Question

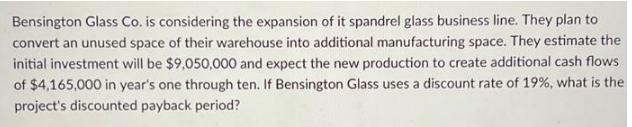

Bensington Glass Co. is considering the expansion of it spandrel glass business line. They plan to convert an unused space of their warehouse into

Bensington Glass Co. is considering the expansion of it spandrel glass business line. They plan to convert an unused space of their warehouse into additional manufacturing space. They estimate the initial investment will be $9,050,000 and expect the new production to create additional cash flows of $4,165,000 in year's one through ten. If Bensington Glass uses a discount rate of 19%, what is the project's discounted payback period?

Step by Step Solution

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the discounted payback period for the project we need to determine how long it takes for the discounted cash flows to recover the initial investment Step 1 Calculate the discounted cash f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

9th Edition

1337614689, 1337614688, 9781337668262, 978-1337614689

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App