Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Benoit Pharmaceuticals, Inc. was formed in 1990 by Richard Benoit, PhD. Formerly a research scientist with a major pharmaceutical, he decided to strike out

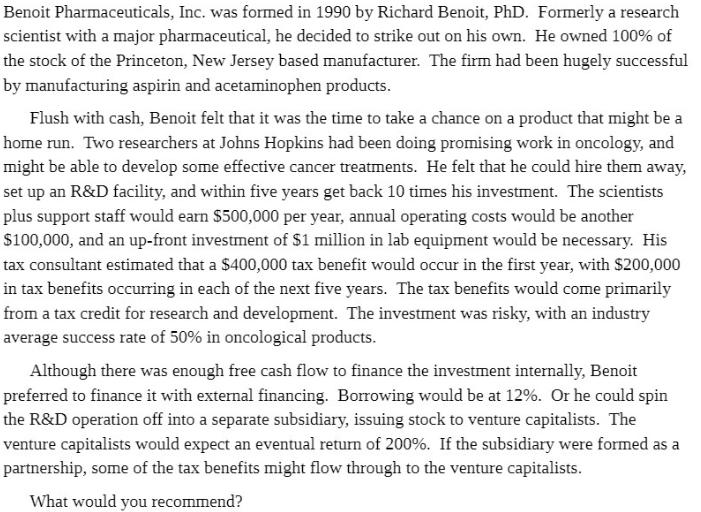

Benoit Pharmaceuticals, Inc. was formed in 1990 by Richard Benoit, PhD. Formerly a research scientist with a major pharmaceutical, he decided to strike out on his own. He owned 100% of the stock of the Princeton, New Jersey based manufacturer. The firm had been hugely successful by manufacturing aspirin and acetaminophen products. Flush with cash, Benoit felt that it was the time to take a chance on a product that might be a home run. Two researchers at Johns Hopkins had been doing promising work in oncology, and might be able to develop some effective cancer treatments. He felt that he could hire them away, set up an R&D facility, and within five years get back 10 times his investment. The scientists plus support staff would earn $500,000 per year, annual operating costs would be another $100,000, and an up-front investment of $1 million in lab equipment would be necessary. His tax consultant estimated that a $400,000 tax benefit would occur in the first year, with $200,000 in tax benefits occurring in each of the next five years. The tax benefits would come primarily from a tax credit for research and development. The investment was risky, with an industry average success rate of 50% in oncological products. Although there was enough free cash flow to finance the investment internally, Benoit preferred to finance it with external financing. Borrowing would be at 12%. Or he could spin the R&D operation off into a separate subsidiary, issuing stock to venture capitalists. The venture capitalists would expect an eventual return of 200%. If the subsidiary were formed as a partnership, some of the tax benefits might flow through to the venture capitalists. What would you recommend?

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Before making a recommendation its important to analyze the financial feasibility of the investment opportunity Based on the information provided the following assumptions can be made The initial inve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started