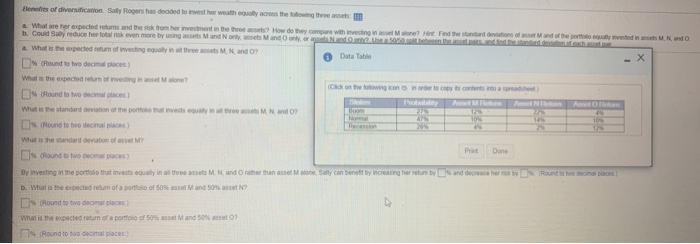

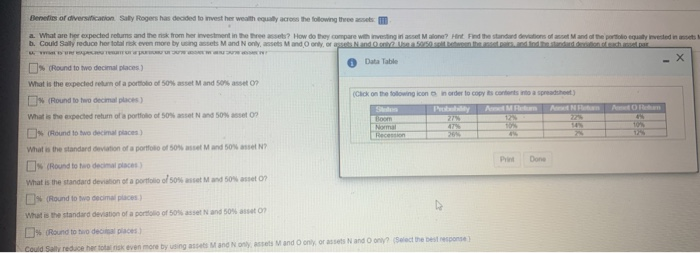

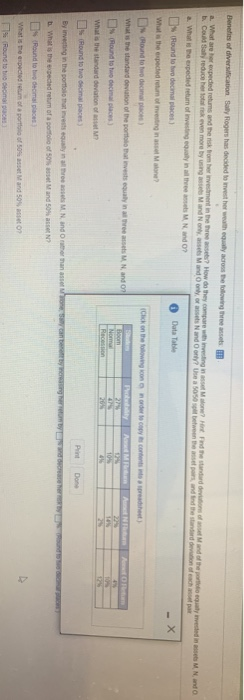

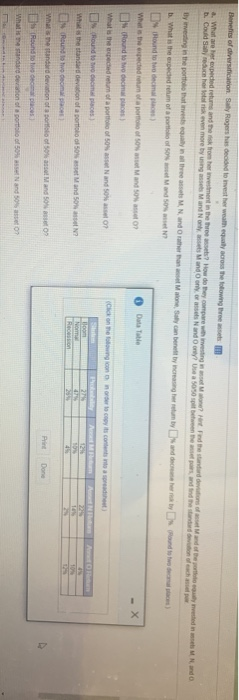

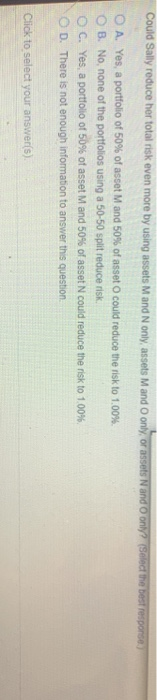

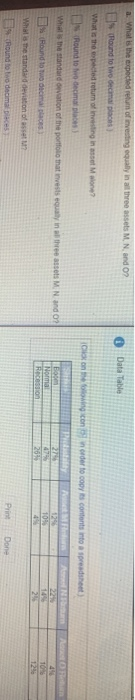

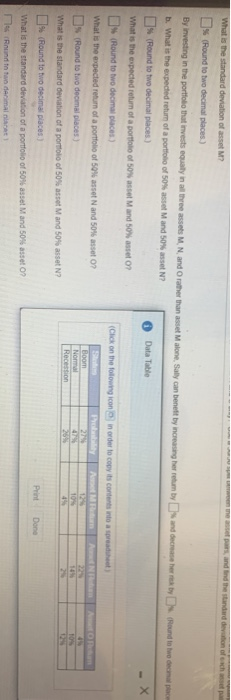

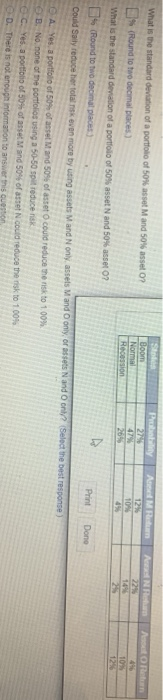

Benefits of diversification Sally Rogers has decided to invest her wealth equally across the following the a. What are the expected returns and then from her investment in the threes? How do they compare with investing in Mon? Hint Find the standard deviations of use and of the portfolio wested in Mundo b. Could say reduce her folk even more by using assets and Nonly Mand on and a. What is the spected return of investing in the Mando? Data Table (Round to two decimal places) What is the expected retum arvesting in one? Click on the wing on in order to co scono a set E (Round to two decimale) AM What is the standard deviation of the protests and Round to two decimale) What is the standard deviation of asse? Print Els Round to ho decimal aces) By investing in the portfolio that invests equally in all three sets M. N and rather than asset Malone, Sally can benutt by increasing her retum by and create here by Round to have decir laces b. What is the expected retum of a portfolio of 50% asset Mand 50% asset ? Round to two decimal places What is the expected return of a portfolio of 50% M and 50% asset? Round to decimal places Boom Beneties of diversification Sally Rogers has decided to invest her wealthy across the following the sem a. What are her expected retums and the risk from her investment in the three sets? How do they compare with investing in asset Malone? Hint Find the standard deviations of use and at the portiodo equity invested in se b. Could Sally reduce her totalrisk even more by using assets M and only, assets M and only, or assets and added WEWE Round to two decimal places) Data Table What is the expected return of a portfolio of 50% asset M and 50% set 0 (Round to two decimal places) (Click on the following icon in order to copy its content to protest What is the expected return of a portfolio of onset N and 50% asset (Round to two decimal places) Normal To Recession What is the standard deviation of a portfolio of 50% Mand SONN? Os Round to ho decimal place) P Done What is the standard deviation of a portfolio of 50% set and sose? D) (Round to two decimal places) What is the standard deviation of a portion of 50% and 50% to? Ds Round to two decal places Could Sally reduce he even more by using a Mand only as Mand only, or assets and only? Select the best response Could Sally reduce her total risk even more by using assets M and N only, assets M and only, or assets N and only? (Select the best response.) O A. Yes, a portfolio of 50% of asset M and 50% of asset O could reduce the risk to 1.00%. OB. No, none of the portfolios using a 50-50 split reduce risk O C. Yes, a portfolio of 50% of asset M and 50% of asset N could reduce the risk to 1.00% D. There is not enough information to answer this question Benefits of diversification Sally Rogers has decided to the weathly across the following them What are the expected retums and the risk om her investment in the three se? How do they compare thing in one? Find the standard de Mand of the need in and b. Could Sally reduce the folk even more by using Mand No Mand only one and only? Use a 5050 between these and find the standard deviation of each What is the expected return of investing in the Mando Os Round to two decimal place) Data Table - X What is the expected retum Mon? sound to be decimal places Click on the following con order to copy contract What is the standard