Question: Bentley Enterprises uses process costing to control costs in the manufacture of Dust Sensors for the mining industry. The following information pertains to operations for

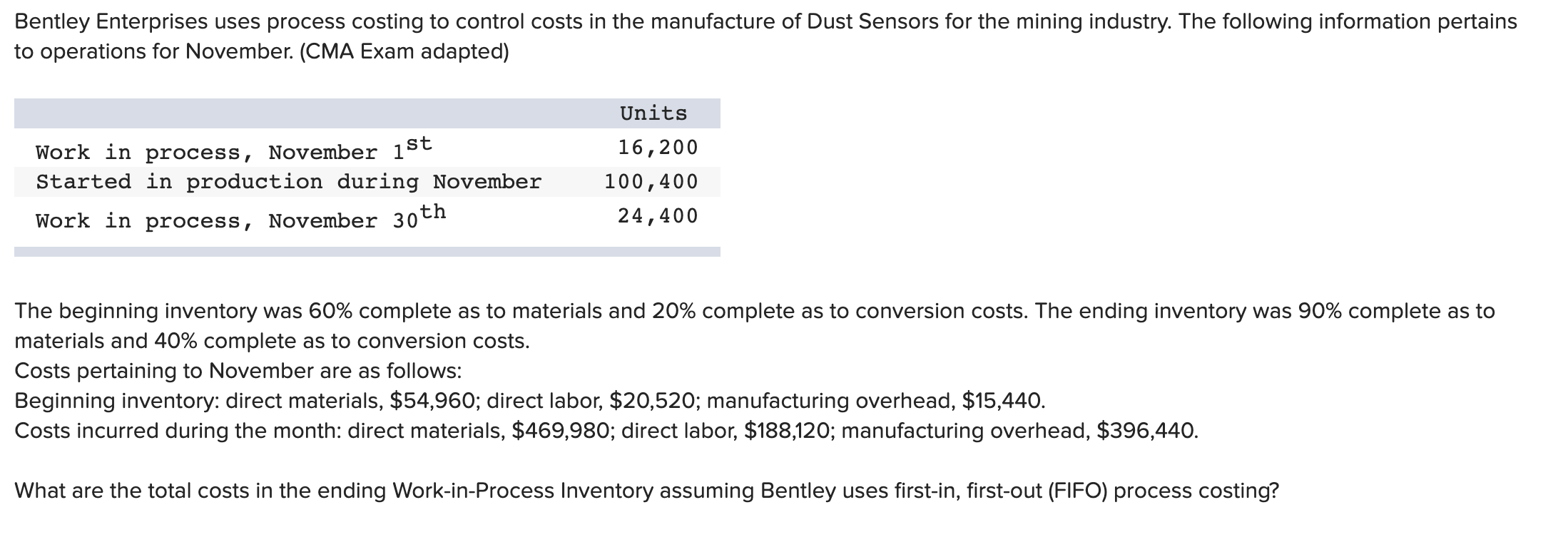

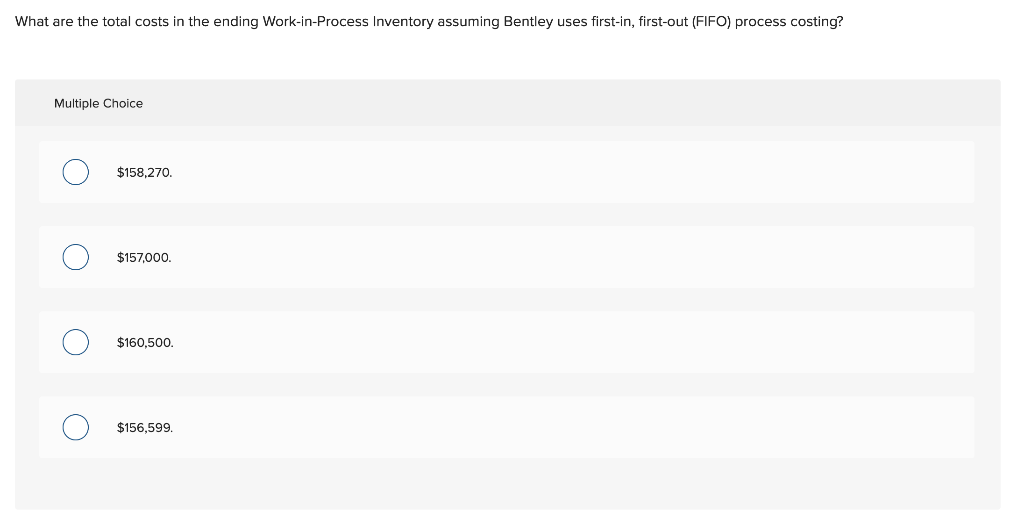

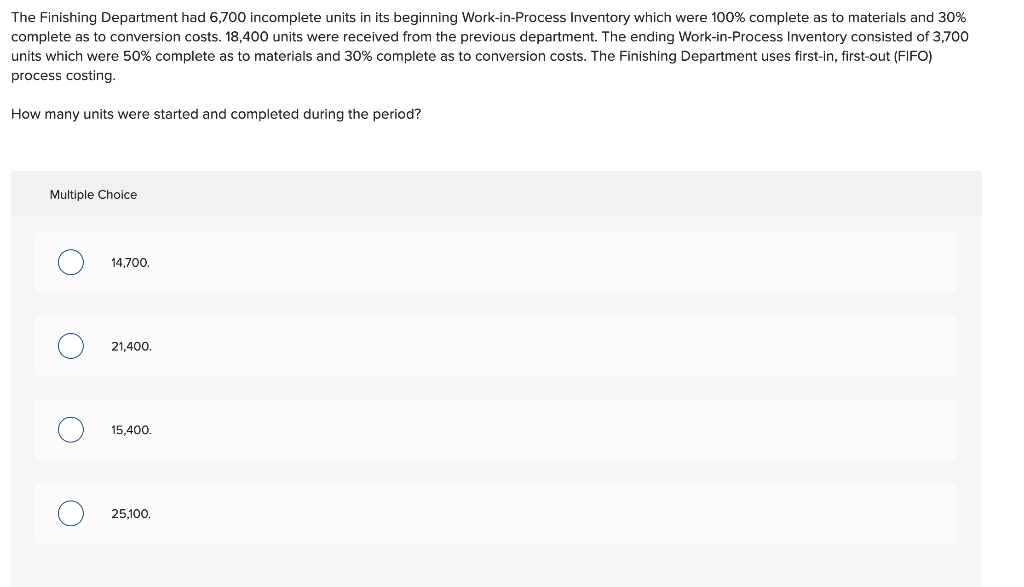

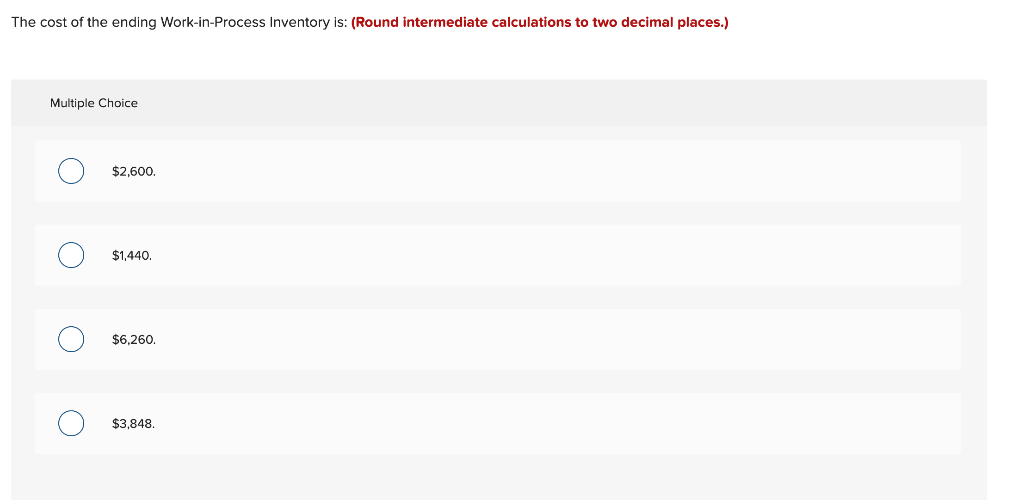

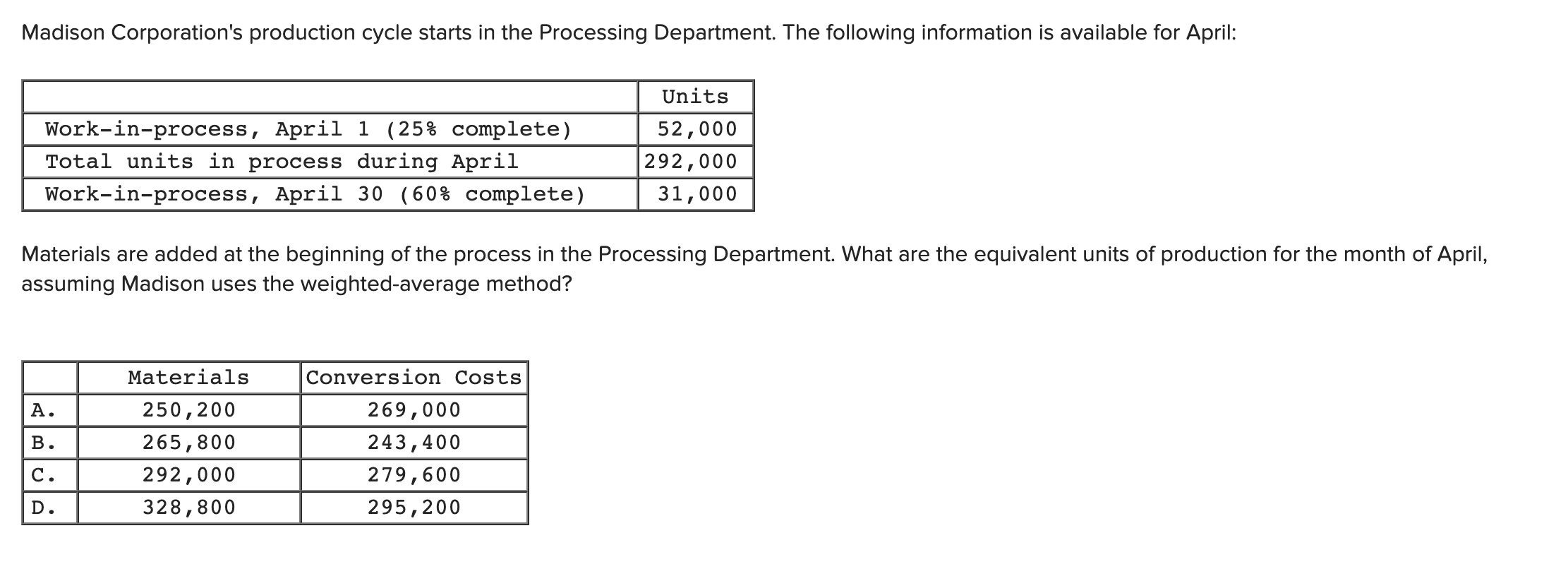

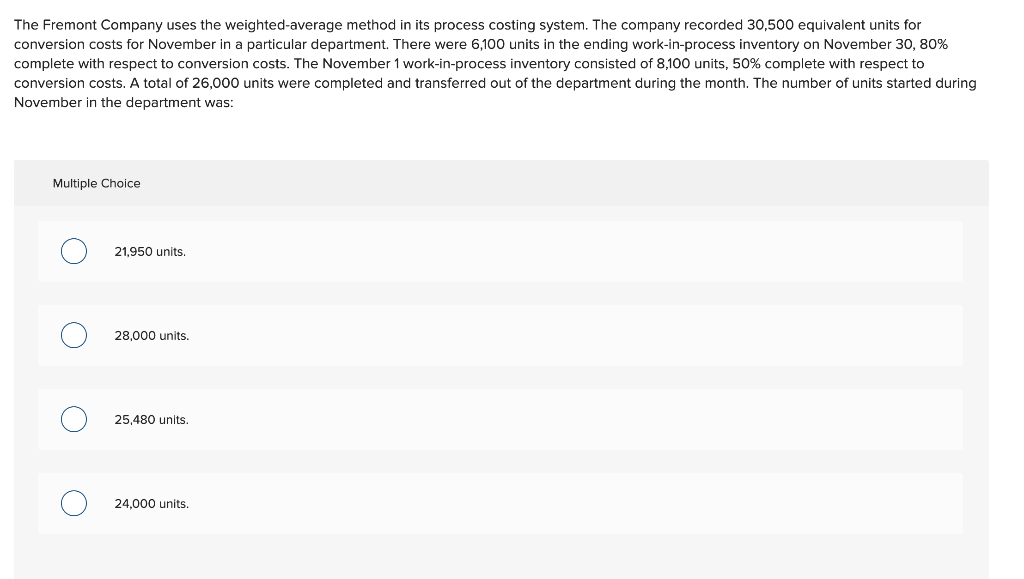

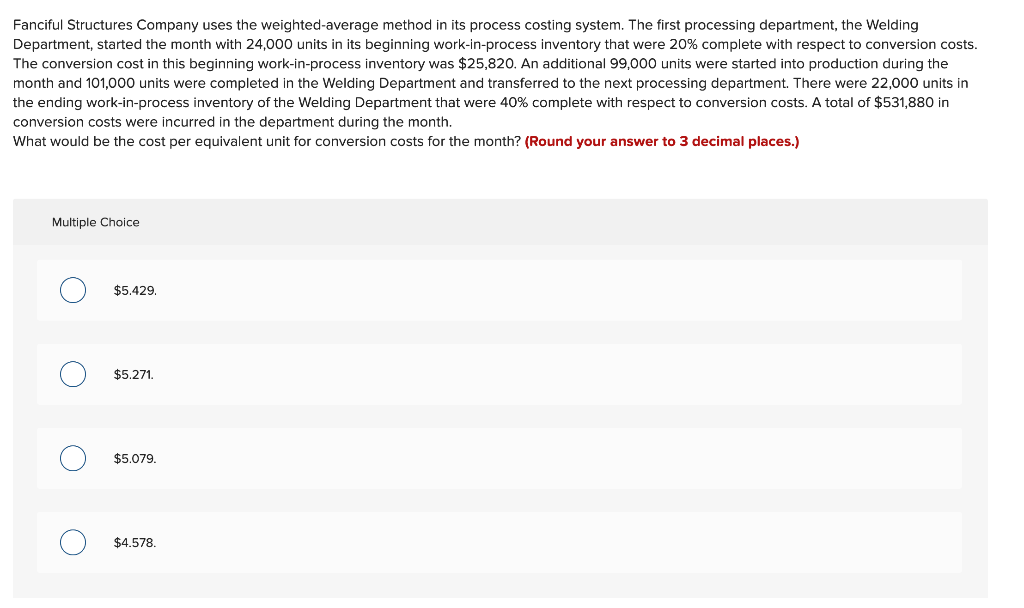

Bentley Enterprises uses process costing to control costs in the manufacture of Dust Sensors for the mining industry. The following information pertains to operations for November. (CMA Exam adapted) Units Work in process, November 1st Started in production during November Work in process, November 30th 16,200 100,400 24,400 The beginning inventory was 60% complete as to materials and 20% complete as to conversion costs. The ending inventory was 90% complete as to materials and 40% complete as to conversion costs. Costs pertaining to November are as follows: Beginning inventory: direct materials, $54,960; direct labor, $20,520; manufacturing overhead, $15,440. Costs incurred during the month: direct materials, $469,980; direct labor, $188,120; manufacturing overhead, $396,440. What are the total costs in the ending Work-in-Process Inventory assuming Bentley uses first-in, first-out (FIFO) process costing? What are the total costs in the ending Work-in-Process Inventory assuming Bentley uses first-in, first-out (FIFO) process costing? Multiple Choice $158,270. $157,000. O $160,500. O $156,599. The Finishing Department had 6,700 incomplete units in its beginning Work-in-Process Inventory which were 100% complete as to materials and 30% complete as to conversion costs. 