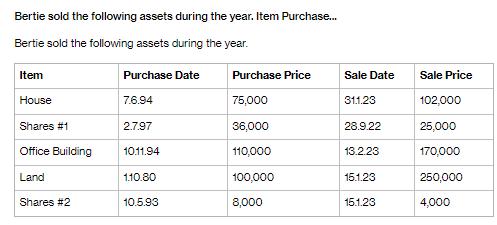

Bertie sold the following assets during the year. Item Purchase... Bertie sold the following assets during the year. Item House Shares #1 Office Building

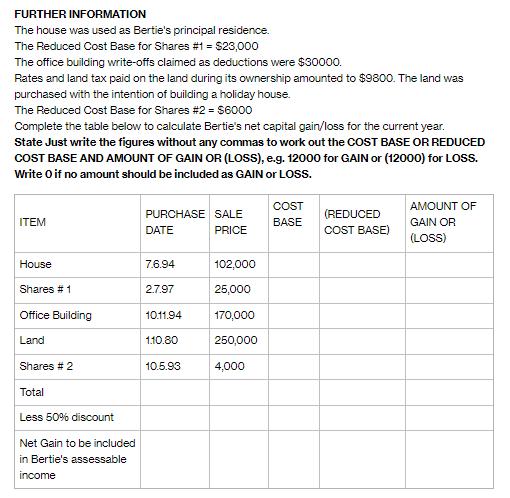

Bertie sold the following assets during the year. Item Purchase... Bertie sold the following assets during the year. Item House Shares #1 Office Building Land Shares #2 Purchase Date 7.6.94 2.7.97 10.11.94 1.10.80 10.5.93 Purchase Price 75,000 36,000 110,000 100,000 8,000 Sale Date 31.1.23 28.9.22 13.2.23 15.1.23 15.1.23 Sale Price 102,000 25,000 170,000 250,000 4,000 FURTHER INFORMATION The house was used as Bertie's principal residence. The Reduced Cost Base for Shares #1 = $23,000 The office building write-offs claimed as deductions were $30000. Rates and land tax paid on the land during its ownership amounted to $9800. The land was purchased with the intention of building a holiday house. The Reduced Cost Base for Shares #2 = $6000 Complete the table below to calculate Bertie's net capital gain/loss for the current year. State Just write the figures without any commas to work out the COST BASE OR REDUCED COST BASE AND AMOUNT OF GAIN OR (LOSS), e.g. 12000 for GAIN or (12000) for LOSS. Write O if no amount should be included as GAIN or LOSS. ITEM House Shares # 1 Office Building Land Shares # 2 Total Less 50% discount Net Gain to be included in Bertie's assessable income PURCHASE SALE DATE PRICE 7.6.94 2.7.97 10.11.94 1.10.80 10.5.93 102,000 25,000 170,000 250,000 4,000 COST BASE (REDUCED COST BASE) AMOUNT OF GAIN OR (LOSS)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Stepbystep explanation I The given problem requires us to calculate Berties net capital gain which is the total amount of gains minus losses fr...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started