deviation of the port that invests equally in the sand AM Hom Os Round to be decimal places Nom AN TON Recen What is the standard deviation of Is Round to be cima pas Paint Done By investing in the portfolio that invests equal in MN and other manassing b. What is the secretum of a portfolio of 50 and 50% ON? Els Round to decimal What is the expected retum portfolio of 50% M and 500 (Round to him Benefits of diversification Sally Rogers has de tester was the long the What are expected returns and the store the two of the wind b. Could you have more and No Mand on and on By investing is the porto seguintes MN and Other than one can bent by increasing them by sand dund to be . What is the expected rehm of a loof on Mondo Hound to be decima What is the expected to a person and so Data Table ) Round to decina pa What is the expected return of a part of 50 and 50% Click on the town on nocy is comuns det sound to come loom NO What is the standard deviation of a portion of 50% M and son 10 Rece O Round to compact What is the standard deviation of a portfolio of SM and 500 Print Os Round to haces What is a standard deviation of portfolio of 50 and 5007 Could Sally reduce her total risk even more by using assets M and N only, assets M and only, or assets N and only? (Select the best responses O A. Yes, a portfolio of 50% of asset M and 50% of asset O could reduce the risk to 1.00% OB. No, none of the portfolios using a 50-50 split reduce risk. OC. Yes, a portfolio of 50% of asset M and 50% of asset N could reduce the risk to 1.00% D. There is not enough information to answer this question Click to select your answer(s). a. What is the expected retum of investing equally in all three assets M N and 02 Data Table Cloning cender to copy contents into a spreadsheet) found to two decimal places) What is the pected return of investing in ass Mone? Os Round to the decimal places) What is the standard deviation of the portfolio that invests equally in the sets M Nando? Hound to medicinales What is the standard deviation of asset? Els Round to two decimal aces Noma Roston 47 109 149 29 498 108 12% Print Done What is the standard deviation of asset ? Os (Round to two decimal places) By Investing in the portfolio that invests equally in all three assets M, N and rather than asset Malone, Sally can benett by increasing her retum bys and decrease by Round to two decapace b. What is the expected return of a portfolio of 50% asset Mand 50% asset N? Os (Round to two decimal places) Data Table What is the expected retum ot a portfolio of 50% asset M and 50% asset Round to two decimal places) (Click on the following icon in order to coby its contents into a sheet What is the expected return of a portfolio of 50% asset N and 50% asset AM Boom Os (Round to two decimal places) Normal Recession 49 What is the standard deviation of a portfolio of 50% assot M and 50% asset N? % (Round to tivo decimal places) Print Done What is the standard deviation of a portfolio of 50% et M and 50% asset ? Round in two derimalat OR 22 109 12 St Pretty AMR What is the standard deviation of a portfolio of 50% asset M and 50% asset ? Boom 12% Normal 47% 1044 Els Round to two decimal places) Recension 264 4 What is the standard deviation of a portfolio of 50% asset N and 50% asset ? (Round to two decimal places) Print Could Sally reduce her totalis even more by using assets M and Nonly assets M and only or assets and only? Select the best response A Yes, a portfolio of 50% of asset Mand 50% of asset could reduce the risk to 100% B. No, none of the portfolios using a 50-50 produce Yes, a portfolio of 50% of asset Mand 50% of asset N could reduce the risk to 100% D. There is not enough information to answer this Done