Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Beranek Corp has $520,000 of assets (which equal total invested capital), and it uses no debt-it is financed only with common equity. The new

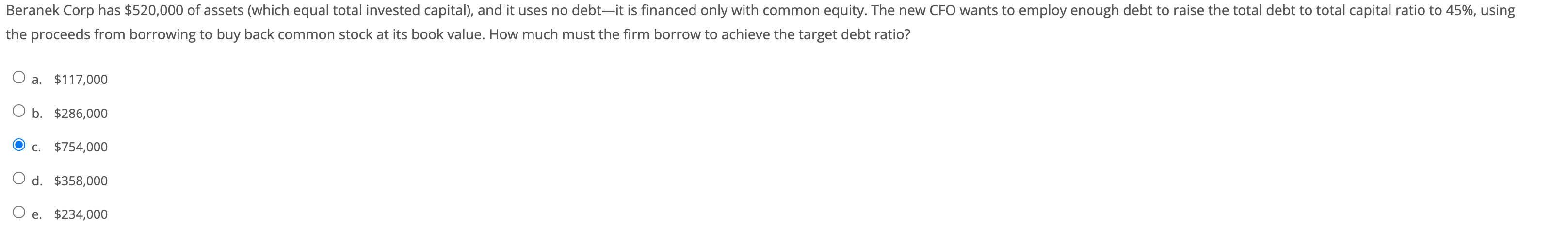

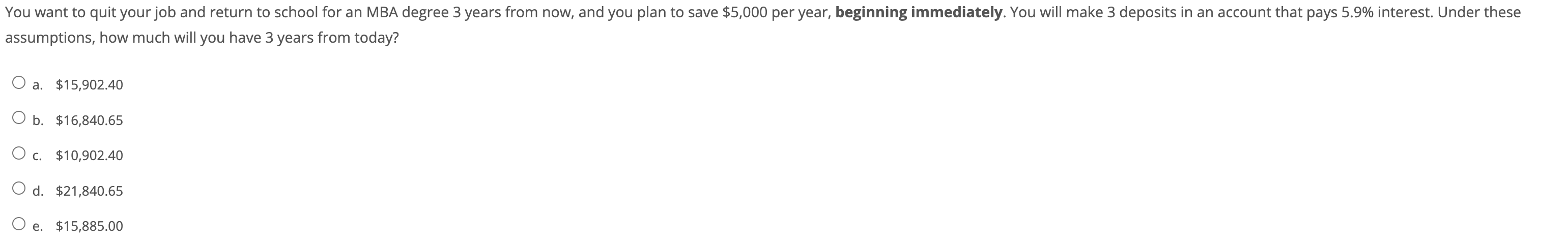

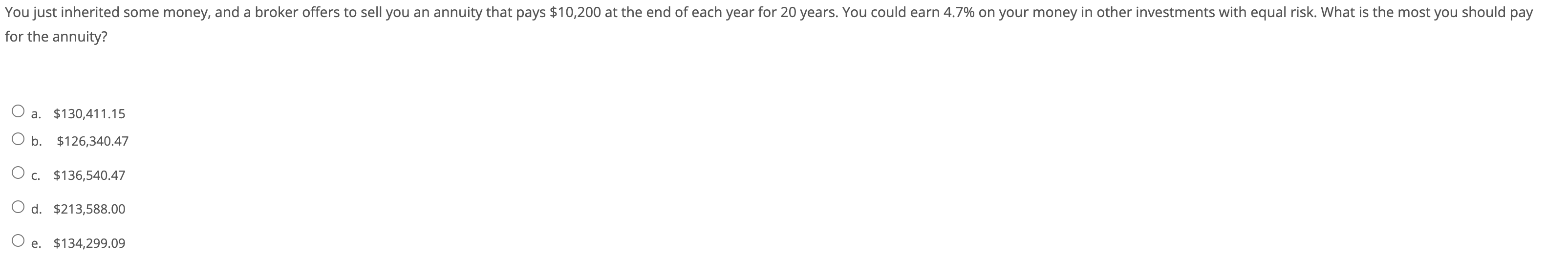

Beranek Corp has $520,000 of assets (which equal total invested capital), and it uses no debt-it is financed only with common equity. The new CFO wants to employ enough debt to raise the total debt to total capital ratio to 45%, using the proceeds from borrowing to buy back common stock at its book value. How much must the firm borrow to achieve the target debt ratio? O a. $117,000 O b. $286,000 c. $754,000 O d. $358,000 e. $234,000 You want to quit your job and return to school for an MBA degree 3 years from now, and you plan to save $5,000 per year, beginning immediately. You will make 3 deposits in an account that pays 5.9% interest. Under these assumptions, how much will you have 3 years from today? O a. $15,902.40 O b. $16,840.65 O c. $10,902.40 O d. $21,840.65 e. $15,885.00 You just inherited some money, and a broker offers to sell you an annuity that pays $10,200 at the end of each year for 20 years. You could earn 4.7% on your money in other investments with equal risk. What is the most you should pay for the annuity? O a. $130,411.15 O b. $126,340.47 O c. $136,540.47 O d. $213,588.00 e. $134,299.09

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1 Debt R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started