BEPS & DEPS?

BEPS & DEPS?

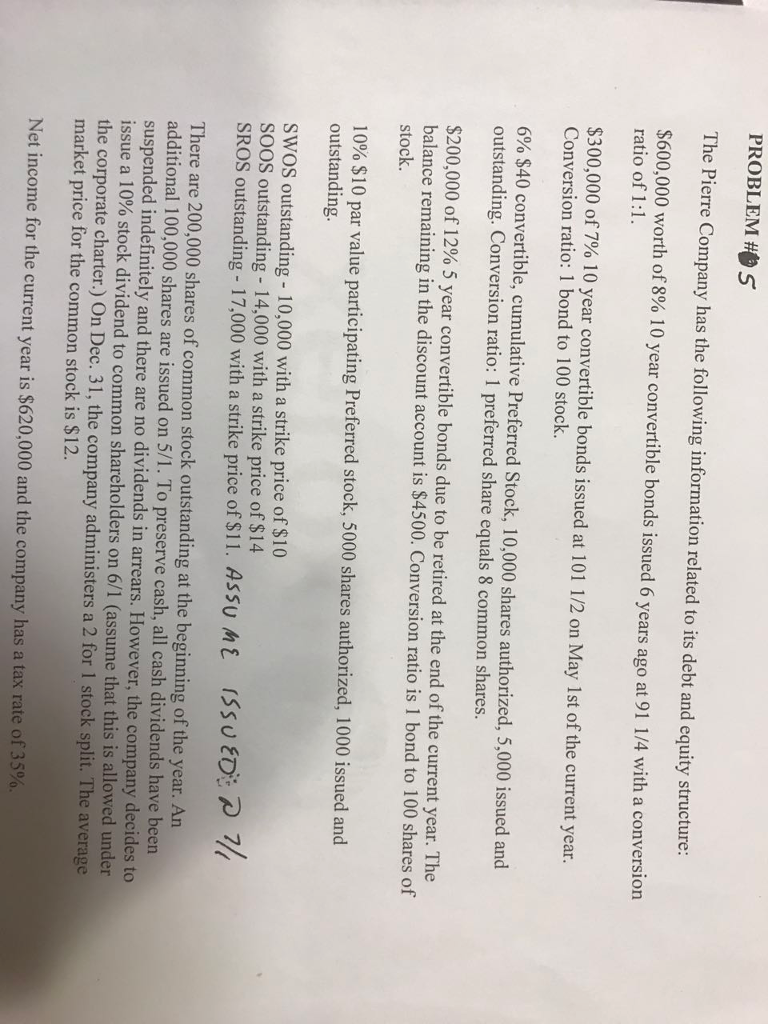

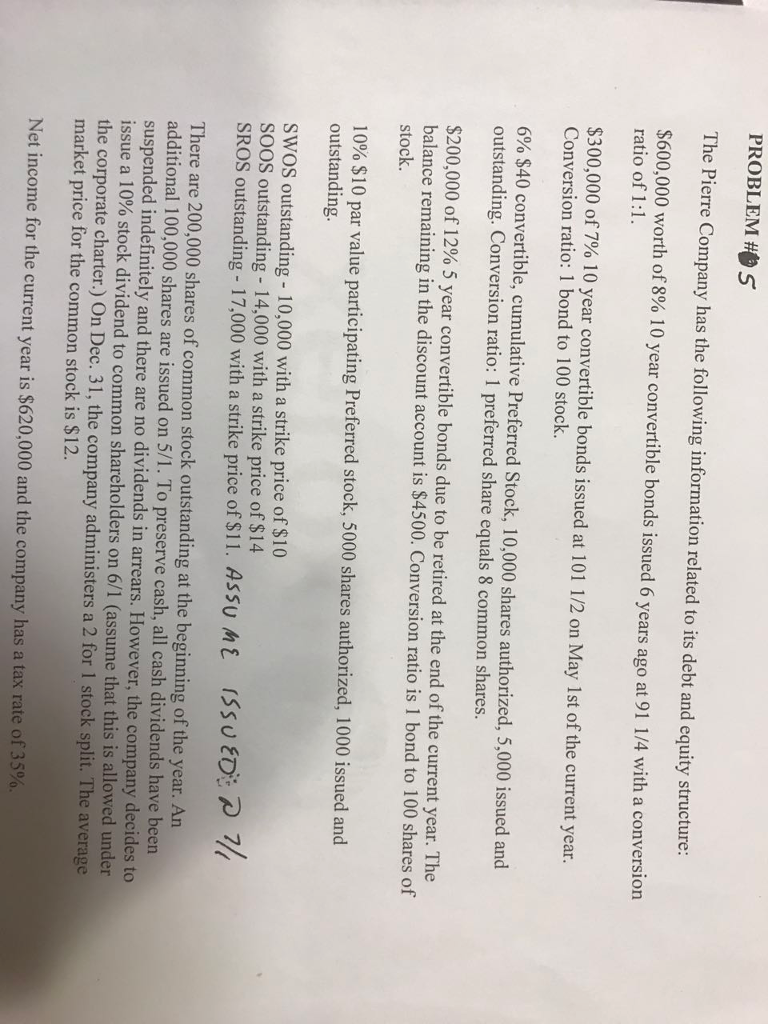

The Pierre Company has the following information related to its debt and equity structure: $600,000 worth of 8% 10 year convertible bonds issued 6 years ago at 91 1/4 with a conversion ratio of 1:1. $300,000 of 7% 10 year convertible bonds issued at 101 1/2 on May 1st of the current year. Conversion ratio: 1 bond to 100 stock. 6% $40 convertible, cumulative Preferred Stock, 10,000 shares authorized, 5,000 issued and outstanding. Conversion ratio: 1 preferred share equals 8 common shares. $200,000 of 12% 5 year convertible bonds due to be retired at the end of the current year. The balance remaining in the discount account is $4500. Conversion ratio is 1 bond to 100 shares o stock. 10% $10 par value participating Preferred stock, 5000 shares authorized, 1000 issued and outstanding. SWOS outstanding - 10,000 with a strike price of $10 SOOS outstanding - 14,000 with a strike price of $14 SROS outstanding - 17,000 with a strike price of $11. There are 200,000 shares of common stock outstanding at the beginning of the year. An additional 100,000 shares are issued on 5/1. To preserve cash, all cash dividends have been suspended indefinitely and there are no dividends in arrears. However, the company decides to 10% dividend common shareholders on 6/1 (assume that this is allowed under the corporate charter.) On Dec. 31, the company administers a 2 for 1 stock split. The average market price for the common stock is $12. Net income for the current year is $620,000 