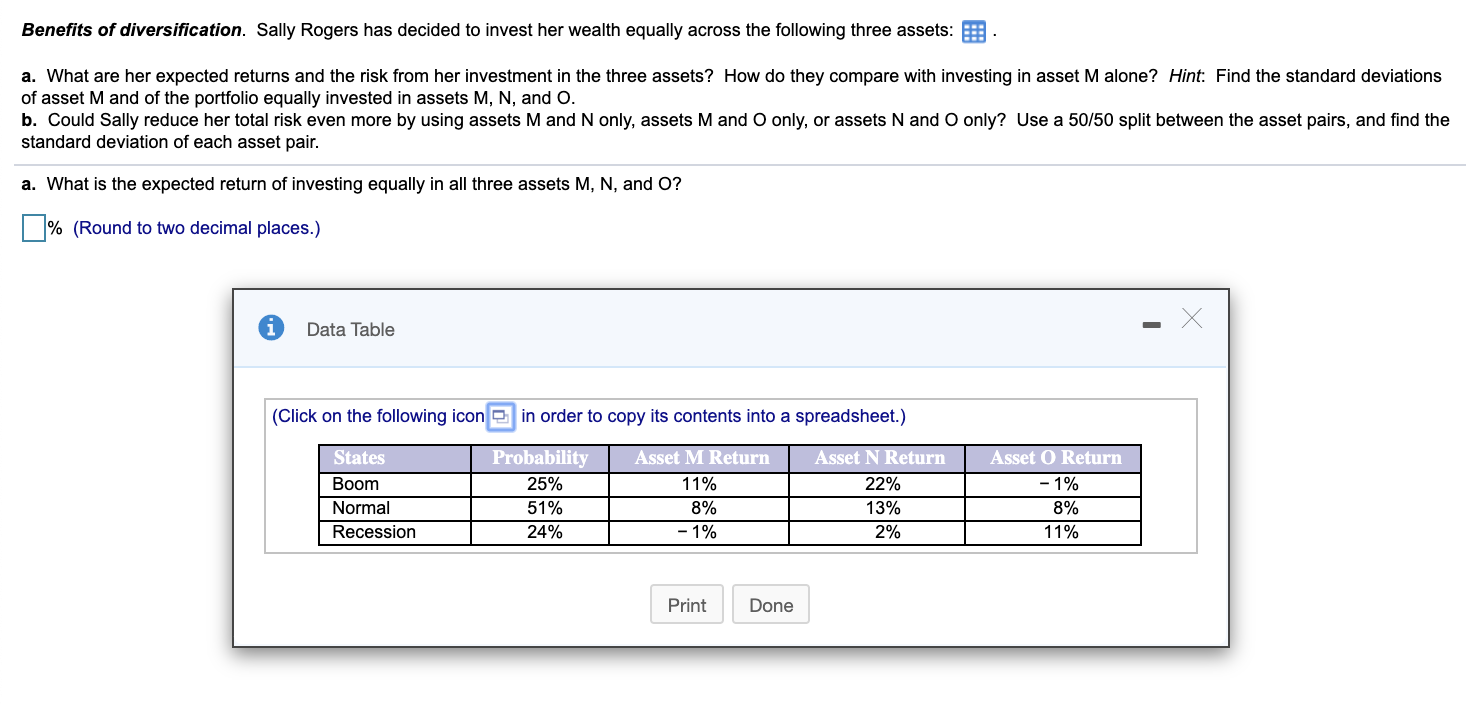

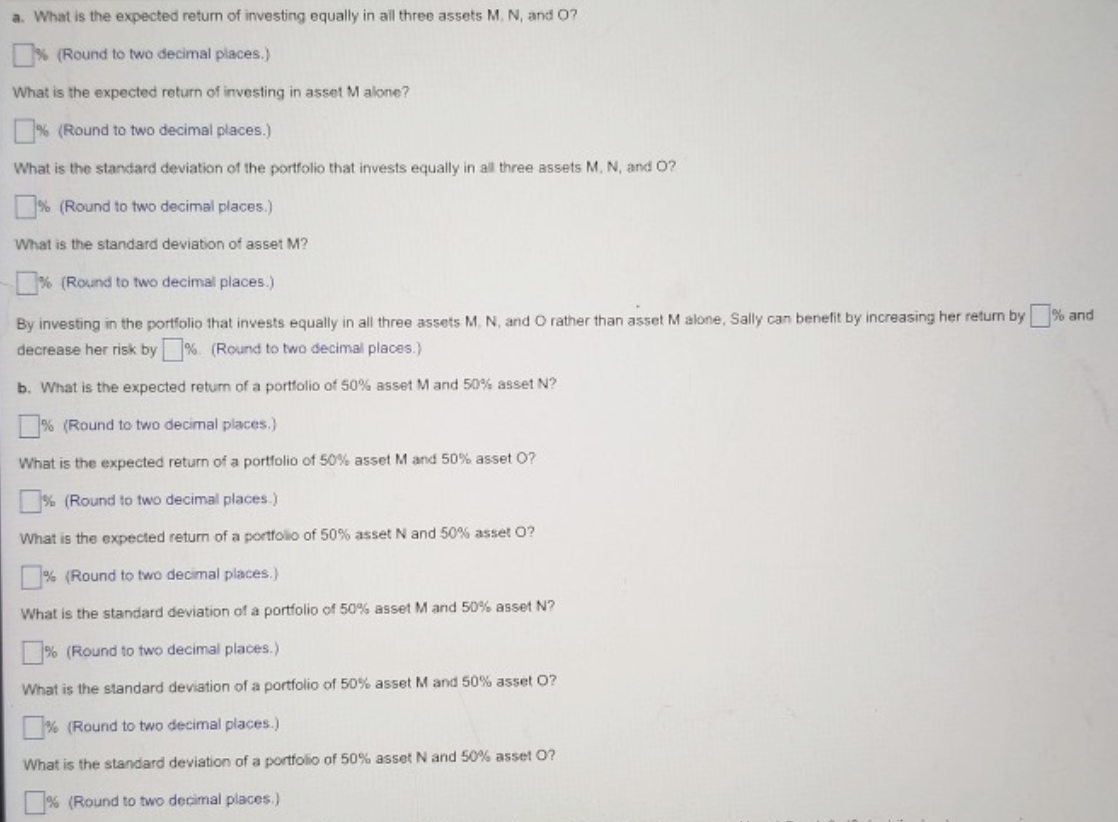

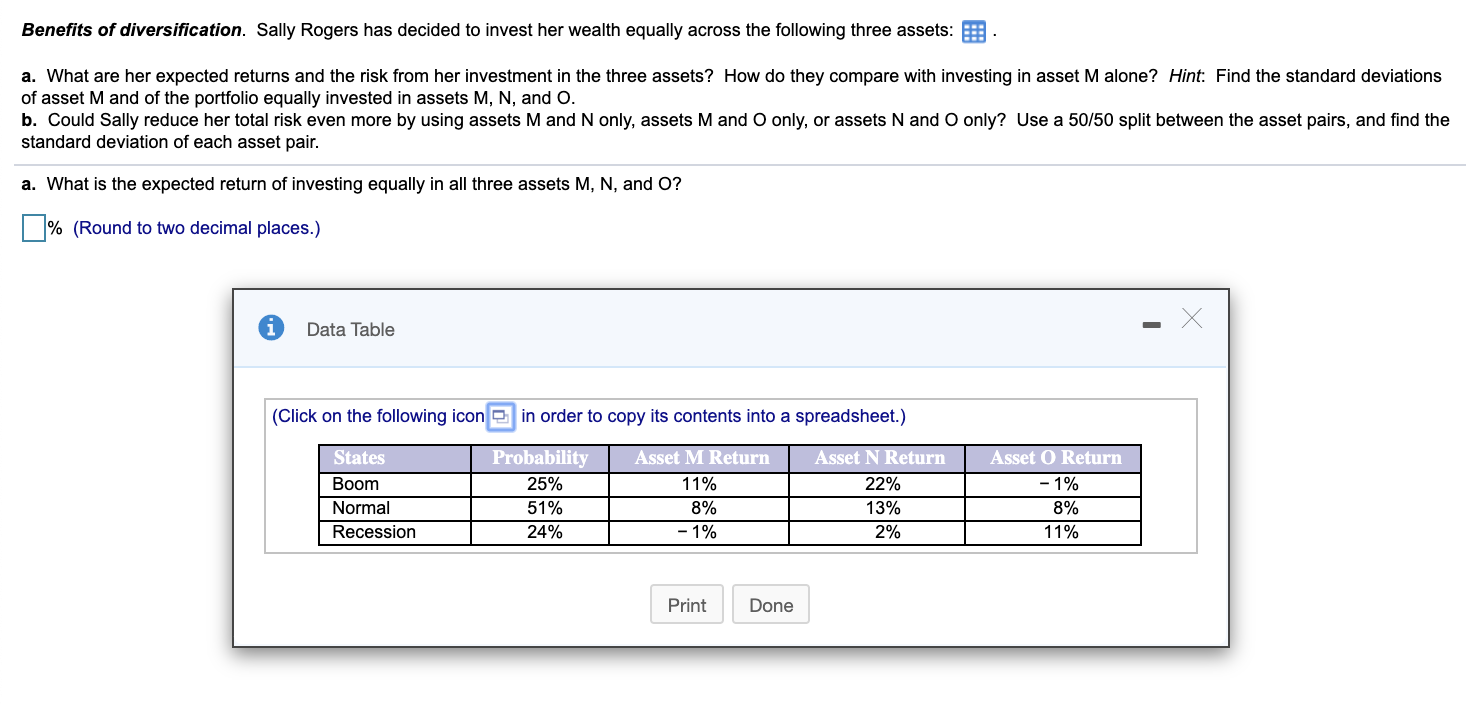

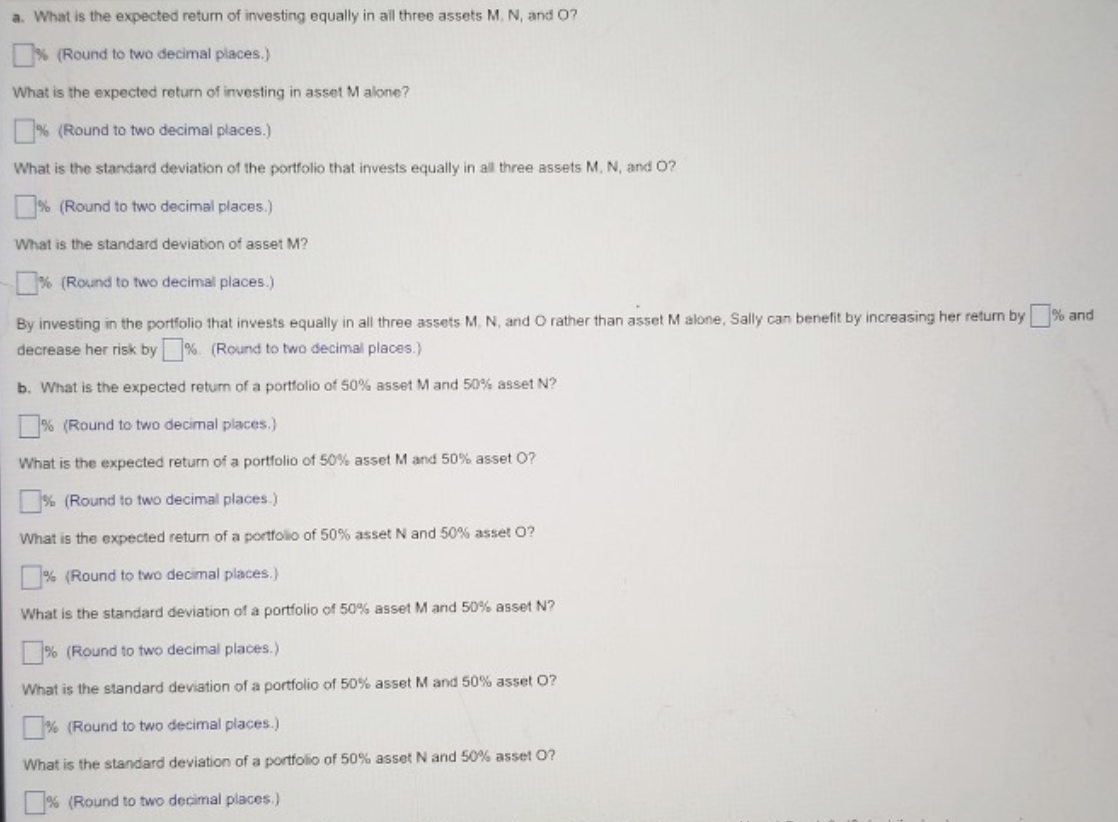

Benefits of diversification. Sally Rogers has decided to invest her wealth equally across the following three assets: . a. What are her expected returns and the risk from her investment in the three assets? How do they compare with investing in asset Malone? Hint: Find the standard deviations of asset M and of the portfolio equally invested in assets M, N, and O. b. Could Sally reduce her total risk even more by using assets M and N only, assets M and O only, or assets N and O only? Use a 50/50 split between the asset pairs, and find the standard deviation of each asset pair. a. What is the expected return of investing equally in all three assets M, N, and O? | % (Round to two decimal places.) 