Answered step by step

Verified Expert Solution

Question

1 Approved Answer

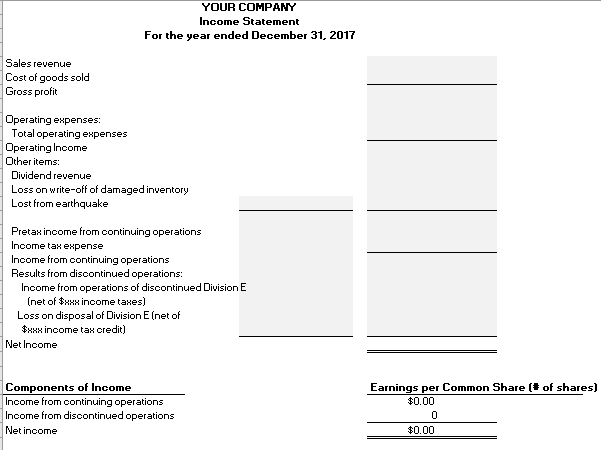

Benson Company uses a periodic inventory system and presents the following items derived from its December 31, 2017, adjusted trial balance: Operating Expenses $ 39,830

Benson Company uses a periodic inventory system and presents the following items derived from its December 31, 2017, adjusted trial balance:

| Operating Expenses | $ 39,830 |

| Dividend Revenue | 1,200 |

| Retained Earnings, January 1, 2017 | 77,550 |

| Sales (net) | 235,650 |

| Common Stock, $10 par | 50,000 |

| Merchandise Inventory, January 1, 2017 | 26,400 |

| Purchases (net) | 81,720 |

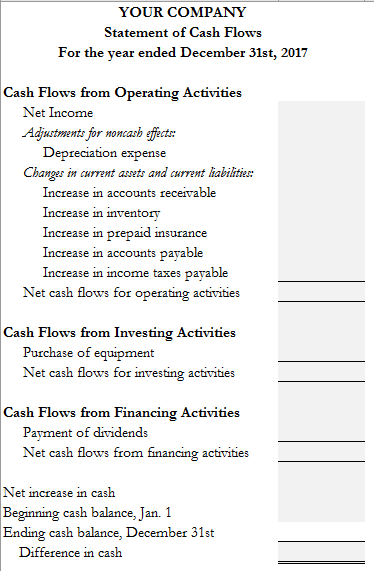

| Balance sheet information | ||

| Assets | 12/31/18 | 12/31/17 |

| Cash | $20,000 | $ 38,000 |

| Accounts receivable | 83,000 | 70,000 |

| Inventory | 90,000 | 85,000 |

| Prepaid Insurance | 2,000 | 1,700 |

| Equipment | 40,000 | 25,000 |

| Less: Accumulated depreciation | (700) | (500) |

| Total assets | $234,300 | $219,200 |

| Liabilities and Stockholders' Equity | ||

| Accounts Payable | $30,000 | $36,000 |

| Income taxes payable | 20,000 | 15,000 |

| Common stock | 100,000 | 100,000 |

| Retained earnings | 84,300 | 68,200 |

| Total liabilities and stockholders' equity | $234,300 | $219,200 |

The following information is also available for 2017 and is not reflected in the preceding accounts:

- The common stock has been outstanding for the entire year. A cash dividend of $0.92 per share was declared.

- The income tax rate on all items of income is 30%.

- The ending merchandise inventory is $30,030.

- A pre-tax $4,200 loss was recognized on the sale of Division E (a component of the company). This division had earned a pre-tax operating income of $2,900 during 2016.

- Damaged inventory was written off at a pre-tax loss of $7,620.

- An earthquake, which is unusual in the area, caused a $4,700 pre-tax loss.

- Prepare a 2016 single-step income statement for Benson Company.

- Calculate the Earnings per share and the Profit margin on sales ratios.

- Prepare the statement of cash flows, using the indirect method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started