and the company has a tax rate of 35%. The Pierre Company has the following information related to its debt and equity structure: $600,000 worth of 8% 10 year convertible bonds issued 6 years ago at 91 1/4 with a conversion ratio of 1:1. $300,000 of 7% 10 year convertible bonds issued at 101 1/2 on May 1st of the current year. Conversion ratio: 1 bond to 100 stock. 6% $40 convertible, cumulative Preferred Stock, 10,000 shares authorized, 5,000 issued and outstanding. Conversion ratio: 1 preferred share equals 8 common shares. $200,000 of 12% 5 year convertible bonds due to be retired at the end of the current year. The balance remaining in the discount account is $4500. Conversion ratio is 1 bond to 100 shares o stock. 10% $10 par value participating Preferred stock, 5000 shares authorized, 1000 issued and outstanding. SWOS outstanding - 10,000 with a strike price of $10 SOOS outstanding - 14,000 with a strike price of $14 SROS outstanding - 17,000 with a strike price of $11. There are 200,000 shares of common stock outstanding at the beginning of the year. An additional 100,000 shares are issued on 5/1. To preserve cash, all cash dividends have been suspended indefinitely and there are no dividends in arrears. However, the company decides to 10% dividend common shareholders on 6/1 (assume that this is allowed under the corporate charter.) On Dec. 31, the company administers a 2 for 1 stock split. The average market price for the common stock is $12. Net income for the current year is $620,000 and the company has a tax rate of 35%

BEPS & DEPS?

BEPS & DEPS?