Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ben Ten (BT) manufactures and sells a single gaming chair at a unit selling price of $400. The company uses variable costing for internal

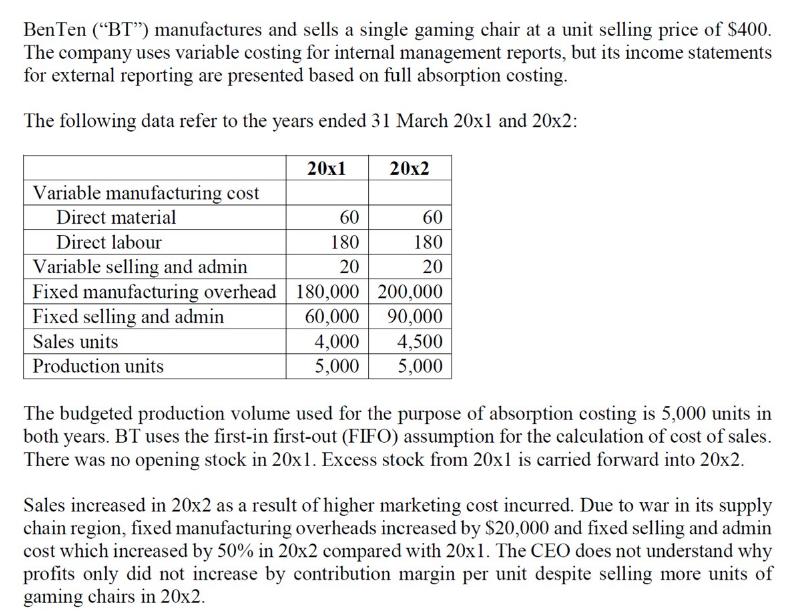

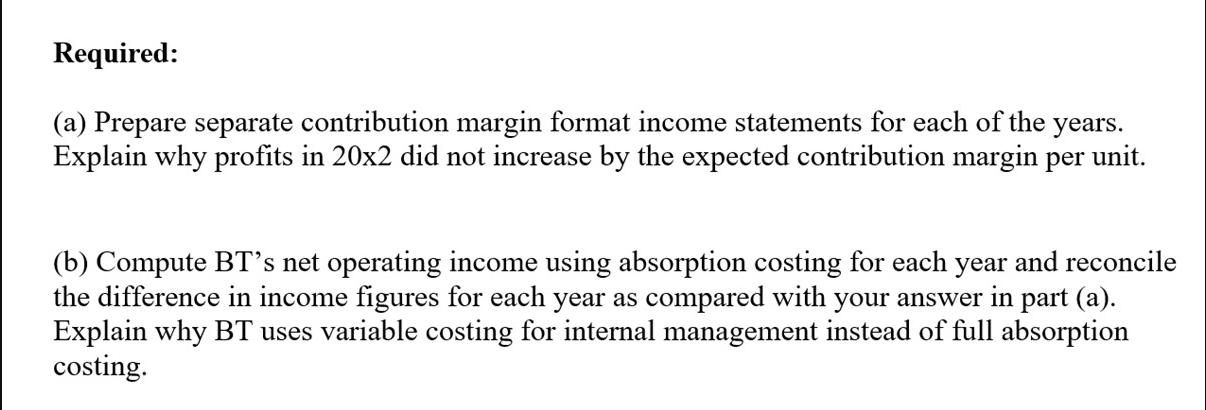

Ben Ten ("BT") manufactures and sells a single gaming chair at a unit selling price of $400. The company uses variable costing for internal management reports, but its income statements for external reporting are presented based on full absorption costing. The following data refer to the years ended 31 March 20x1 and 20x2: 20x2 Variable manufacturing cost Direct material Direct labour Variable selling and admin Fixed manufacturing overhead Fixed selling and admin Sales units Production units 20x1 60 180 20 60 180 20 180,000 200,000 60,000 90,000 4,000 4,500 5,000 5,000 The budgeted production volume used for the purpose of absorption costing is 5,000 units in both years. BT uses the first-in first-out (FIFO) assumption for the calculation of cost of sales. There was no opening stock in 20x1. Excess stock from 20x1 is carried forward into 20x2. Sales increased in 20x2 as a result of higher marketing cost incurred. Due to war in its supply chain region, fixed manufacturing overheads increased by $20,000 and fixed selling and admin cost which increased by 50% in 20x2 compared with 20x1. The CEO does not understand why profits only did not increase by contribution margin per unit despite selling more units of gaming chairs in 20x2. Required: (a) Prepare separate contribution margin format income statements for each of the years. Explain why profits in 20x2 did not increase by the expected contribution margin per unit. (b) Compute BT's net operating income using absorption costing for each year and reconcile the difference in income figures for each year as compared with your answer in part (a). Explain why BT uses variable costing for internal management instead of full absorption costing.

Step by Step Solution

★★★★★

3.36 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

a Contribution Margin Format Income Statements Lets prepare contribution margin format income statements for each year Income Statement for the Year Ended 31 March 20x1 Sales 4000 units 400 1600000 Va...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started