Answered step by step

Verified Expert Solution

Question

1 Approved Answer

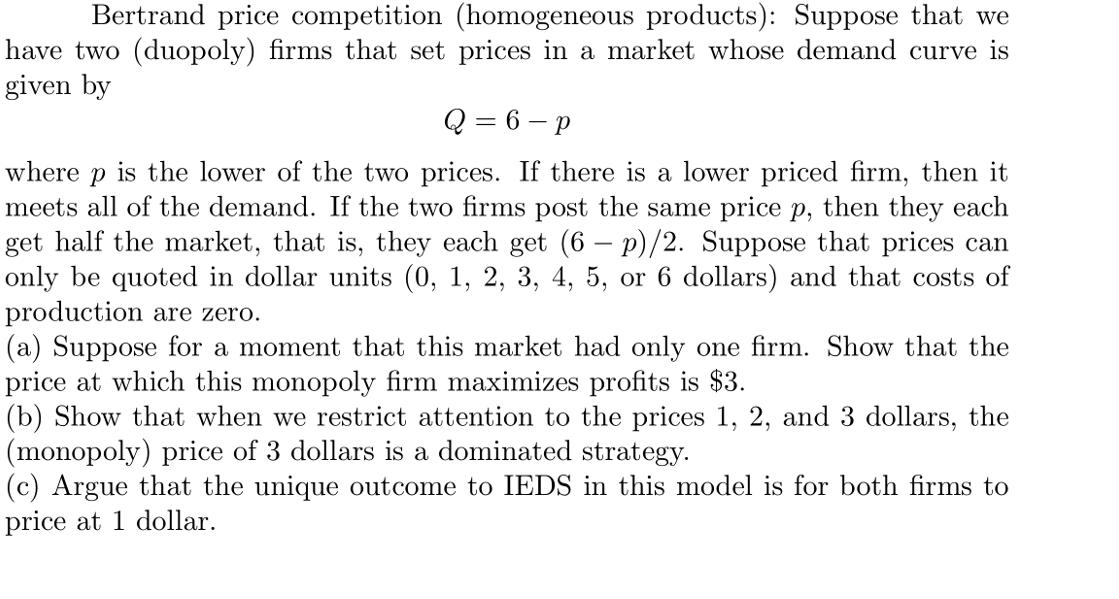

Bertrand price competition (homogeneous products): Suppose that we have two (duopoly) firms that set prices in a market whose demand curve is given by

Bertrand price competition (homogeneous products): Suppose that we have two (duopoly) firms that set prices in a market whose demand curve is given by Q = 6 p where is the lower of the two prices. If there is a lower priced firm, then it meets all of the demand. If the two firms post the same price p, then they each get half the market, that is, they each get (6 p)/2. Suppose that prices can only be quoted in dollar units (0, 1, 2, 3, 4, 5, or 6 dollars) and that costs of production are zero. (a) Suppose for a moment that this market had only one firm. Show that the price at which this monopoly firm maximizes profits is $3. (b) Show that when we restrict attention to the prices 1, 2, and 3 dollars, the (monopoly) price of 3 dollars is a dominated strategy. (c) Argue that the unique outcome to IEDS in this model is for both firms to price at 1 dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

DATE 20 PAGE No Cost of production iso tor one fim ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started