1 Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Asset M Return 11% States Boom Normal Recession Probability 25% 51% 24% Asset N Return 22% 13% 2% Asset O Return - 1% 8% 11% 8% -1% Print Done a. What is the expected return of investing equally in all three assets M. N, and O? % (Round to two decimal places.) What is the expected return of investing in asset Malone? % (Round to two decimal places.) What is the standard deviation of the portfolio that invests equally in all three assets M. N, and O? % (Round to two decimal places.) What is the standard deviation of asset M? - % (Round to two decimal places.) % and By investing in the portfolio that invests equally in all three assets M N and O rather than asset Malone, Sally can benefit by increasing her return by decrease her risk by % (Round to two decimal places.) b. What is the expected return of a portfolio of 50% asset Mand 50% asset N? |_% (Round to two decimal places.) What is the expected return of a portfolio of 50% asset M and 50% asset O? % (Round to two decimal places.) What is the expected return of a portfolio of 50% asset N and 50% asset ? % (Round to two decimal places.) What is the standard deviation of a portfolio of 50% asset M and 50% asset N? % (Round to two decimal places.) What is the standard deviation of a portfolio of 50% asset M and 50% asset ? % (Round to two decimal places.) What is the standard deviation of a portfolio of 50% asset N and 50% asset O? % (Round to two decimal places)