18,400 units were received from the previous department. The ending Work-in-Process Inventory consisted of 3,700 units which were 50% complete as to materials and 30% complete as to conversion costs. The Finishing Department uses first-in, first-out (FIFO) process costing. How many units were started and completed during the period? Multiple Choice O O 14,700 O 21,400 15.400 O 25,100 O The debits to Work-in-Process for Department #2 for the month of April of the current year, together with information concerning production, are presented below. All direct materials come from Department #1. The units completed include the 2,800 in process at the beginning of the period. Department #2 uses FIFO costing. ???? WORK-IN-PROCESS DEPARTMENT #2 2,800 units, } completed $2,800 Product X, 9,400 units From Dept. 1, 9,200 units 5,520 Direct Labor 9,600 Factory OH 8,000 2,600 units, y complete ???? The cost of the ending Work-in-Process Inventory is: (Round intermediate calculations to two decimal places.) The cost of the ending Work-in-Process Inventory is: (Round intermediate calculations to two decimal places.) Multiple Choice $2,600. O O O $1,440. O O $6.260 O O $3,848. Madison Corporation's production cycle starts in the Processing Department. The following information is available for April: Work-in-process, April 1 (25% complete) Total units in process during April Work-in-process, April 30 (60% complete) Units 52,000 292,000 31,000 Materials are added at the beginning of the process in the Processing Department. What are the equivalent units of