Question

Bernadette Inc. makes several products and uses one cost driver (direct labour hours) to assign overhead to the products. Bernadette has started to wonder whether

Bernadette Inc. makes several products and uses one cost driver (direct labour hours) to assign overhead to the products. Bernadette has started to wonder whether the use of activity based costing (ABC) would be more appropriate. To start, Bernadette would like to investigate what the costing would look like for one product (Product A) using ABC.Details are below.

Current Unit Information of Product A (using direct labour hours as the overhead cost driver)

Selling Price$23

Direct Materials$10

Direct Labour6

Overhead3

$19

# of units of Product A sold150,000

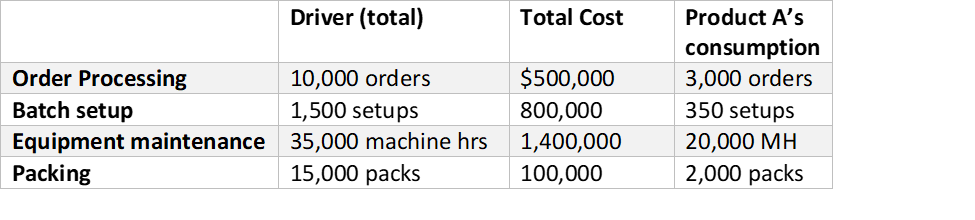

For ABC purposes, Bernadette has broken down the overhead into 4 main activities with related costs:

Required -

a)What is the total unit cost of Product A using activity based costing?

b)Is Product A currently under-costed or over-costed?

c)Give an example of one useful decision that Bernadette Inc. might make in relation to Product A now that they know a truer cost of Product A.

Order Processing 10,000 orders Equipment maintenance 35,000 machine hrs $500,000 3,000 orders 1,400,000 20,000 MH

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started