Answered step by step

Verified Expert Solution

Question

1 Approved Answer

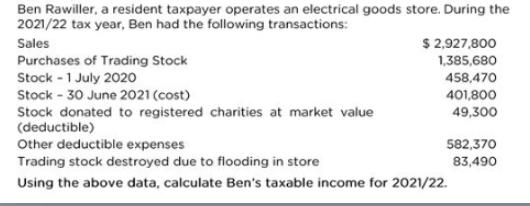

Ben Rawiller, a resident taxpayer operates an electrical goods store. During the 2021/22 tax year, Ben had the following transactions: Sales Purchases of Trading

Ben Rawiller, a resident taxpayer operates an electrical goods store. During the 2021/22 tax year, Ben had the following transactions: Sales Purchases of Trading Stock Stock-1 July 2020 $ 2,927,800 1,385,680 458,470 401,800 49,300 Stock - 30 June 2021 (cost) Stock donated to registered charities at market value (deductible) Other deductible expenses Trading stock destroyed due to flooding in store Using the above data, calculate Ben's taxable income for 2021/22. 582,370 83,490

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Ben Rawillers taxable income for the 202122 tax year we need to consider the following ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started