production for the month of April, assuming Madison uses the weighted-average method? A. B. Materials 250,200 265,800 292,000 328,800 Conversion Costs 269,000 243,400 279,600 295,200 C. D. Multiple Choice Option A. O Option B. O Option C. O Option D The Fremont Company uses the weighted average method in its process costing system. The company recorded 30,500 equivalent units for conversion costs for November in a particular department. There were 6,100 units in the ending work-in-process inventory on November 30, 80% complete with respect to conversion costs. The November 1 work-in-process inventory consisted of 8,100 units, 50% complete with respect to conversion costs. A total of 26,000 units were completed and transferred out of the department during the month. The number of units started during November in the department was: Multiple Choice 21,950 units. 28.000 units. 25,480 units. O O 24,000 units. Fanciful Structures Company uses the weighted-average method in its process costing system. The first processing department, the Welding Department, started the month with 24,000 units in its beginning work-in-process inventory that were 20% complete with respect to conversion costs. The conversion cost in this beginning work-in-process inventory was $25,820. An additional 99,000 units were started into production during the month and 101,000 units were completed in the Welding Department and transferred to the next processing department. There were 22,000 units in the ending work-in-process inventory of the Welding Department that were 40% complete with respect to conversion costs. A total of $531,880 in conversion costs were incurred in