Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Benson borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount available.

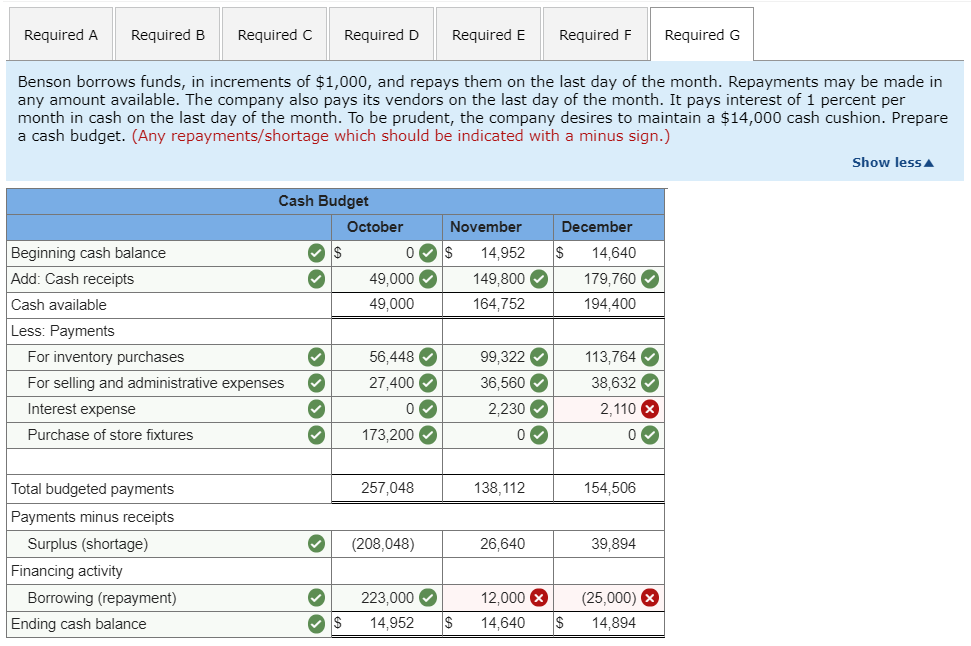

Benson borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount available. The company also pays its vendors on the last day of the month. It pays interest of 1 percent per month in cash on the last day of the month. To be prudent, the company desires to maintain a $14,000 cash cushion. Prepare a cash budget. (Any repayments/shortage which should be indicated with a minus sign.)

Can someone tell me what I'm doing wrong here? Thanks!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started