Answered step by step

Verified Expert Solution

Question

1 Approved Answer

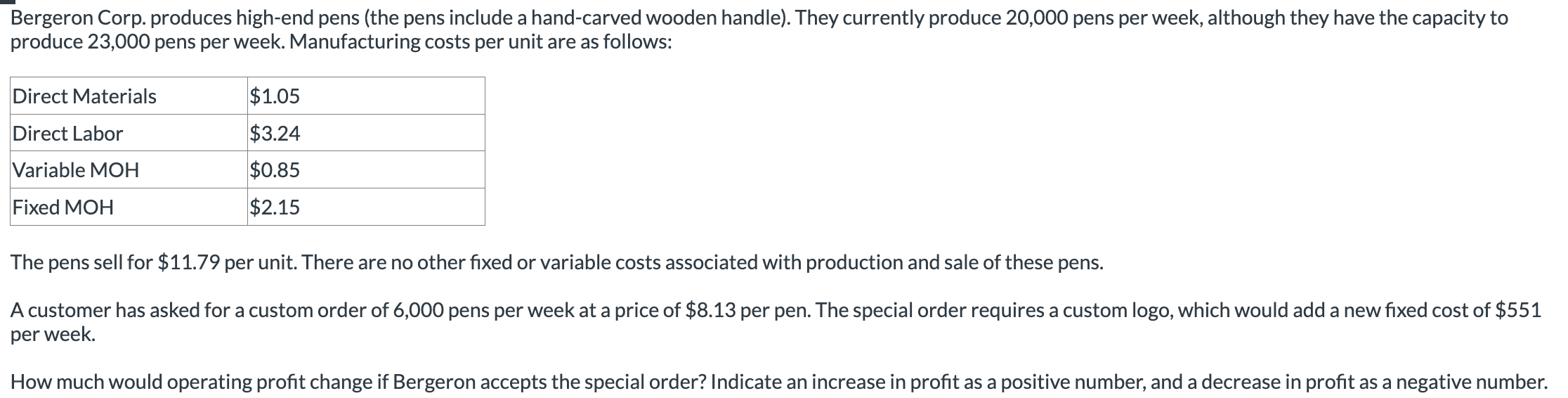

Bergeron Corp. produces high-end pens (the pens include a hand-carved wooden handle). They currently produce 20,000 pens per week, although they have the capacity

Bergeron Corp. produces high-end pens (the pens include a hand-carved wooden handle). They currently produce 20,000 pens per week, although they have the capacity to produce 23,000 pens per week. Manufacturing costs per unit are as follows: Direct Materials $1.05 Direct Labor $3.24 Variable MOH Fixed MOH $0.85 $2.15 The pens sell for $11.79 per unit. There are no other fixed or variable costs associated with production and sale of these pens. A customer has asked for a custom order of 6,000 pens per week at a price of $8.13 per pen. The special order requires a custom logo, which would add a new fixed cost of $551 per week. How much would operating profit change if Bergeron accepts the special order? Indicate an increase in profit as a positive number, and a decrease in profit as a negative number.

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the change in operating profit if Bergeron accepts the special order we need to compare ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e3dad6963e_959255.pdf

180 KBs PDF File

663e3dad6963e_959255.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started