the department during the month. What would be the cost per equivalent unit for conversion costs for the month? (Round your answer to 3 decimal places.) Multiple Choice $5.429 O O O $5.271. O $5.079. O $4.578. Bentley Enterprises uses process costing to control costs in the manufacture of Dust Sensors for the mining industry. The following information pertains to operations for November. (CMA Exam adapted) Units Work in process, November 1st Started in production during November Work in process, November 30th 16,200 100,400 24,400 The beginning inventory was 60% complete as to materials and 20% complete as to conversion costs. The ending inventory was 90% complete as to materials and 40% complete as to conversion costs. Costs pertaining to November are as follows: Beginning inventory: direct materials, $54,960; direct labor, $20,520; manufacturing overhead, $15,440. Costs incurred during the month: direct materials, $469,980; direct labor, $188,120; manufacturing overhead, $396,440. What are the total costs in the ending Work-in-Process Inventory assuming Bentley uses first-in, first-out (FIFO) process costing? What are the total costs in the ending Work-in-Process Inventory assuming Bentley uses first-in, first-out (FIFO) process costing? Multiple Choice $158,270. $157,000. O $160,500. O $156,599. The Finishing Department had 6,700 incomplete units in its beginning Work-in-Process Inventory which were 100% complete as to materials and 30% complete as to conversion costs. 