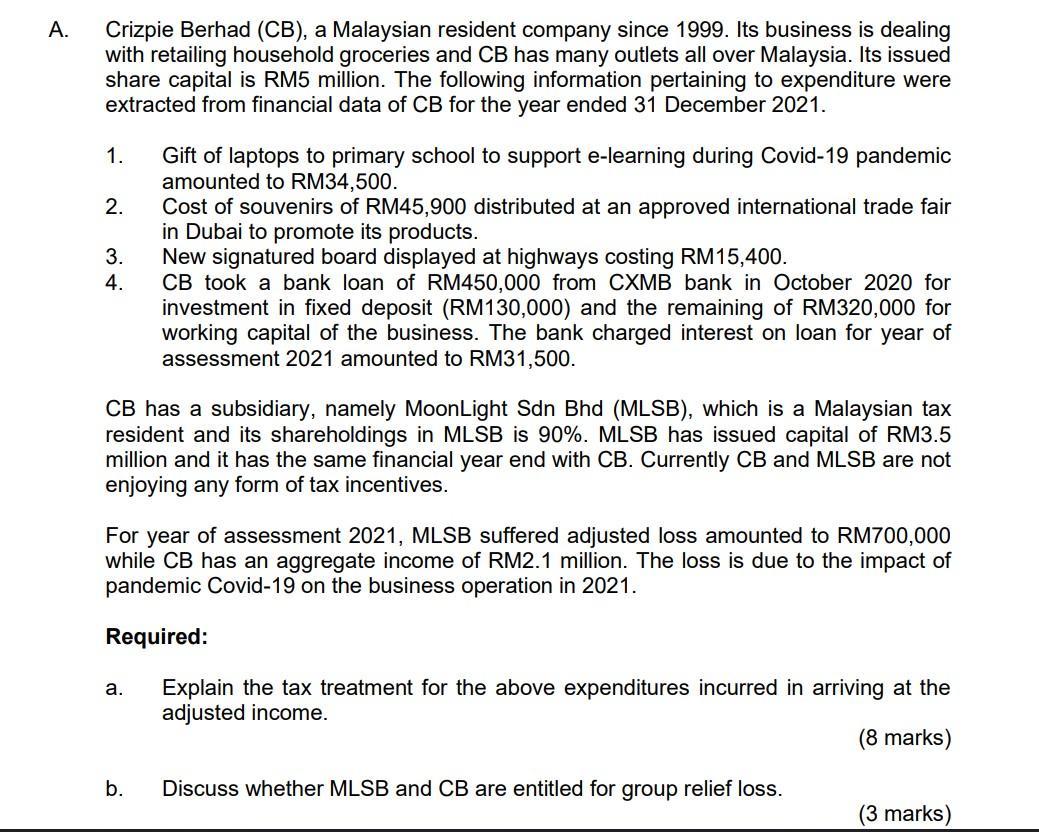

A. Crizpie Berhad (CB), a Malaysian resident company since 1999. Its business is dealing with retailing household groceries and CB has many outlets all over Malaysia. Its issued share capital is RM5 million. The following information pertaining to expenditure were extracted from financial data of CB for the year ended 31 December 2021. 1. 2. 3. 4. Gift of laptops to primary school to support e-learning during Covid-19 pandemic amounted to RM34,500. CB has a subsidiary, namely MoonLight Sdn Bhd (MLSB), which is a Malaysian tax resident and its shareholdings in MLSB is 90%. MLSB has issued capital of RM3.5 million and it has the same financial year end with CB. Currently CB and MLSB are not enjoying any form of tax incentives. a. Cost of souvenirs of RM45,900 distributed at an approved international trade fair in Dubai to promote its products. New signatured board displayed at highways costing RM15,400. CB took a bank loan of RM450,000 from CXMB bank in October 2020 for investment in fixed deposit (RM130,000) and the remaining of RM320,000 for working capital of the business. The bank charged interest on loan for year of assessment 2021 amounted to RM31,500. For year of assessment 2021, MLSB suffered adjusted loss amounted to RM700,000 while CB has an aggregate income of RM2.1 million. The loss is due to the impact of pandemic Covid-19 on the business operation in 2021. Required: b. Explain the tax treatment for the above expenditures incurred in arriving at the adjusted income. (8 marks) Discuss whether MLSB and CB are entitled for group relief loss. (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANS WER The amount in the fund on December 31 2011 would be 21 8 13 WORK ING We can use ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started