Answered step by step

Verified Expert Solution

Question

1 Approved Answer

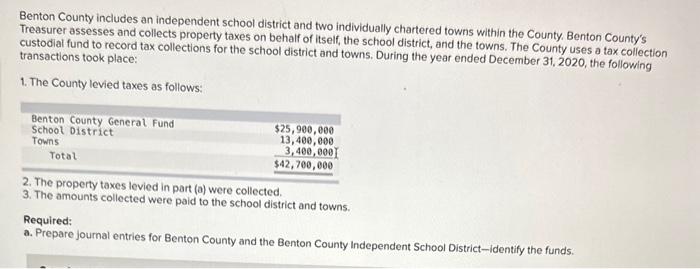

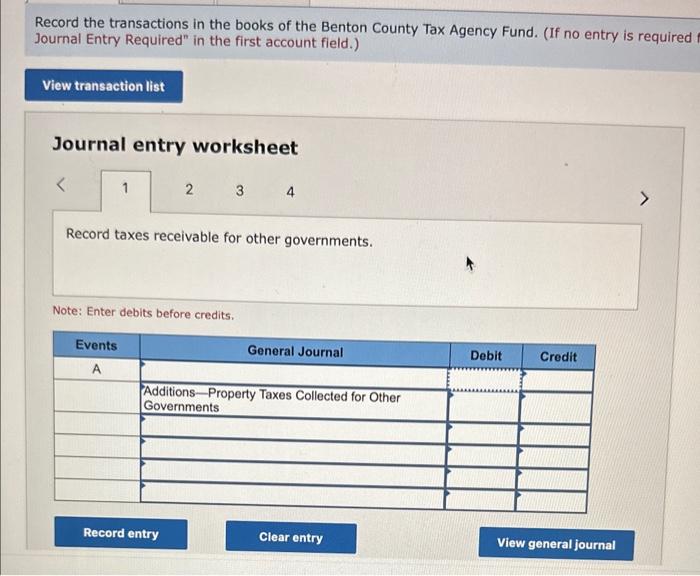

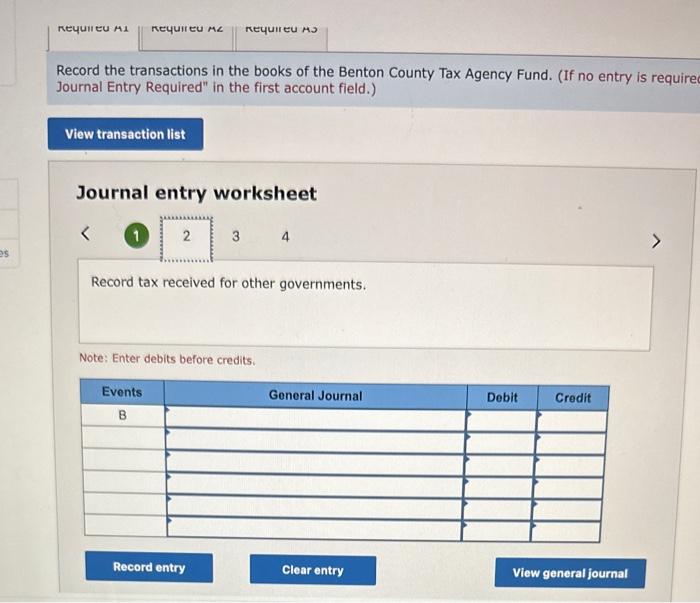

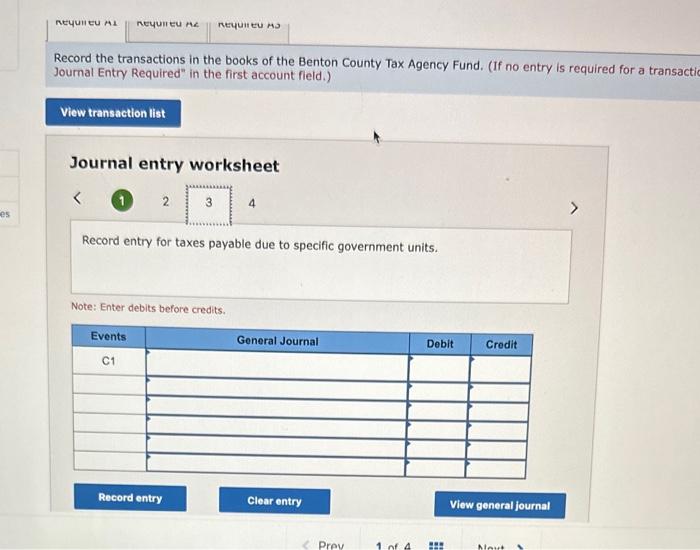

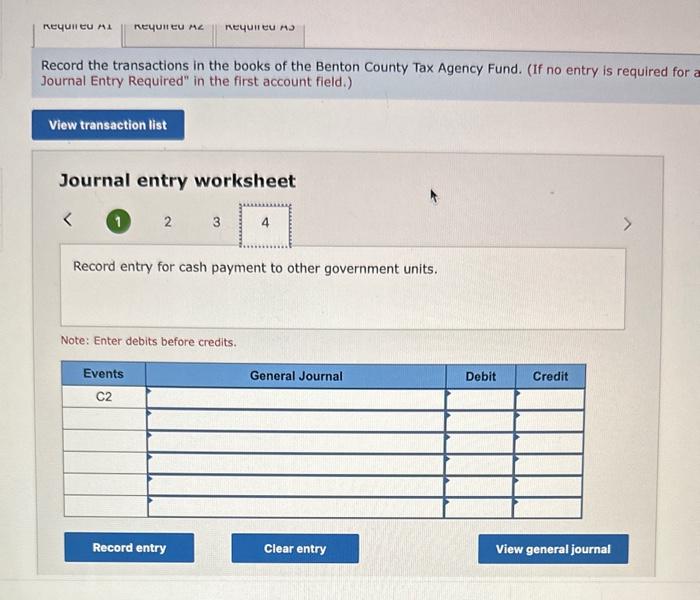

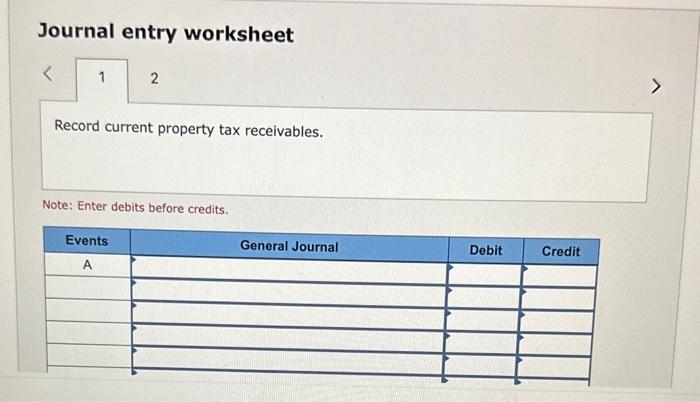

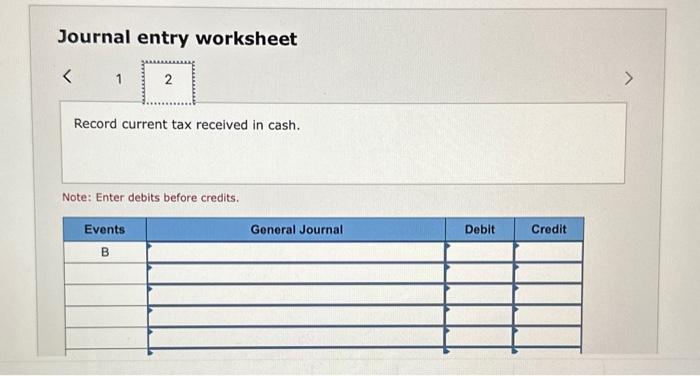

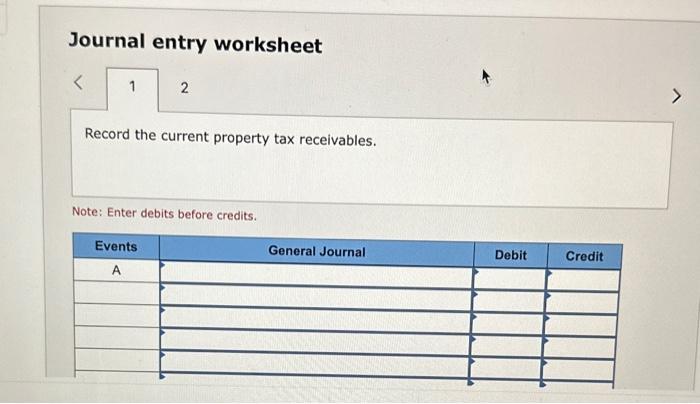

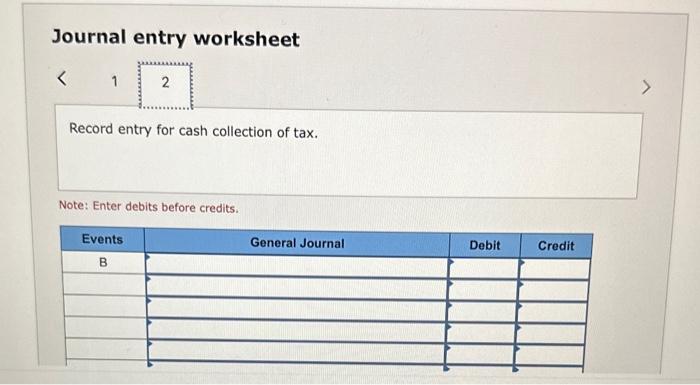

Benton County includes an independent school district and two individually chartered towns within the County. Benton County's Treasurer assesses and collects property taxes on behalf

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started