18,400 units were received from the previous department. The ending Work-in-Process Inventory consisted of 3,700 units which were 50% complete as to materials and 30% complete as to conversion costs. The Finishing Department uses first-in, first-out (FIFO) process costing. How many units were started and completed during the period? Multiple Choice O O 14,700 O 21,400 15.400 O 25,100 O The debits to Work-in-Process for Department #2 for the month of April of the current year, together with information concerning production, are presented below. All direct materials come from Department #1. The units completed include the 2,800 in process at the beginning of the period. Department #2 uses FIFO costing. ???? WORK-IN-PROCESS DEPARTMENT #2 2,800 units, } completed $2,800 Product X, 9,400 units From Dept. 1, 9,200 units 5,520 Direct Labor 9,600 Factory OH 8,000 2,600 units, y complete ???? The cost of the ending Work-in-Process Inventory is: (Round intermediate calculations to two decimal places.) The cost of the ending Work-in-Process Inventory is: (Round intermediate calculations to two decimal places.) Multiple Choice $2,600. O O O $1,440. O O $6.260 O O $3,848. Madison Corporation's production cycle starts in the Processing Department. The following information is available for April: Work-in-process, April 1 (25% complete) Total units in process during April Work-in-process, April 30 (60% complete) Units 52,000 292,000 31,000 Materials are added at the beginning of the process in the Processing Department. What are the equivalent units of production for the month of April, assuming Madison uses the weighted-average method? A. B. Materials 250,200 265,800 292,000 328,800 Conversion Costs 269,000 243,400 279,600 295,200 C. D. Multiple Choice Option A. O Option B. O Option C. O Option D The Fremont Company uses the weighted average method in its process costing system. The company recorded 30,500 equivalent units for conversion costs for November in a particular department. There were 6,100 units in the ending work-in-process inventory on November 30, 80% complete with respect to conversion costs. The November 1 work-in-process inventory consisted of 8,100 units, 50% complete with respect to conversion costs. A total of 26,000 units were completed and transferred out of the department during the month. The number of units started during November in the department was: Multiple Choice 21,950 units. 28.000 units. 25,480 units. O O 24,000 units. Fanciful Structures Company uses the weighted-average method in its process costing system. The first processing department, the Welding Department, started the month with 24,000 units in its beginning work-in-process inventory that were 20% complete with respect to conversion costs. The conversion cost in this beginning work-in-process inventory was $25,820. An additional 99,000 units were started into production during the month and 101,000 units were completed in the Welding Department and transferred to the next processing department. There were 22,000 units in the ending work-in-process inventory of the Welding Department that were 40% complete with respect to conversion costs. A total of $531,880 in conversion costs were incurred in the department during the month. What would be the cost per equivalent unit for conversion costs for the month? (Round your answer to 3 decimal places.) Multiple Choice $5.429 O O O $5.271. O $5.079. O $4.578

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts