Answered step by step

Verified Expert Solution

Question

1 Approved Answer

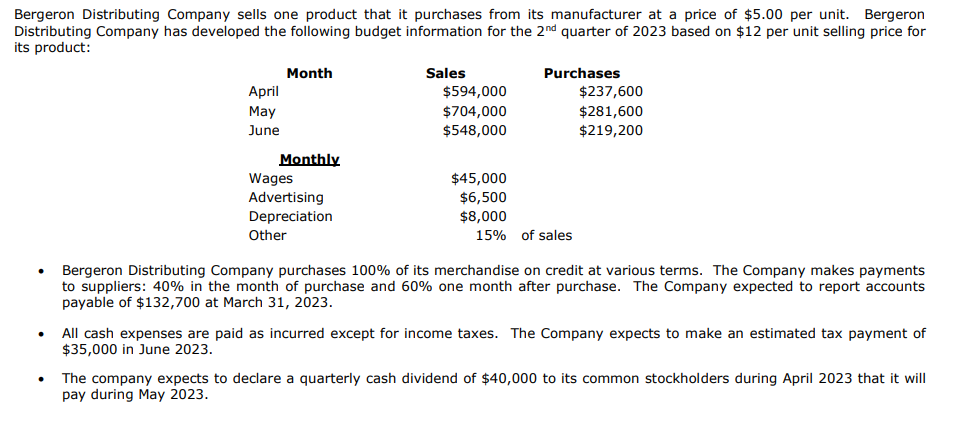

Bergeron Distributing Company sells one product that it purchases from its manufacturer at a price of $5.00 per unit. Bergeron Distributing Company has developed

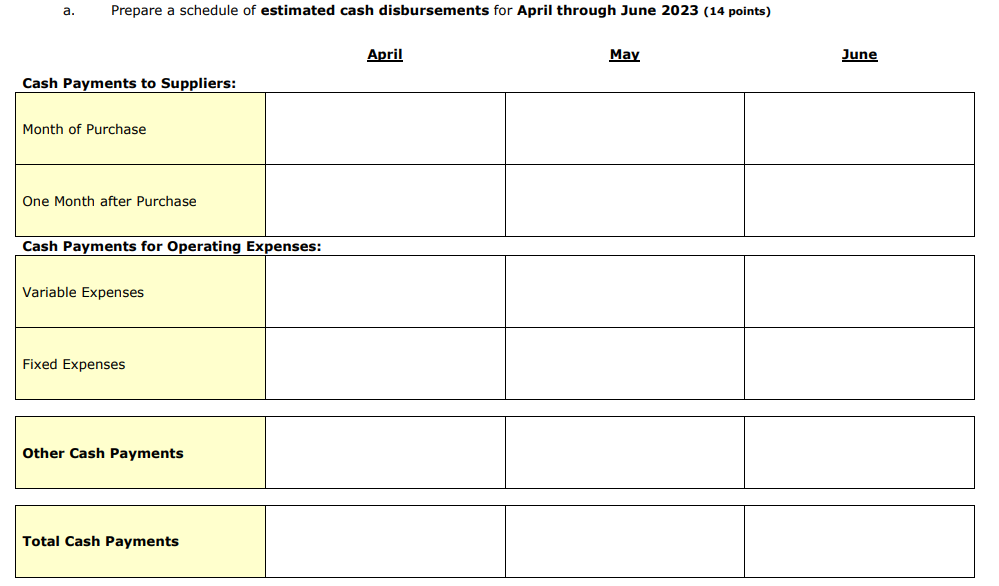

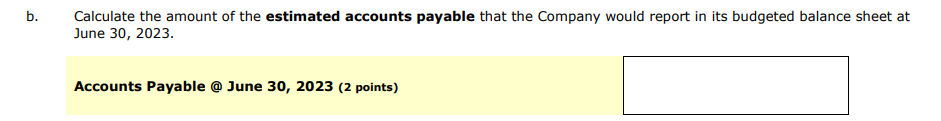

Bergeron Distributing Company sells one product that it purchases from its manufacturer at a price of $5.00 per unit. Bergeron Distributing Company has developed the following budget information for the 2nd quarter of 2023 based on $12 per unit selling price for its product: April May June Month Monthly Wages Advertising Depreciation Other Sales $594,000 $704,000 $548,000 $45,000 $6,500 $8,000 Purchases 15% of sales $237,600 $281,600 $219,200 Bergeron Distributing Company purchases 100% of its merchandise on credit at various terms. The Company makes payments to suppliers: 40% in the month of purchase and 60% one month after purchase. The Company expected to report accounts payable of $132,700 at March 31, 2023. All cash expenses are paid as incurred except for income taxes. The Company expects to make an estimated tax payment of $35,000 in June 2023. The company expects to declare a quarterly cash dividend of $40,000 to its common stockholders during April 2023 that it will pay during May 2023. a. Prepare a schedule of estimated cash disbursements for April through June 2023 (14 points) Cash Payments to Suppliers: Month of Purchase One Month after Purchase Cash Payments for Operating Expenses: Variable Expenses Fixed Expenses Other Cash Payments Total Cash Payments April May June Calculate the amount of the estimated accounts payable that the Company would report in its budgeted balance sheet at June 30, 2023. Accounts Payable @ June 30, 2023 (2 points)

Step by Step Solution

★★★★★

3.43 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

a Prepare a schedule of estimated cash disbursements for April through June 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started